As with all rapidly growing companies, Roku (ROKU) has enjoyed significant upward growth trajectory, even while it continues to experience a lot of volatility. For investors willing to hold on during turbulent times, the company should reward them over the long term.

In this article we’ll look at why its growth narrative remains in place, and why it’ll probably take some time before it starts to turn a consistent profit.

Most recent numbers

In its latest earnings report Roku stated it generated revenue of $261 million, up 50 percent over the same reporting period last year. Most of that was the result of its active user accounts jumping 36 percent, and its average revenue per user climbing 30 percent.

Another factor is Roku has been changing its focus from set-top boxes to media software, which produces wider margins for the company.

Earnings will remain negative for now because it’s taking the bulk of its revenue and reinvesting it into growing its top line. With its major competitor being Amazon, it can’t afford to take its foot off the accelerator, otherwise it could lose a lot of its momentum, and would find it extremely difficult to make up ground.

At this time Amazon’s Fire TV has over 40 million monthly active users, while Roku has about 32.3 million monthly active users. Roku has more room for growth because it only operates in 20 countries as of the end of the last reporting period, while Amazon has a presence in over 100 countries.

Moving from a smaller customer base and much smaller international footprint, Roku will grow at a higher rate than Amazon going forward. Depending on its pace of expansion, it’s possible in the not-too-distant future that Roku will be running neck and neck with the e-commerce giant in this space.

Expectations are in the next earnings report the gap between Amazon and Roku monthly active users will shrink, based upon the history of its performance in the fourth calendar quarter. Further out, it should be able to incrementally chip away at Amazon’s lead. The pace of Amazon’s growth will determine the length of time it’ll take for Roku to possibly surpass Amazon’s active user base.

The most important thing to consider is that Roku has a lot of upside growth left in it before it starts to slow down. By the end of fiscal 2020, analysts see Roku’s active users increasing to as high as approximately 44 million.

Manufacturing TV base growing

At CES Roku announced it was increasing the number of manufacturers for Roku TV in the European and North American markets to 15. These include but aren’t limited to heavyweights like Hitachi, JVC, RCA, Hisense, Sharp, and Magnavox.

Not only that, but a couple of the manufacturers are increasing the number of models Roku TV will be included in.

It should be noted that while the increase in manufacturers is impressive, there will be some cannabilization of its existing manufacturers. For that reason expectations need to be managed, but it’s still a solid positive for the company.

Consensus Verdict

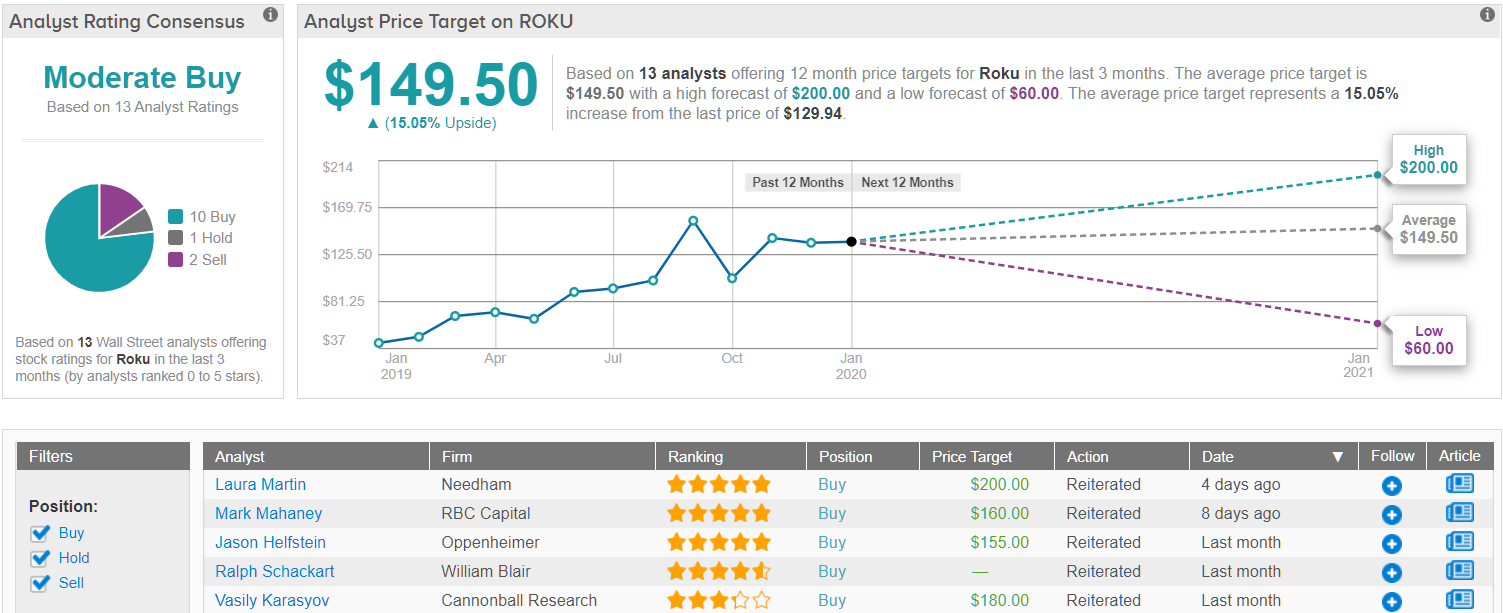

Wall Street is quite positive on this streaming giant: Roku has received 10 ‘buy,’ 1 ‘hold’ and 2 ‘sell’ ratings in the past three months. Running the numbers across the Street, the 12-month average price target lands at $149.50, representing about 15% upside from current levels. (See Roku stock analysis on TipRanks)

Conclusion

Over the last year Roku has been releasing earnings reports that surpass expectations; both in revenue and earnings. In some reports is wildly exceeded expectations. I believe it still has enough gas in the tank to continue to do so, although with more analysts and investors putting Roku on their radar, it’s going to be harder to surprise the market as expectations rise.

For now, investors are being patient on the earnings side of the business, understanding it must spend in order to increase its top line performance before it starts to be concerning with its bottom line. And as mentioned above, it has been able to cut losses in some of its quarters.

Roku remains an excellent growth story. Even so, its string of strong quarters does generate some concern if it misses for the first time in awhile. That would crush the stock in the short term, depending on management commentary as to the reasons behind it.

The future looks bright for Roku, but it’s not a stock for the feint of heart. It will continue to be volatile, and if Amazon is able to beat expectations with its Fire TV, it’ll be rightly perceived that Roku could take longer to match its active user base. That wouldn’t be a disaster in any way, but it would slow its pace of growth and share price trajectory.

I think the company has a lot of momentum left in it. As it expands to other markets and increases its manufacturing base for TVs using its product, it should continue to enjoy solid growth for some time.

Eventually its pace of growth will slow down, but I don’t think that time is yet.

To find good ideas for tech stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.