Nielsen, a preeminent firm that tracks media trends such as how much television programming consumers watch, recently suggested that stay-at-home orders and social quarantining could lead to a 60% jump in the media content we watch. This includes live TV, radio, gaming, time surfing the web, and even watching this content on your smartphone or tablet of choice.

Newer media channels from the likes of Netflix, Amazon’s Prime service, or Hulu, are often mentioned as destinations of choice for consumers. But we still watch plenty of shows on cable TV, and this is increasingly shifting to channels that reach them more directly. I myself am almost through the last season of the Walking Dead on the AMC network.

Research firm RBC Capital has noticed that shares of some more traditional providers of cable-TV content have been selling off rather dramatically lately. The drops are at least 30% and could be considered too severe. This is because these media assets still have considerable value and throw off profits that can benefit shareholders and the migration of reaching consumers more directly.

We ran three media stocks which recently gotten the thumbs-up from RBC through TipRanks’ database to see whether the Street agrees with this newly positive outlook. So which three stocks RBC is re-evaluating right now? Let’s take a closer look.

AMC Networks (AMCX)

If I were to ask you about the value of a media company that has created hits like Mad Men, Breaking Bad, and The Walking Dead, you might think it would be pretty high. But AMC Networks’ stock is down more than 40% this year and 60% over the past year.

New York-city based AMC Networks owns five entertainment programming networks: AMC, WE tv, BBC AMERICA, IFC, and SundanceTV. Its content can be viewed in 130 countries and the bulk of its sales are tied to bundled cable packages from traditional TV. But it is migrating to going directly to the consumer and hopes to create shows as popular as the hits mentioned above.

In an extensive 42-page report, RBC analyst Kutgun Maral did concede that there is near term weakness: “we expect National Networks advertising revenue (32% of total company) will see material headwinds from softness across national TV ad spend given the ongoing COVID-19 pandemic.”

However, Maral quickly acknowledges that the recent share drop seems to be extreme. The P/E ratio is ridiculously low in the low single digits.

“With shares down ~46% YTD, we think there’s broad acknowledgement of the challenges AMCX faces but not a lot of appreciation for the value it is creating across SVOD, its sustainable FCF outlook, deleveraging off an already healthy balance sheet, or M&A optionality.” On the last point, with the stock being cheap and media content growing increasingly important, a larger media firm could buy the company outright.

Maral also thinks AMCX “will increasingly be viewed as an attractive takeout candidate given its strong content production pedigree and studio, early traction with [going directly to the consumer], relatively attractive positioning across the linear ecosystem, and scope for cost synergies under a larger company”

As a result, Maral has initiated coverage on AMC shares with an “outperform” rating and $27 price target. (To watch Maral’s track record, click here)

But the Street does not share this optimism — quite the contrary. Right now, AMC stock has a Hold consensus rating with only 1 recent Buy rating. This is versus 5 Hold and 1 Sell ratings. Yet, the $28.17 price target suggests a potential upside of 17% from the current share price. (See AMC stock analysis on TipRanks)

Discovery, Inc (DISCA)

Maryland-based Discovery owns an impressive array of media assets. First and foremost is its namesake the Discovery Channel, followed by TLC, Animal Planet, Investigation Discovery, Science Channel, MotorTrend, Food Network, the Oprah Winfrey Network, as well as other brands.

Discovery’s share price decline hasn’t been as dramatic as AMCX’s, but it is still down around 30% so far this year, and has fallen 28% over the past year. This has pushed the forward P/E into the single digits, which is probably too cheap for such a collection of appealing programming and channels.

RBC’s Kutgun Maral also initiated coverage on Discovery with an “outperform” rating and $26 price target. Its thesis echoes that of AMC Networks – namely a growing direct-to-consumer business, steady free cash flow generation, and takeover potential.

Maral believes “Discovery is demonstrably balancing its legacy revenue streams while it leans into next-gen/DTC initiatives that are scaling rapidly.” In other words, it is shifting from a model where sales come primarily from cable TV providers more to direct-to-consumer apps and channels for a monthly fee.

Maral also details that Discovery generates a lot of free cash flow, has a solid balance sheet, and could end up getting bought out by a larger media company. On that last point, the analyst writes: “DISCA is the most attractive takeout candidate within traditional media. It is uniquely positioned to offer the growing number of DTC services a way to differentiate their platform with leading nonfiction and lifestyle brands that have global appeal, with content that has a low-cost profile, is fully owned, and has demonstrated strong viewer engagement with a female-skew.”

