In April, to combat falling sub additions and lackluster growth, Netflix (NFLX) announced that it will finally look into adding an ad-supported tier, a move the streaming giant has avoided for years. But the company surprised Wall Street on Wednesday, with its choice of partner for the venture.

Netflix announced that it had selected Microsoft (MSFT) as its worldwide advertising technology and sales collaborator, giving the tech giant exclusivity for all ads served on Netflix.

Microsoft had not been considered in the leading pack for the role, and RBC analyst Matthew Swanson believes the choice could have a negative effect on those who were considered frontrunners for the anticipated windfall.

”That said,” the analyst went on to note, “the addition of premium inventory to the market should be a positive for the broader CTV market, increasing competition and accentuating the value added services of these providers as demand shifts from direct sales towards reserved and open auctions as the supply/demand curves find a new equilibrium.”

Netflix COO Greg Peters highlighted Microsoft’s proven ability to support all Netflix’ advertising needs but none-the-less, Swanson is also surprised by the choice. Although with Bing and LinkedIn, Microsoft does have a background in advertising, the company does not have an “established presence” within CTV (connected TV). Furthermore, it lacks a ready-made salesforce and ad-server for the market.

Then again, Swanson ponders if that might be the exact reason why Microsoft was picked. In contrast to Google, Amazon or NBC Universal, Microsoft does not have “conflicting inventory” which offers direct competition to Netflix.

And given Netflix’ press release made much of Microsoft’s “flexibility to innovate over time on both the technology and sales side, as well as its robust stance on privacy protections,” Swanson thinks the appeal might lie in the partnership being a “blank slate” in CTV, which give the pair the ability to build the product and “go-to-market together.”

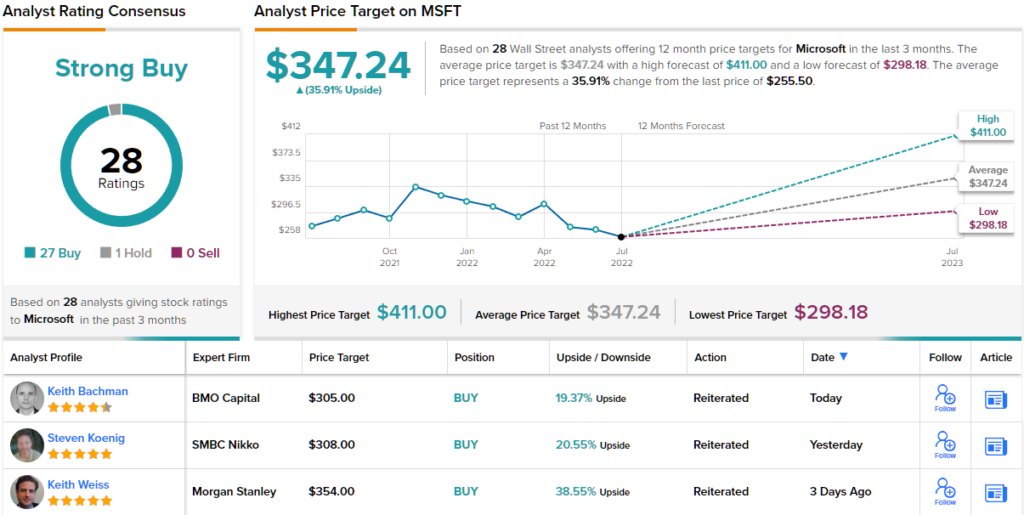

Overall, the Street remains firmly in Microsoft’s corner; barring one Hold, all 27 other reviews are positive, making the consensus view here a Strong Buy. Going by the $347.24 average price target, the shares are anticipated to climb 36% higher in the year ahead. (See Microsoft stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.