If some companies have a host of new issues to deal with following the unexpected trauma of a worldwide pandemic, then other companies have a brewing opportunity. Although you can probably count Roku (ROKU) as one of the most likely candidates to come near the top of such a list, the streaming platform hasn’t been immune to the coronavirus. Roku’s share price is down by 30% year-to-date.

According to Wedbush analyst Michael Pachter, the recent share price decline has “reined in Roku’s usually lofty valuation,” and is the reason why the analyst reduced the price target from $115 to $86. In addition, Pachter maintains his Neutral rating. From current levels, the Wedbush analyst believes the share price will drop by 9% in the year ahead. (To watch Pachter’s track record, click here)

Despite the rating and target reduction, Pachter identifies how Roku can take advantage of the current stay at home climate. With social distancing currently encouraged and enforced quarantines in place around the world, the analyst counts all of the SVOD (subscription video-on-demand) and AVOD (ad-based video on demand) services as “well-positioned,” and none more so than Roku, given the company’s “revenue share agreements with most SVOD partners as well as TVOD (transactional video-on-demand).”

Additionally, Pachter argues the need for people to stay in couldn’t have come at a better time for Roku, with a host of Oscar nominated films available to rent and purchase. “We think people are currently far more likely to watch many of these films for a transactional fee than they are under normal circumstances, and we view Roku as a prime beneficiary,” Pachter said.

Nonetheless, despite “expanding its licensing partnerships, while driving advertising revenue growth,” there’s a glaring reason why the analyst currently remains on the sidelines. “Roku’s path to profitability is unclear, as Roku continues to expand its workforce to support its next leg of growth. Achieving profitability in Roku’s international markets will take time, in our view,” Pachter concluded.

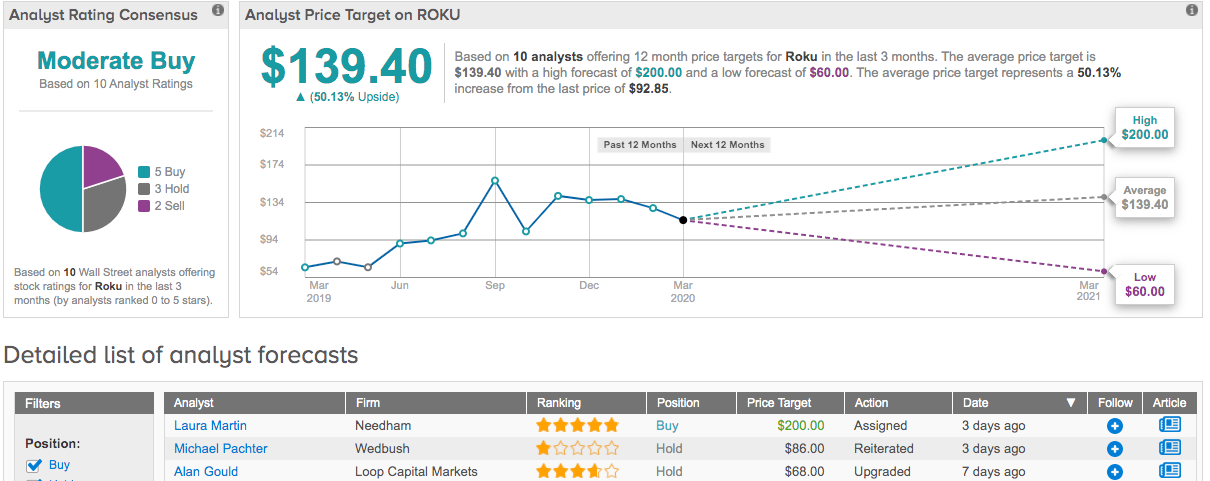

So, that’s the Wedbush view. Turning now to the rest of the Street, Roku’s Moderate Buy consensus rating breaks down into 5 Buys, 3 Holds and 2 Sells. With an average price target of $139.40, the analysts forecast possible upside in the shape of 50% over the next twelve months. (See Roku price targets and analyst ratings on TipRanks)