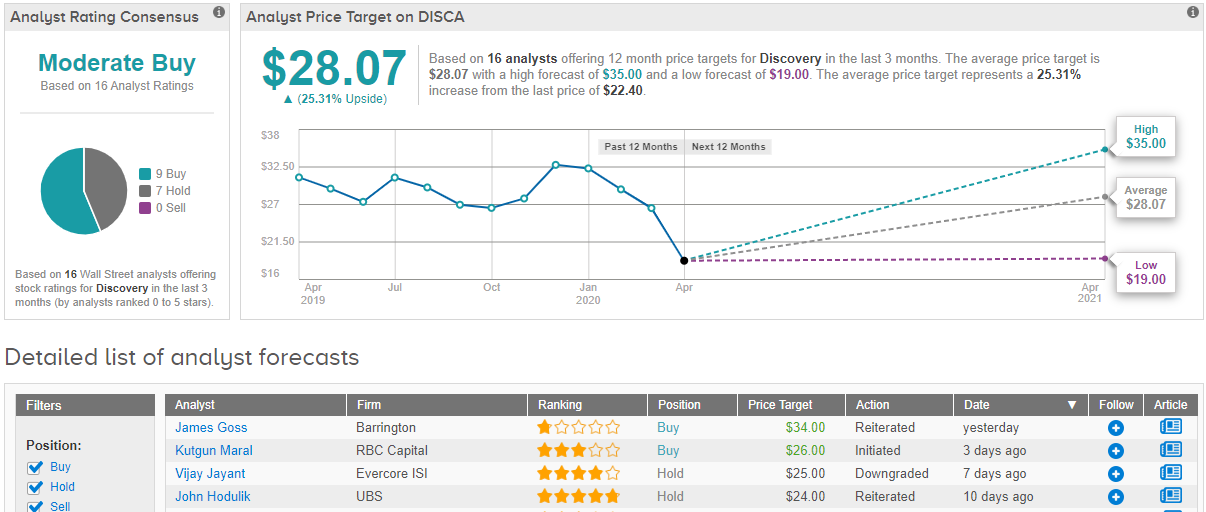

Overall, Wall Street almost evenly split between the bulls and those choosing to play it safe. Based on 16 analysts polled by TipRanks in the last 3 months, 9 rate Discovery a Buy, while 7 say Hold. Notably, the 12-month average price target stands at $28.07, marking about 25% upside for the stock. (See Discovery stock analysis on TipRanks)

Fox Corporation (FOXA)

Similar to Discovery, Fox stock is also down about 30% so far in 2020 and over the past year. Its forward P/E is down below 12, and RBC also sees potential here.

New-York-based Fox Corporation owns an impressive array of news, sports, and entertainment assets. It is perhaps best known for FOX News, FOX Business, FOX Studios movies, and an impressive array of sports channels.

Lead analyst Kutgun Maral has been busy and also issued an extensive initiation coverage report on Fox with an “outperform” rating and $31 price target. While Discovery has the greatest buyout potential, Maral believes “Fox [has] the most attractive portfolio of traditional media assets across our coverage.”

Similar dynamics are at play as affiliate fees paid by cable TV firms, which are 48% of Fox’s revenue, will slowly grow as consumers embrace content that can directly reach them. Advertising sales (43% of sales) will also struggle a bit as the economy struggles in the face of covid-19. But Maral sees continued steady free cash flow generation since Fox is one of the largest media players for advertisers to embrace. And sports, when it comes back, provides a very loyal viewership.

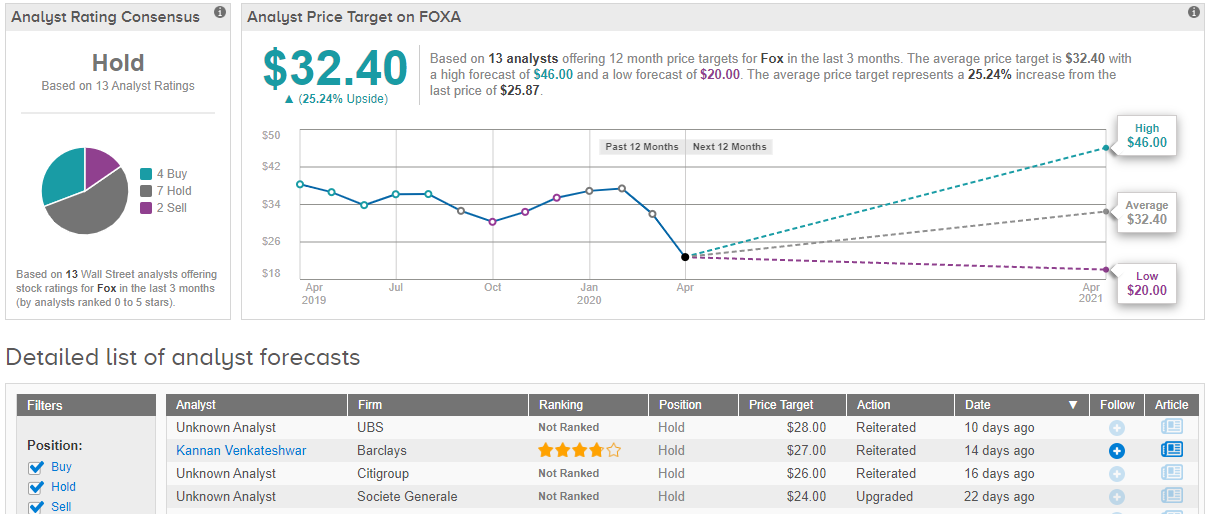

Most of Wall Street is surveying the media giant from the sidelines, with TipRanks analytics demonstrating Fox as a Hold. Based on 13 analysts polled in the last 3 months, 4 rate the stock a Buy, 7 maintain a Hold, while 2 issue a Sell. The 12-month average price target stands at $32.40, marking a nearly 25% upside from where the stock is currently trading. (See Fox stock analysis on TipRanks)