Quest Diagnostics Inc. (DGX) said that its second-quarter adjusted earnings per share could come in the range of breakeven to slightly profitable, as testing volumes have recovered faster than anticipated. This comes at a time when some U.S. local governments are starting to gradually lift restrictions on business activity, including in the health care system.

The diagnostics company added that the financial update assumes that its base “testing volume and COVID-19 molecular and antibody testing volume trends continue”. The company added that it sees “higher” recovery in U.S. geographies where state or local governments are lifting restrictions.

Still since Quest reported its first-quarter results on April 22, it has continued to experience a “material” decline in its testing volumes due to the coronavirus pandemic.

“As the pandemic continues to severely impact the economy of the U.S. and other countries around the world, the company continues to expand the amount of COVID-19 testing available to the country,” it said in a SEC filing.

It added that it “remains unable to reasonably estimate the adverse impact the pandemic will have on its businesses, operating results, cash flows and/or financial condition” due to the uncertainty of the pandemic’s impact on the U.S. economy and its healthcare system its duration.

Earlier this week, Quest announced that it received emergency use authorization (EUA) for its self-collection COVID-19 test kit from the U.S. Food and Drug Administration (FDA).

The company expects to have more than 500,000 kits available by the end of June, with plans to make additional kits on an ongoing basis.

Since the beginning of April, Quest Diagnostics’ shares have almost doubled and are trading at $122.61 as of Tuesday’s close.

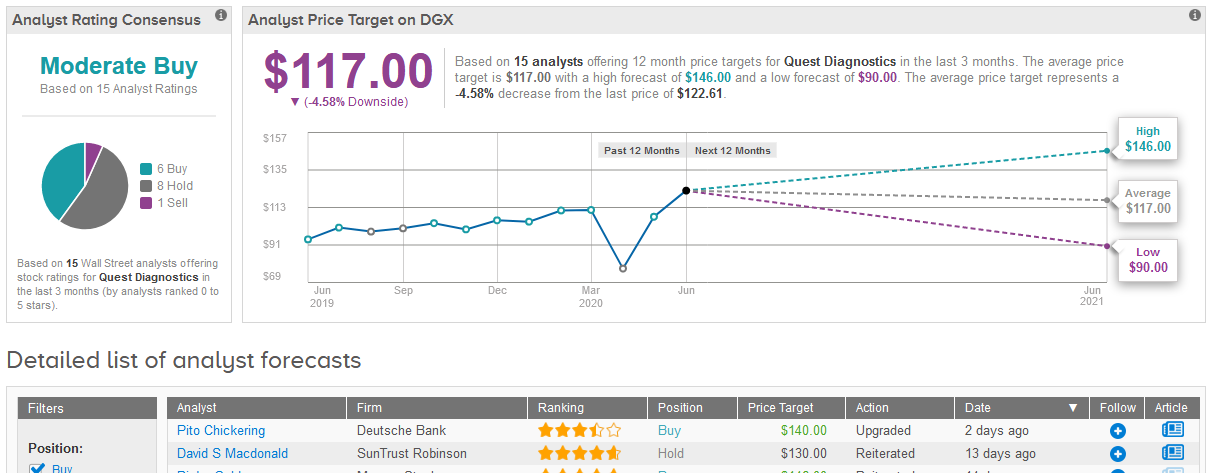

Deutsche Bank analyst Pito Chickering this week reinitiated a Buy rating on the stock with a $140 price target, saying that the lab industry should see a rebound in routine testing in the near term.

Chickering believes that the COVID-19 testing addressable market is greater than appreciated by the broader market.

Wall Street analysts take a cautiously optimistic stance on the stock. The Moderate Buy consensus is made of 8 Holds, 6 Buys and 1 Sell. The $117 average price target now implies 4.6% downside potential in the shares in the coming 12 months. (See Quest Diagnostics stock analysis on TipRanks).

Related News:

Quest’s Covid-19 Self-Collection Test Kit Gets FDA Nod For Emergency Use

Moderna Embarks On Phase 2 Study Of Covid-19 Candidate; Shares Pop 11%

Efgartigimod’s Positive Data Is Good News for Momenta’s Nipocalimab