Talk about a wild ride! From the market high hit February 19, before “coronavirus” became an official “pandemic,” to the market low hit just over a month later, the S&P 500 dropped 34% — then bounced. The past three weeks have seen an incredible run-up in stock prices from their March 23 lows. And yet, even today, we’re still down nearly 20% from where we started.

So there may still be bargains to be found. At least, that’s what investment banker RBC Capital thinks. And so, RBC created its first “U.S. Small Cap Growth Idea List” for investors searching for stock gems amidst the rubble.

So far, RBC’s list covers 15 names offering investors either a history of “attractive normalized growth” or the potential for “strong durable growth” after the Coronacrisis passes.

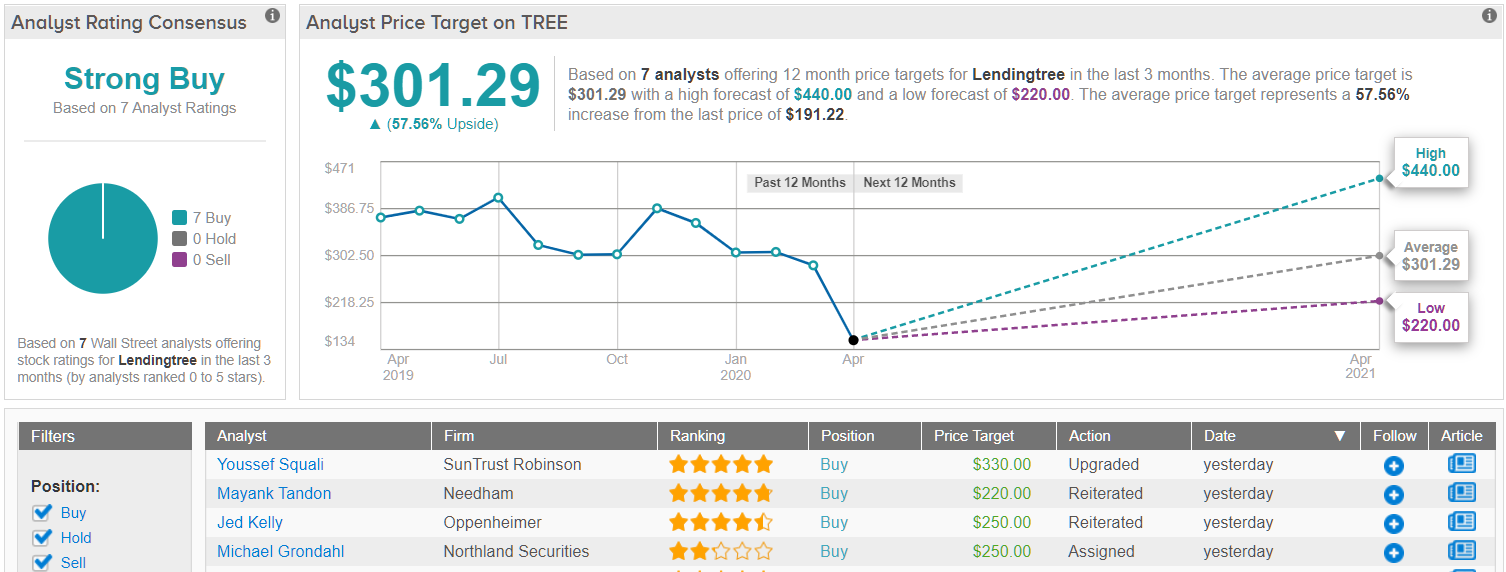

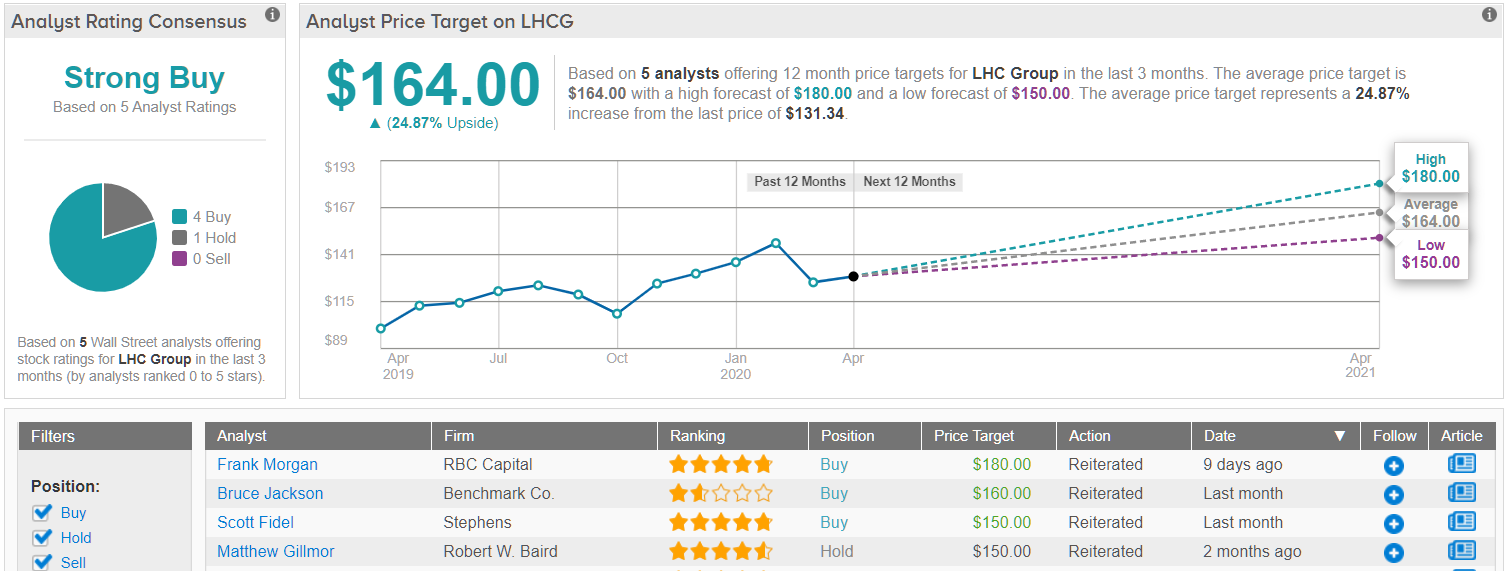

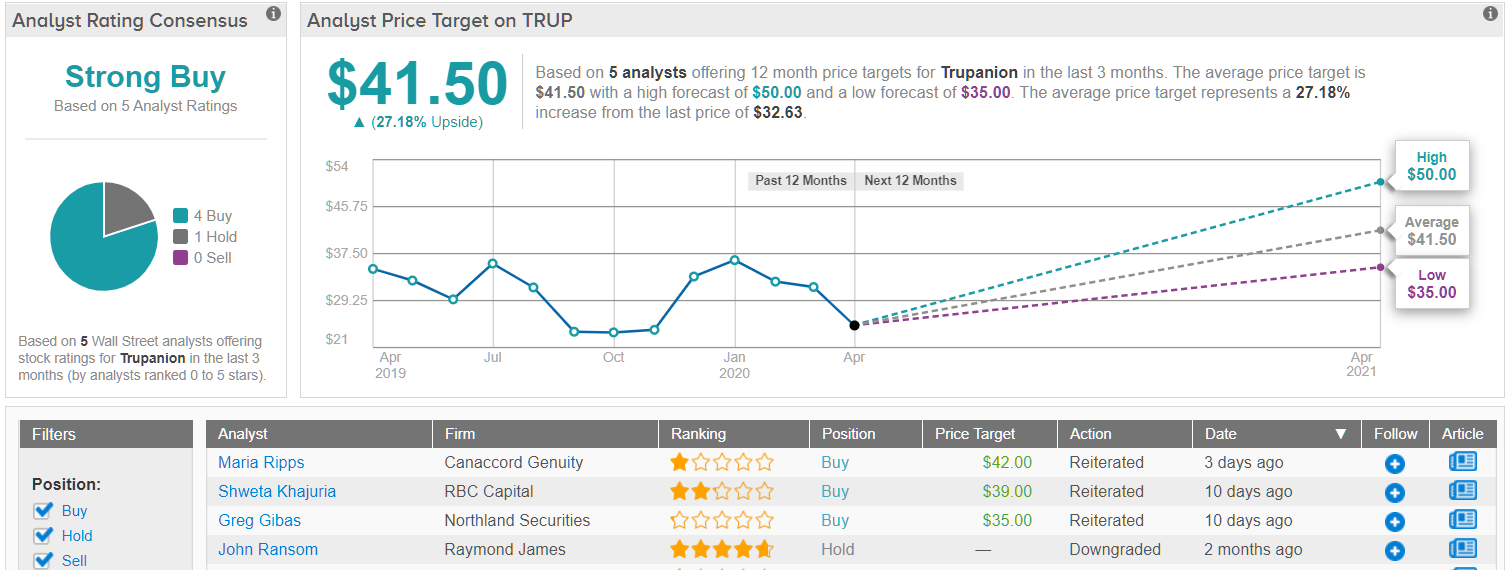

We ran three throughTipRanks’ database to determine the rest of the Street’s sentiment. We found out that all earned support from other analysts as well, enough so to be given a “Strong Buy” consensus rating. Not to mention all three could see substantial gains in the twelve months ahead.

