Raven Industries has acquired the intellectual property (IP) and patent portfolio of Jaybridge Robotics for an undisclosed amount. The agricultural technology company intends to leverage this patent portfolio for the development of Raven’s Driverless Ag Technology which also includes the integration of this technology into Raven’s AutoCart platform.

Raven Industries’ (RAVN) Director of Technology Solutions, Jared Kocer said, “By acquiring Jaybridge’s intellectual property we are able to advance our autonomy strategy by combining necessary, technology-leading patents with our current suite of proprietary products in this space. Having this technology will allow us to accelerate the development of vehicle automation for agriculture equipment applications.”

The acquisition of the patent portfolio was completed in the first quarter of this fiscal year. Jaybridge’s IP portfolio includes patents for path-planning, obstacle detection and avoidance technology, and multi-machine control systems. In the fiscal fourth quarter, Raven invested $4.4 million in R&D activities while the company’s applied technology unit reported net sales of $34.9 million, up 6% year-on-year. (See Raven Industries stock analysis on TipRanks)

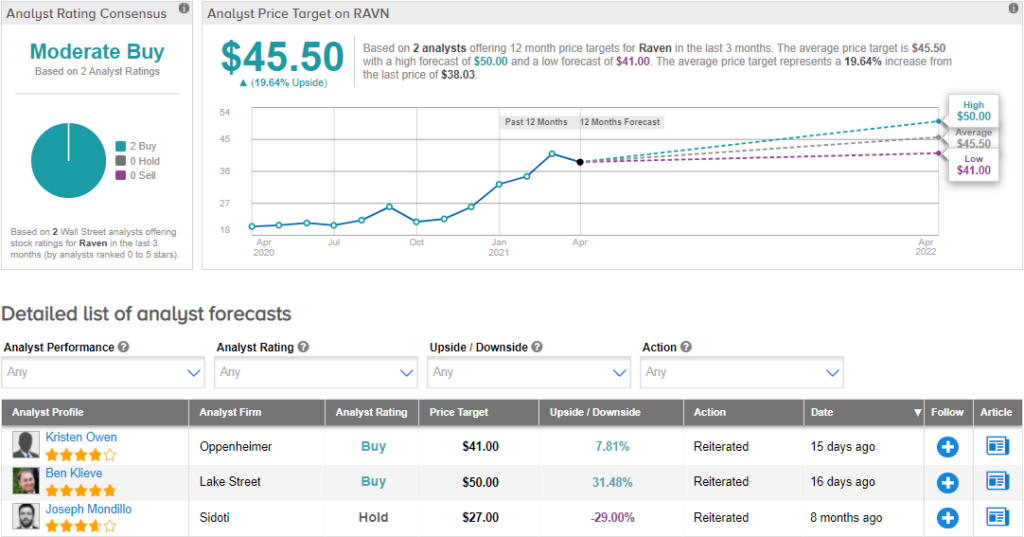

Last month, Oppenheimer analyst Kristen Owen reiterated a Buy and a price target of $41 on the stock. Owen commented on RAVN’s fiscal 4Q FY21 results, “While growth across the end markets was muted relative to our own expectations, management noted building momentum in ag and sequential improvement throughout the quarter in energy, setting a more favorable backdrop for FY22.”

“Looking ahead, RAVN sees ATD [applied technology division] leading yr/yr revenue growth, and achieving key Autonomy milestones with the delivery of AutoCart systems and the initial commercialization of Dot,” Owen added.

The rest of the Wall Street community is cautiously optimistic on the stock with a Moderate Buy consensus rating. That is based on 2 analysts suggesting a Buy. The average analyst price target of $45.50 implies around 19.6% upside potential to current levels.

Related News:

Best Buy Launches $200 Per Year Membership Program

Norwegian Cruise Line Unveils Plan To Resume Cruising

Shell Expects To Take A $200M Hit From Texas Winter Storm