COVID-19’s impact has turned normal life upside down, making even the most commonplace behavior, such as attending live concerts, appear as from another lifetime.

Which brings us to Live Nation (LYV). The live events specialist, like all event-based companies, has been hit particularly hard by the viral outbreak, with concerts and sporting events bought to a standstill across the globe. The share price has reflected the COVID-19 punch – down to the tune of 40% year-to-date.

But recent news concerning Live Nation boosted the shares by 10% in Monday’s trading session.

Saudi Arabia’s sovereign wealth fund, the Public Investment Fund (PIF), declared via an SEC filing that it had purchased a 5.7% stake in the company, by acquiring 12.3 million LYV shares -currently valued at $500 million. The investment is a passive one, as the shares were bought on the open market, and not as part of capital raised on behalf of the company. The purchase makes Saudi Arabia Live Nation’s third largest shareholder.

The passive move to exert more influence on the global entertainment industry could be part of a wider scheme by Saudi Arabia to claw back its waning international influence, and boost its reputation.

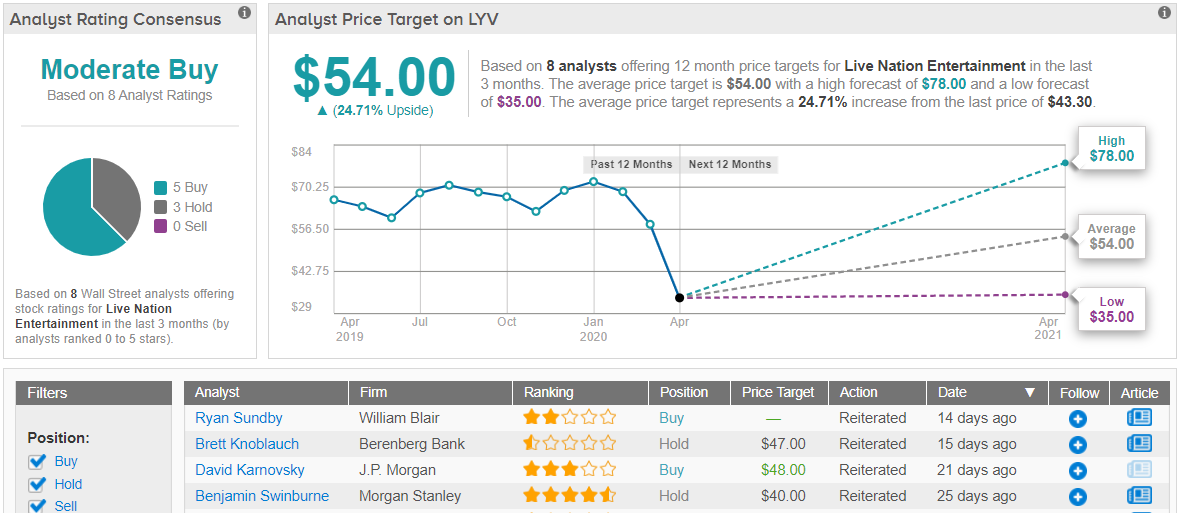

Despite the overall certainty regarding the live entertainment industry, JP Morgan’s David Karnovsky argues investors should take the long term view when considering Live Nation’s prospects.

Karnovsky said, “For a stock where the most common pushback used to be valuation, this sets up fairly well for a patient investor, and this along with our long-term confidence in the live events business informs our Overweight rating. We recognize though with a lack of visibility into a touring schedule, the stock is likely to remain rangebound and potentially volatile near-term.”

Along with the Overweight rating, Karnovsky has a $48 price target in mind. The implication for investors? Upside of 11% from current levels. (To watch Karnovsky’s track record, click here)

Overall, the rest of the Street remains cautiously optimistic. Live Nation’s Strong Buy consensus rating breaks down into 5 Buy ratings and 3 Holds. The average price target comes in at $54, and implies possible upside of 25%. (See Live Nation stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.