According to Redfin (RDFN), the online real estate brokerage, homebuying demand has unquestionably emerged from the Covid-19 doldrums. For the week of May 17 demand was 16.5% higher than it was before the pandemic on a seasonally-adjusted basis, according to Redfin’s latest weekly report.

To handle the sudden demand uptick, Redfin has brought back approximately 350 of the 1,000 employees that were impacted by the furlough it carried out in early April.

Mortgage rates have stimulated the housing market, with the average 30-year fixed rate mortgage at record lows of 3%. Additionally, in a recent Federal Reserve survey, 13% of respondents reported a job loss or furlough in March or early April, but that number was disproportionately represented by households with income less than $40,000, at 39%. Those with the means to purchase a home were less impacted by unemployment.

Additionally, search data from Redfin.com suggests that in the wake of coronavirus and with remote employment on the rise, people are increasingly intending to migrate from expensive metropolitan ares to smaller and less expensive cities and suburbs.

Tiffany Aquino, a Redfin agent in Virginia, said, “The pandemic has people re-evaluating their lifestyle and their goals. People who were considering a move two or three years down the line are pulling the trigger now. People are putting family priorities first.”

Technology might be a factor in this. Redfin said that 3D virtual home tours are rapidly becoming more prevalent, which for obvious reasons is an advantage during this period of “stay in place” mandates throughout the world.

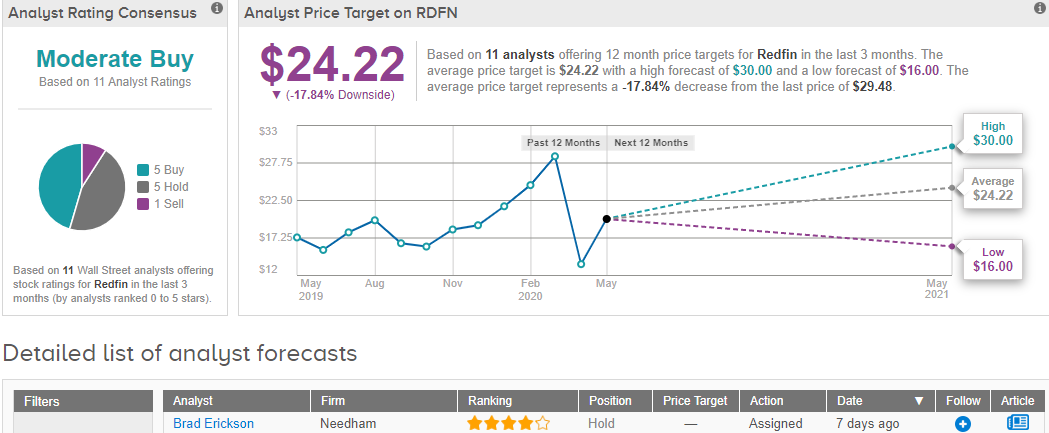

Investors have liked these recent developments, as Redfin rose by over 20% in the last week and 7.2% on Friday, to close at $29.48. TipRanks shows that analysts hold an overall moderately bullish outlook on Redfin. Stephens analyst John Campbell recently raised his price target from $19 to $26, saying that he remains a “big fan” of Redfin and that “it does appear as though the market is going to likely fare far better than we feared.” Yet with the stock running up of late, the 12-month analyst price target of $24.22 represents 18% downside from its current level. (See Redfin stock analysis on TipRanks).

Related News:

KB Home Declares Second-Quarter Cash Dividend

Google, Apple Roll Out Coronavirus Contact Tracing Technology

Apple is Said to Snap Up Startup NextVR For Virtual Reality Content; Top Analyst Sees Buying Opportunity