All the news right now is about the coronavirus and its effect on the economy – and rightly so. The damage – from lockdowns, quarantines, trade and travel restrictions – is unprecedented. US unemployment claims have rocketed in recent weeks, and government data indicates that between 14 and 17 million Americans are unemployed due to the shutdowns. There is no longer any question about hitting a recession – it’s here. What matters now is, how deep will it go, how long will it last, and how steeply will it recover.

Stock markets plummeted when the lockdowns began, but last week was Wall Street’s best since 1974. Markets bottomed out on March 23, and what seemed at first to be a ‘bear market rally’ has turned into something more substantial. Traders are taking advantage of low stock prices to position themselves for what the inevitable economic recovery. Of particular interest are dividend stocks, a segment that is showing high upside potential. Dividend stocks offer investors more than just potential for price appreciation – the dividend payout also offers a steady income stream, in good times and bad. These stocks are commonly used as defensive plays, to protect a portfolio’s income qualities when share prices fall.

RBC Capital, one of the major names on the Street, sees signs that the markets be starting to heal. Institutional investors have, for the second consecutive week, pushed up their positioning, buying more than selling. And retail investors, in the weekly survey of sentiment, may be showing a return to bullishness. In the latest survey results, bearish sentiment slipped from 52.07% to 49.73%, the first time in three weeks that bearish views had slipped below 50%.

So, despite a general sense that the coronavirus impact has pushed us into recession, there are initial signs that we have turned the corner. In line with that, and with the cautiously optimistic tone the bank has taken, RBC’s stock analysts have highlighted three high-quality dividend stocks also offering investors over 20% upside potential. We’ve looked at those stock picks through the lens of the TipRanks database, to find out why they are so compelling. Here are the results.

Enbridge, Inc. (ENB)

The energy sector is well known for strong cash flows and reliable dividends. Enbridge occupies transport niche, owning and operating North America’s longest transport network for crude oil and other hydrocarbons. The company is flat-out Canada’s largest distributor of natural gas, and provides gas for utilities in Ontario, Quebec, New Brunswick, and the US state of New York. The company has three main divisions: liquids pipelines, natural gas pipelines, and utility and power services.

Enbridge ended 2019 on a mixed note, with high natural gas pipeline volumes failing to compensate for lower Mainline distribution. Quarterly revenues gained 7% yoy, reaching US$6.7 billion, but missed the forecasts by almost 2%. On a clearly positive note, distributable cash flow – which funds the company’s dividend – rose from US$1.33 billion to US$1.47 billion.

For the current quarter, Q1 of calendar 2020, the company has already paid out the dividend – at new rate of 61 cents (US) per share to stockholders of record as of February 14. The dividend annualizes to $2.44, making the yield an impressive 8.5%. This compares favorably to the S&P average dividend of just about 2%, and it is far higher than US Treasury bonds, traditionally a ‘safe haven’ investment but currently yielding less than 1% on average.

Covering ENB for RBC, 5-star analyst Robert Kwan sees some risk, but also a company in a powerful position to weather a storm. Kwan writes, referring to the COVID-19 impact, “We expect lower volume on Mainline to be relatively short lived and with that, the financial impact does not appear to be overly material.” Looking ahead, Kwan adds, “…while liquidity questions have more recently come into focus, we note that Enbridge has enough liquidity to fund its 2020 capital plan more than two times, which mitigates exposure to dislocations in the capital markets.” the analyst concluded, “We believe the stock represents significant long-term value with an attractive, well covered dividend.”

The company’s solid position leads Kwan to maintain his Buy rating, along with a CAD61.00 (US$42.94) price target that implies an upside of 50% from current levels. (To watch Kwan’s track record, click here)