LendingTree (TREE)

First up is LendingTree, “one of the leading marketplaces for online consumer loans,” as RBC 5-star analyst Mark Mahaney observes.

The company connects borrowers with lenders in the credit card, deposit account, and insurance segments, among others. Lendingtree was founded in 1996, went public in 1998, and so is a survivor of the original dot.com bubble.

LendingTree “is well positioned to capture greater share” of “a very large and expanding” market, argues Mahaney, and up until recently was “seeing accelerating top-line growth from two revenue segments (Mortgage and Non-Mortgage) while maintaining stable, mid-teens EBITDA margins.”

Granted, both halves of LendingTree’s business are facing near term “headwinds from the COVID Recession,” with lower consumer spending generally, less spending on cars in particular (reducing demand for car insurance), and also less home-buying (reducing leads for mortgages). That said, the stock is trading “at 3-year trough multiples” after the recent sell-off, and Mahaney believes it will perform well during any upcoming economic recovery.

Priced at $190, Mahaney thinks LendingTree stock is worth closer to $295, and worthy of an “outperform” rating. In this, he’s in the majority. Of the seven ratings recorded on TipRanks over the past couple months, six have rated LendingTree shares the equivalent of a “buy,” and the average target price on the stock is nearly $343 — 80% more than what it fetches today. So the message is clear: LendingTree is a Strong Buy. (See LendingTree stock analysis on TipRanks)

LHC Group, Inc. (LHCG)

Our second RBC pick of the day comes from analyst Frank Morgan, who offers up LHC Group — one of the largest home health, hospice, and personal cares services providers in the U.S.

“We believe LHCG is positioned for strong earnings growth in the next few years driven by a number of high-visibility opportunities,” argues Morgan, noting that U.S. government “health policy and reimbursement initiatives are … pushing post-acute care into low cost/high value settings, like home health care.” Capitalizing on this trend, he believes, will be “large, sophisticated and well capitalized operators like LHCG,” which have access to the capital necessary to roll up competition in a “highly fragmented industry” where smaller operators currently comprise almost 80% of the market.

LHC Group has in fact already made progress in consolidating the sector, recently merging with Almost Family to secure its position as “the largest independent provider of in-home services.” With this status in hand, Morgan believes LHC will become the “partner of choice for hospitals and health systems” looking to form joint ventures through which to provide in-home care.

Priced at less than $140 today, Morgan values LHC Group stock at closer to $180. On the one hand, this price seems aggressive, it being among the highest valuations assigned to LHC of any analyst opining on the stock in the past six months. On average, analysts tracked by TipRanks value LHC shares at only $164. On the other hand, Morgan’s price target could turn out to be conservative, inasmuch as he values the stock at “a discount to that of LHCG’s closest peer.” (See LHC Group stock analysis on TipRanks)

Trupanion, Inc. (TRUP)

Last but not least, we come to Trupanion, a rising star in the “underpenetrated” market for pet insurance. RBC analyst Shweta Khajuria notes that currently, fewer than 5% of pet owners in the U.S. are paying for health insurance for their pets. This number may indicate lack of interest in the concept — or the potential for “robust growth” for the company that succeeds in attracting pet owners’ interest.

To attract this interest, Trupanion has set up a “national sales force” covering “over 130 Territory Partners” blanketing some “10K active pet hospitals” with marketing. The service they are hawking, by the way, is differentiated by offering coverage for “all pet conditions and ailments” — the only pet insurance company that does this, notes Khajuria. Boasting such a “differentiated business model,” and also “a very strong management team,” Khajuria believes Trupanion will be the company to succeed in popularizing pet insurance.

From an investors’ perspective, meanwhile Trupanion’s “subscription-based model faces low churn, creating strong revenue visibility that is more predictable than most subscription businesses,” and at the same time makes Trupanion’s revenue stream somewhat more “COVID-Recession resistant than [other companies] in our small cap coverage.” This bodes well for Trupanion’s continuing its record of “notching nineteen straight quarters of mid-to high-20s% Y/Y revenue growth.”

All in all, Khajuria values Trupanion stock at $39 a share — about 19% more than it costs today. As a result the analyst keeps his rating at Outperform. (To watch Khajuria’s track record, click here)

Wall Street tends to agree with the analyst’s confidence on the pet insurance firm, considering TipRanks analytics reveal TRUP as a Strong Buy. Out of 5 analysts tracked in the last 3 months, 4 are bullish on Trupanion stock while 1 remains sidelined. With a return potential of nearly 27%, the stock’s consensus target price stands at $41.50. (See Trupanion stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.