Seagate Technology reported better-than-expected fiscal third quarter results on Thursday. The data storage company posted revenues of $2.73 billion, up by around 0.5% year-on-year and ahead of analysts’ estimates of $2.68 billion. The company reported non-GAAP diluted earnings per share of $1.48 that came in ahead of consensus estimates of $1.32.

Seagate Technology’s (STX) CEO, Dave Mosley said, “Seagate delivered another quarter of strong financial performance driven by ongoing operational execution and record sales of our high capacity nearline drives. We grew revenue, expanded profitability and achieved non-GAAP EPS above our guided range. Our March quarter results underscore the strength of our HDD [hard disk drive] product portfolio and increasing demand for mass capacity storage.”

STX has declared a fiscal 3Q cash dividend of $0.67 per share which will be payable on July 7 to shareholders of record as on May 12.

STX expects that the rising demand for its mass data storage solutions and HDD products could result in a “solid” year-on-year growth in revenues in the fiscal fourth quarter. The company expects revenues of $2.85 billion in 4Q that could rise or fall by around $150 million and anticipates non-GAAP diluted EPS of $1.60 that could increase or decrease by 15 cents. (See Seagate Technology stock analysis on TipRanks)

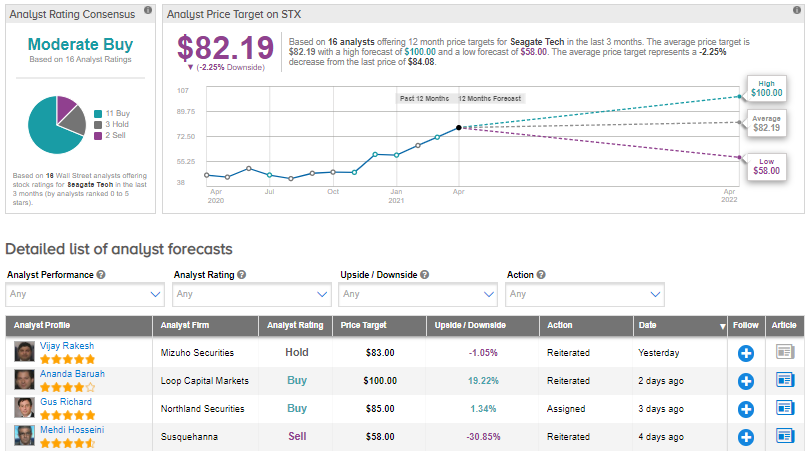

Following the third-quarter earnings, Mizuho Securities analyst Vijay Rakesh raised the price target from $78 to $83 and reiterated a Hold on the stock. Rakesh said in a research note, “STX noted revenue in the MarQ was driven by Cloud strength and recovery in enterprise. As we highlighted post our Inspur call, STX noted 18TB [terabytes] is ramping well and is expected to grow sequentially every quarter through 2021; we estimate it could reach ~40-50% of mass-capacity shipments by C3Q21.”

Overall, consensus among Wall Street analysts is a Moderate Buy based on 11 Buys, 3 Holds, and 2 Sells. The average analyst price target of $82.19 implies downside potential of about 2.3% to current levels.

Related News:

Chipotle Mexican Grill Delivers Mixed Results In 1Q

AT&T’s 1Q Results Beat Estimates; Shares Up 5%

Roku Rebrands Content From Quibi Acquisition – Roku Originals