Roper Technologies Inc announced Thursday that it reached an agreement to buy private equity-owned insurance software vendor Vertafore Inc in an all-cash deal valued at $5.35 billion.

Roper (ROP) expects the acquisition to be immediately cash accretive and as such to contribute approximately $590 million of revenue and $290 million of EBITDA in 2021. The company said it will fund the transaction using its cash on hand, revolving credit facility, and new debt.

Vertafore’s cloud-based software provides agency management, compliance, workflow, and data solutions that simplify and automate property and casualty (P&C) insurance lifecycles. More than 20,000 agencies and 1,000 insurance carriers are using Vertafore’s software to streamline their processes, improve efficiency, and drive productivity.

“Vertafore is a fantastic business characterized by clear leadership in its niche market, a strong management team, high customer retention, and a long track record of consistent revenue and cash flow growth,” said Roper CEO Neil Hunn. “The acquisition of Vertafore is a great example of our disciplined capital deployment strategy which focuses on durable, long-term cash flow compounding.”

Vertafore was snapped up by Vista Equity Partners and Bain Capital in 2016 from private equity firm TPG for $2.7 billion, including debt.

Meanwhile Roper operates businesses that design and develop software and engineered products and solutions for a variety of niche end-markets, including healthcare, transportation, commercial construction, food, energy, water and education.

“We remain committed to maintaining our solid investment grade ratings,” Hunn added. “Our ability to consistently generate cash flow will allow us to rapidly reduce our leverage following this acquisition.”

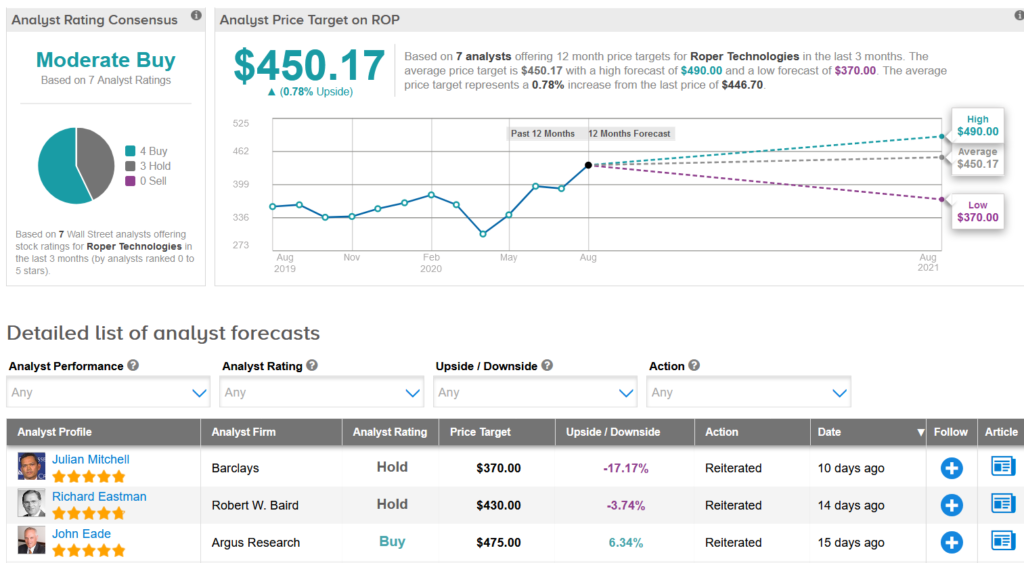

Shares in Roper have surged 28% year-to-date, and the stock scores a cautiously optimistic Moderate Buy consensus from the Street. That’s with an average analyst price target of $450.17, indicating that the stock is almost fully priced.

Oppenheimer analyst Christopher Glynn maintained a Hold rating on ROP without a price target following the release of its second quarter earning results.

“Our Perform rating reflects a pause (from previous long-held Outperform rating) as FCF yield has fallen to ~3.2%, but noting capital allocation driven cash-compounding outlook remains vibrant, and as we review appropriate comps for FCF yield,” Glynn wrote in a note to investors.

He believes that Roper remains an attractive long-term opportunity with consistent organic growth from a high-quality portfolio of businesses, but argues that this is already reflected in valuation. “ROP’s strong positions in key niche markets support best-in-class incremental margins” he added. (See Roper stock analysis on TipRanks)

Argus Research analyst John Eade raised the stock’s price target to $475 from $400 and kept a Buy rating as he believes the company is “well prepared” for the other side of COVID-19 with products benefiting from the work-from-home shift, environmental testing, and electronic surveillance.

Related News:

Facebook, Snap Held Talks To Buy TikTok Rival Dubsmash – Report

Lyft Drops After Court Order To Classify Drivers As Employees

Occidental Petroleum Posts $8.4 Billion Loss in 2Q Amid Oil Price Crisis