SAP SE (SAP) sees a “significant amount” of new business being postponed as the German software maker’s first-quarter profit and revenue misses analysts’ estimates.

SAP said first-quarter total revenue grew 7% year-on-year to €6.52 billion, short of analysts’ estimates by about €10 million. The increase was driven by a 27% advance in cloud revenue. Earnings per share amounted to 85 cents in the first three months of the year, missing analysts’ forecasts by 9 cents.

The software maker said that business activity in the first two months of the quarter was “healthy” but as the impact of the coronavirus rapidly accelerated a significant amount of new business was postponed. As a result, the company saw software licenses revenue falling 31% year-on-year.

SAP completed its share buyback program of approximately €1.5 billion by mid-March and does not plan to conduct additional share buybacks in 2020. Furthermore, the company said that its proposed dividend plan of €1.58 per share was unchanged.

Looking ahead SAP expects 2020 total revenue to be in a range of €27.8 to €28.5 billion down from a previous range of € 29.2 billion to €29.7 billion. Operating profit is forecast to be in a range of €8.1 to €8.7 billion, down from the earlier range of € 8.9 billion to €9.3 billion.

Moreover, the company expects operating cash flow of about €5 billion down from an earlier forecast of about €6 billion. Free cash flow is projected to amount to about €3.5 billion compared with €4.5 billion earlier.

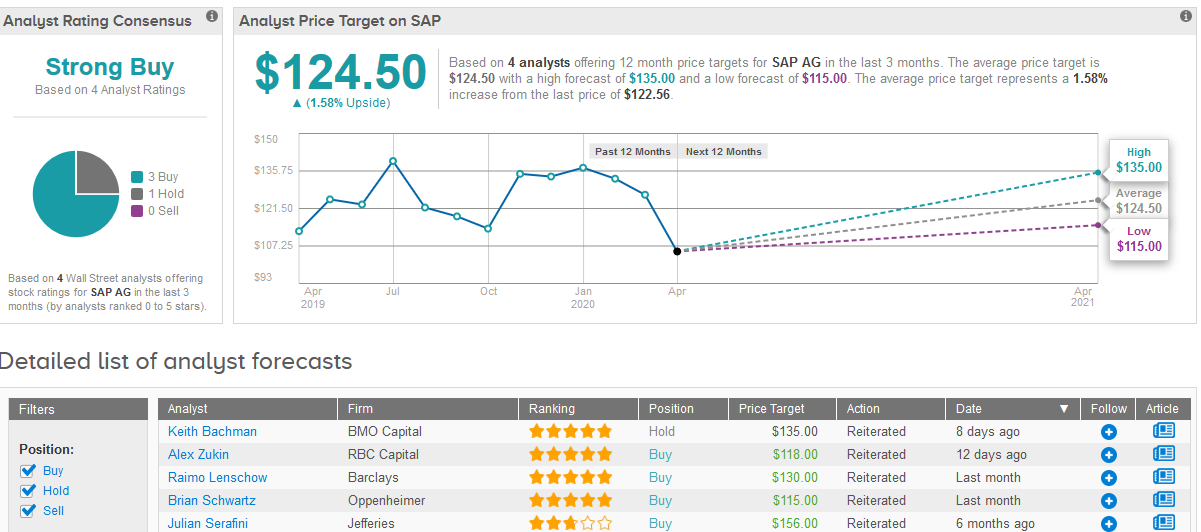

Wall Street analysts have a bullish view on SAP as 3 out of 4 analysts covering the company in the past three months rate the stock a Buy and 1 has a Hold adding up to a Strong Buy consensus rating. The $124.50 average price target implies shares will advance a mere 1.6% in the coming 12 months. (See SAP stock analysis on TipRanks).

In a separate statement, SAP announced that Jennifer Morgan, the company’s Co-Chief Executive Officer, who had joined in October will leave her position at the end of the month, putting Christine Klein in sole charge of the software maker.

“With unprecedented change within the world, it has become clear that now is the right time for the company to transition to a single CEO leading the business,” said Morgan.

Related News:

Coca-Cola Sees Coronavirus Impact to Be ‘Material’ in Q2; Slashes 2020 Guidance

United Airlines Expects $2.1 Billion Quarterly Loss as Travel Stalls

IBM Beats Quarterly Profit Estimates, Suspends 2020 Guidance