Quest Diagnostics Inc. (DGX) reported higher-than-expected first-quarter earnings and revenue as the coronavirus crisis started to have an adverse impact only in the last month of the quarter.

In the first three months of the year, revenue declined 3.7% to $1.8 billion year-on-year beating analysts’ estimates by $60 million. Adjusted earnings per share amounted to $0.94 down from $1.40 but above the $0.89 expected by analysts. The company’s shares rose 5.4% to close at $99.58 in U.S. trading on Wednesday. The U.S. laboratory operator provides medical testing services in U.S. hospitals.

“We were very pleased with Quest’s results in January and February, which were consistent with the full-year guidance we provided in January,” said Steve Rusckowski, Chairman, CEO and President. “However, in March, we experienced a material decline in testing volumes due to the COVID-19 pandemic. During the last two weeks of March, volumes declined in excess of 40%, including COVID-19 testing.”

Quest announced a number of cost-cutting measures to weather the coronavirus crisis in coming months. The measures include executive pay cuts, reduced hours for employees whose work has significantly declined, and furloughs. Looking ahead, the company said that it is withdrawing its 2020 financial guidance, while its Board of Directors remains committed to its quarterly dividend payout.

Moreover, the biotech company warned that the COVID-19 pandemic is likely to impact its ability to comply with financial covenants, from as early as the end of the second quarter. As a result, it would not be able to borrow against its credit facilities and the lenders would have the right to request any outstanding payments.

To avert a debt repayment scenario, Quest is in advanced discussions with its lead lender seeking an amendment to certain financial covenants of its unsecured revolving credit line, which would provide the company with the necessary financial flexibility in 2020. It expects to reach an agreement on the amendment later in the quarter.

Quest has in recent months joined a list of biotech companies in the hunt for finding a cure to contain the spread of the coronavirus disease.

“I am proud that the Quest team has stepped up to bring crucial COVID-19 testing capacity to the nation during this crisis,” said Rusckowski. “To date, we have performed approximately one million molecular tests and have begun to perform blood-based antibody testing. We believe antibody testing will become a critical tool to understand who has been exposed to the virus and who may have immunity.”

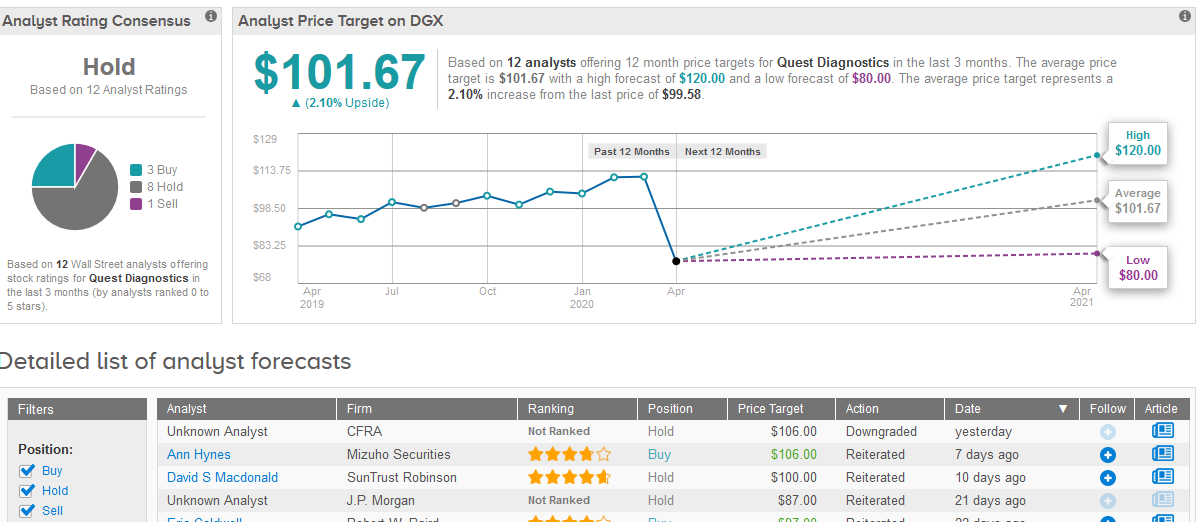

Wall Street analysts are bearish on the company’s stock assigning a Hold consensus rating based on 8 Holds, 3 Buys and 1 Sell. The $101.67 average price target implies a mere 2.1% upside potential for the shares in the coming 12 months. (See Quest Diagnostics stock analysis on TipRanks)

As of the end of March, Quest had $342 million in available cash and $1.3 billion in borrowing capacity.

Related News:

Pfizer Rises on Nod to Start First In-Human COVID-19 Vaccine Trial in Germany

Karyopharm (KPTI) Bulls Find More Reasons to Smile

Immunomedics Jumps Almost 30% In After-Hours On FDA Approval