Big Oil has seen bigger losses in recent months, as the energy industry has been hit by a series of related shocks. In the first half of the year, demand fell sharply. The lockdown policies put in place to halt the spread of the coronavirus had a major part in that – but demand was likely to fall anyway, from a producer perspective, as the global stockpiles were nearing capacity. The combination of both factors delivered a massive one-two punch to the industry.

This doesn’t mean that investors can’t find deals among the oil companies. RBC, Canada’s premier investment bank, has long had its pulse on oil stocks – Canada is the world’s fifth largest crude producer, and what happens to the oil industry will impact our northern neighbor. In response, RBC has reported on its Best Ideas in the global – and North American – energy markets for 2020.

We ran three of the firm’s Best Ideas through TipRanks’ database to get a better sense of the broader analyst community’s opinion. We revealed that the Street is overwhelmingly bullish on all of the names, with each earning a “Strong Buy” consensus rating.

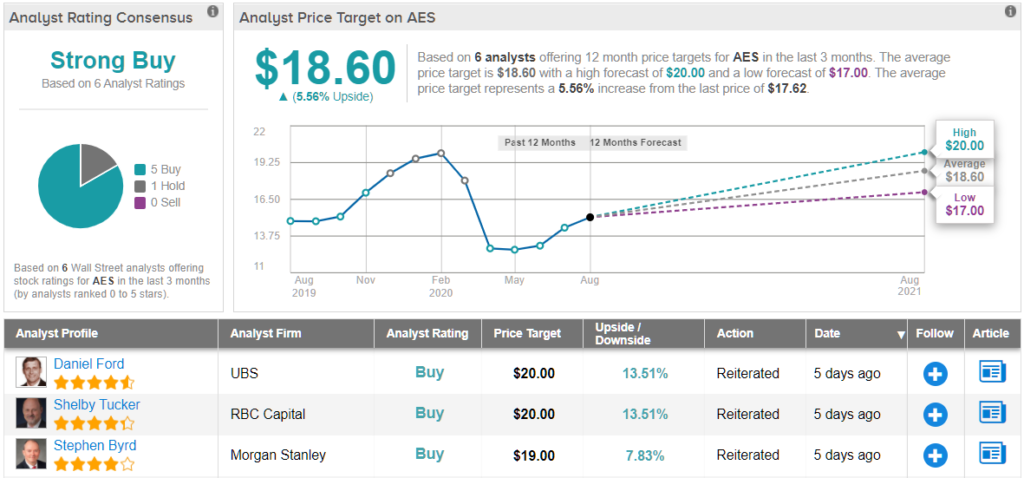

AES Corporation (AES)

The first company on our list, AES, is a diversified energy provider. The company owns and operates, through development and acquisition, a network of power generation plants and distribution systems in 14 countries. AES has a portfolio of assets worth over $34 billion, and brought in revenues of $10 billion in 2019.

All of this gave the company a solid foundation when the coronavirus hit. AES kept its earnings positive during the first half, and while Q2 EPS was sequentially lower than Q1, the first quarter figure missed the forecast where the second quarter number showed a beat. Looking ahead, AES is expected to see third quarter earnings rise sharply as normal economic activity resumes.

Reviewing this stock for RBC, 5-star analyst Shelby Tucker likes the company’s prospects. He writes, “Generation remains highly contracted and is resilient to near-term demand weakness […] The company is on track to achieve investment grade ratings from S&P and Moody’s despite the effects of COVID-19, in our view. […] The pandemic-induced sell-off creates an attractive entry point, in our view. AES currently trades at 7.8x EV/EBITDA relative to 11.3x for utilities.”

To this end, Tucker gives AES a Buy rating, and his $20 price target suggests a 14% upside to the stock in the coming year. (To watch Tucker’s track record, click here)

While the stock has a Strong Buy analyst consensus rating, based on 5 Buys compared to 1 Hold, the average price target, at $18.60, implies a modest 5.5% upside from the $17.62 trading price. (See AES stock analysis on TipRanks)

Cheniere Energy (LNG)

The next company on our list of RBC picks is Cheniere Energy. This Texas-based firm is a leading producer of liquified natural gas (LNG), a less volatile and more easily transported form of the natural gas produced in copious quantities by the oil industry. Natural gas is a cleaner-burning fuel compared to other petroleum products, and plays an important role in reducing emissions. The liquified form is the primary way in which it is shipped into the markets.

Cheniere owns and operates the infrastructure needed to liquify the gas and load it for transport. The company owns rail cars and pipelines for overland transport in the US; shipments overseas are loaded at the company’s Sabine Pass and Corpus Christi terminal facilities.

While depressed demand has hurt Cheniere’s stock price, holding it down in recent weeks, the company’s contract for service structure has allowed it to maintain earnings during the corona crisis. LNG beat the forecasts on earnings in both Q1 and Q2 of 2020, despite a 20% fall-off in revenue during the first half of the year.