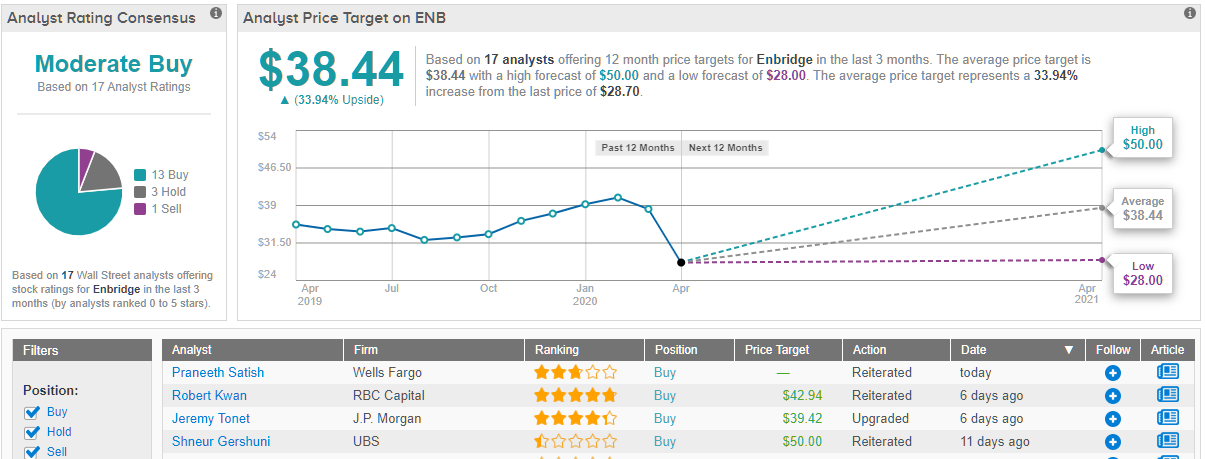

Overall, ENB stock has a Moderate Buy rating from the analyst consensus. This is based on 17 reviews, including 13 Buys balanced against 3 Holds and 1 Sell rating. In New York, shares are selling for $28.70, and the $38.44 average price target suggests room for a 34% upside in the coming 12 months. (See Enbridge’s stock analysis at TipRanks)

Altria Group, Inc. (MO)

Sin stocks – alcohol and tobacco – are another traditional defensive stock play. It’s long been known that, in hard times, people will give up luxuries – but hang on to the smaller comforts like beer and cigarettes. Altria, the owner of the best-selling Marlboro brand, is an old name in the tobacco industry.

The company is also not putting all of its eggs into a single basket. As social pressures have eaten into cigarette sales over recent decades, the company has diversified, taking stakes in JUUL brand e-cigarettes, the Canadian cannabis company Cronos, and the Belgian brewing company ABInBev. Altria has shifted from a pure tobacco giant to a veritable one-stop shop for common vices.

It remains a viable business strategy, however. E-cigs, while controversial, are widely touted as a probable successor to traditional cigarettes. Cannabis is a growing niche, now fully legal in Canada and fully or partly legal in a growing number of US states. And by owning both a brewer and a cannabis grower, Altria is positioned to move when the cannabis-infused beverage market opens up.

On the negative side, Altria is facing potential Federal Trade Commission litigation, under anti-trust laws, related to its 35% stake in JUUL. The government is contending that the stake unlawfully eliminates competition. It will be at least 9 months before any court hearings even begin, however, and the process will almost certainly be long and drawn out. It remains to be seen if Altria will fight or simply sell back all or part of its stake in JUUL.

Heading into the coronavirus quarter, Altria finished 2019 with solid earnings. EPS was $1.02 for Q4 2019, and revenues came in at $4.8 billion. Both numbers were modestly higher than the forecasts. The company held its 84-cent quarterly dividend steady, for the third quarter in a row. The next payment is due out at the end of this month. With an annualized payment of $3.36 per share, MO’s dividend is considered high in absolute terms – but the 8.37% yield is the real attraction.

RBC Capital analyst Nik Modi sees the FTC issue as minor in the short-term, saying that it should not impact the stock. Modi writes, “Altria intends to fight the ruling… It should, however, buy them some time to get a more favorable valuation.” He also adds that the company has a firm foundation going forward: “Altria’s core tobacco business (which generates all of the company’s profit) is performing well and cigarette volume declines are moderating, while pricing remains solid.”

Modi’s Buy rating on MO stock comes with a $68 price target indicative of a 68% upside potential. (To watch Modi’s track record, click here)

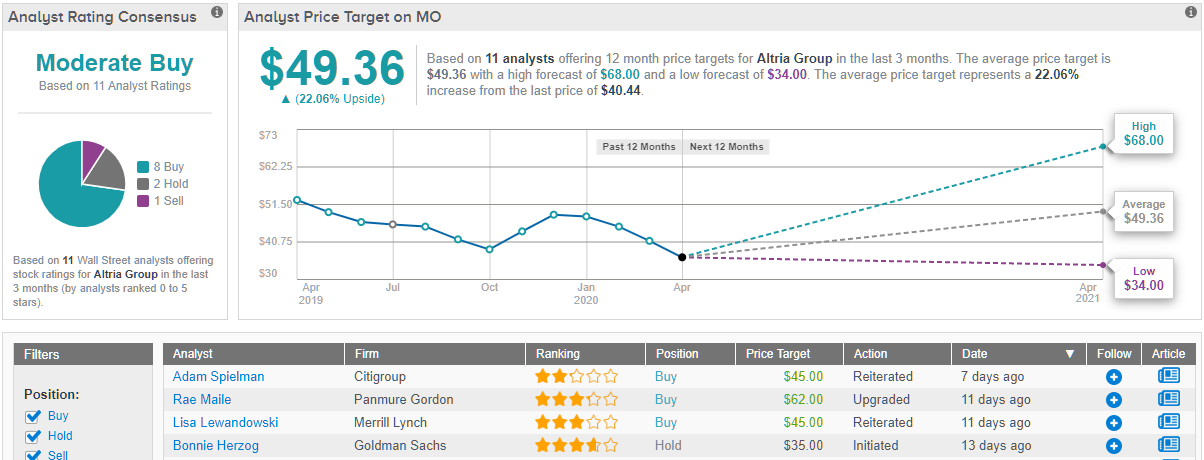

Overall, Wall Street is pretty upbeat about the tobacco giant. TipRanks analysis of 11 analyst ratings shows a consensus Moderate Buy rating, with 8 analysts Buying and, 2 recommending Hold, and only 1 saying Sell. The average price target among these analysts stands at $49.36, representing a 22% increase from current levels. (See Altria stock analysis on TipRanks.)

Coty, Inc. (COTY)

With the third and final stock on this list, we turn to the cosmetics industry. Coty currently holds the largest position globally in the fragrance niche, is the world’s second largest hair care product company, and the third largest cosmetic maker. The company owns well-known brands such as Covergirl, Calvin Klein Fragrances, Clairol, Max Factor, and Wella.

A strong stable of popular brand names is a true asset, giving the company a solid position in its niche. COTY brought in 27 cents per share in its fiscal Q2 report, beating both the forecast and the year-ago numbers by 12.5%. Revenues edged over the estimates, reaching $2.35 billion, but were down year-over-year.

For such a large company, COTY shares are priced low. The easy cost of entry, however, is paired with an 8.3% dividend yield and a 3-year history of dividend growth. The shares currently pay out 13 cents quarterly, and the 46% payout ratio indicates that the dividend is both affordable and has plenty of room for further growth.

Nik Modi covered this stock for RBC, too, and sees it as a net positive in the long run. He writes of COTY, “Coty is constantly innovating and bringing new products to market. The success of these new products is a catalyst for growth… We believe improvements to its leverage ratio and an increase in capital deployment to shareholders through increased share repurchases or dividend payouts could be inflection points for Coty’s multiple.”

Modi’s Buy rating here is backed by his $9 price target, which implies a hefty 55% upside potential for the company this year. (To watch Modi’s track record, click here)

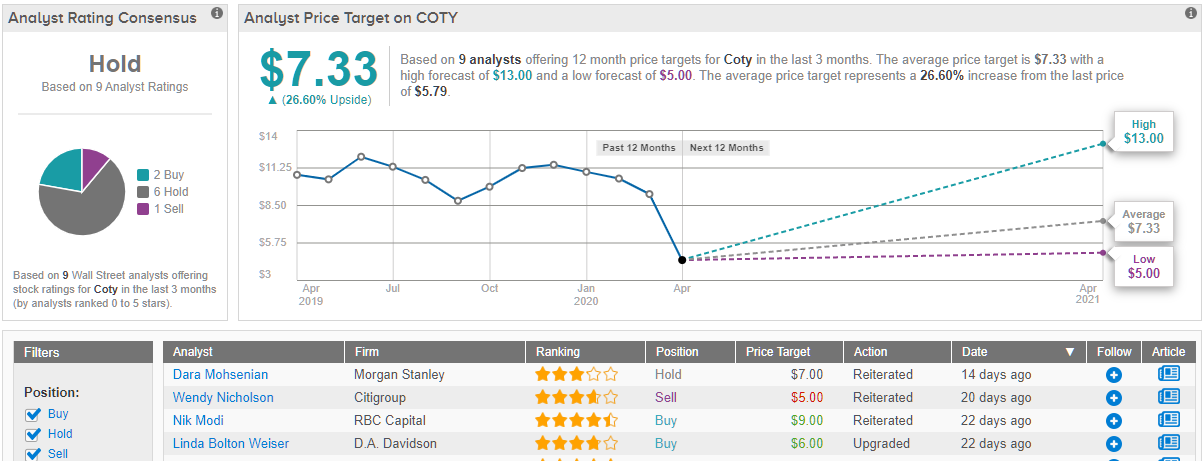

According to TipRanks, the consensus on Wall Street is that COTY stock is a “hold” for investors. But TipRanks might as well have said “buy” — because analysts, on average, think the stock, currently at $5.79, could zoom ahead to $7.33 within a year, delivering nearly 27% profits to new investors. (See Coty stock analysis at TipRanks)

To find good ideas for dividend stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.