Elvira Scotto, another 5-star analyst from RBC, is impressed with Cheniere, especially its ability to keep up business. She writes of the company’s business model, “Cheniere has long-term take-or-pay contracts on 85% of its nine-train portfolio capacity. All of Cheniere’s Sale and Purchase Agreement customers are investment grade rated or have investment grade credit metrics. Importantly, utilities or state-owned utilities/oil and gas companies represent 68% of Cheniere’s contracted capacity.”

Scotto believes that Cheniere’s current low share price represents an opportunity, saying “we still see value” in the stock. Her price target of $65 indicates her confidence in a 26% one-year upside to the stock, and supports her Buy rating. (To watch Scotto’s track record, click here)

LNG has a Strong Buy rating from the analyst consensus, and it is unanimous – no fewer than 6 positive reviews have been received in the last three months. Shares are selling for $52.25, and the average price target, $65.83, is slightly more bullish than Scotto’s; it suggests an upside potential of 27% for Cheniere Energy. (See LNG stock analysis on TipRanks)

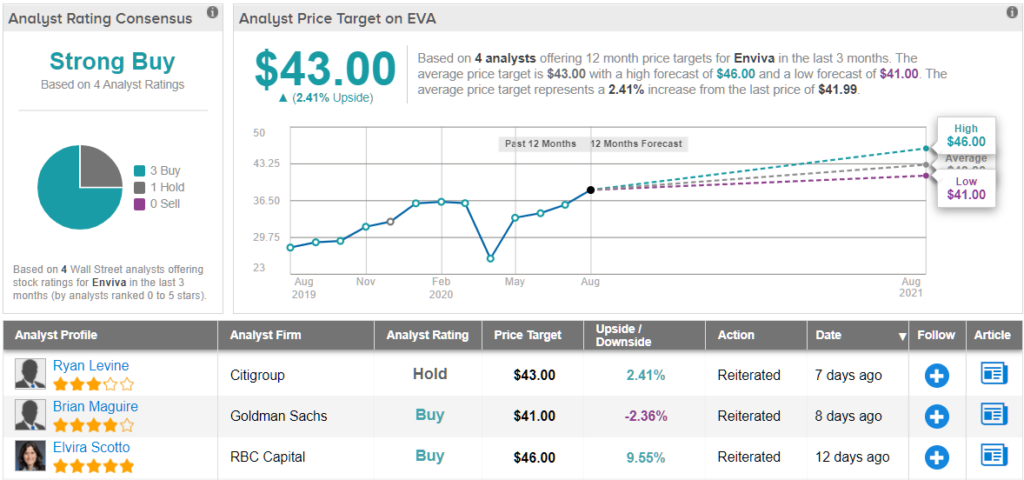

Enviva Partners LP (EVA)

The last of RBC’s energy picks on today’s list is Enviva Partners, a company squarely in the ‘green energy’ sector. Enviva produces processed biomass fuel, a type of wood pellet sold as power generation fuel to industrial customers. Biomass pellets burn cleaner than coal, and provide a productive way to dispose of sawdust, woodchips, and other common waste from the lumber sector.

Enviva’s production facilities are located in the Southeast, but the company is mainly an exporter. Of the 3 million tons of annual pellet production, most gets sent overseas to the UK and Europe. Plants using the biomass pellets saw an 80% reduction in carbon emissions on average.

Despite a sharp drop in earnings in the first half, Enviva has seen a strong share price recovery from the market collapse of February/March. Shares bottomed out on March 23, but have since nearly doubled. Since the current cycle began on February 20, EVA is up 14%, outperforming the S&P 500 over the same period. Reflecting another good sign for investors, last week, EVA announced its regular dividend payment, of 76.5 cents per share, will be paid out at the end of this month. The move marked the twentieth consecutive increase in the company’s dividend, which currently yields 7.3%.

EVA shares were reviewed by RBC’s Elvira Scotto, noted above, who was impressed with the company’s steady production. She wrote, “EVA’s production facilities have continued to run normally through the pandemic and EVA has not witnessed any issues in its supply chain. In addition, customers continue to take product…” Scotto adds that, “Based on total contracted revenue backlog of ~$19 billion, EVA plans to more than double its 2019 EBITDA in the next couple of years.”

In line with her comments, Scotto rates EVA shares a Buy. Her $46 price target suggests an upside potential of 9.5%.

Enviva’s recent share appreciation has pushed the stock price right up next to the average price target of $43, resulting in a modest upside potential of 2.41%. EVA is currently trading at $42. The stock has a Strong Buy rating from the analyst consensus, based on 3 Buys and 1 Hold. (See Enviva stock analysis on TipRanks)

To find good ideas for energy stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.