The U.S. Securities and Exchange Commission (SEC) has moved forward with several applications seeking to launch Solana ($SOL) spot exchange-traded funds (ETFs).

In a new regulatory filing, the Wall Street regulator opened a public commentary period on a proposed ETF from Canary Capital that would enable people to invest in a Solana ETF. The SEC has also acknowledged similar filings for spot Solana ETFs from Grayscale, VanEck, 21Shares and Bitwise.

The public comment period is to last 21 days, after which the SEC will render a verdict of approval or rejection on the proposed SOL ETFs. Crypto analysts are cautiously optimistic that the Solana ETFs will be approved by the SEC, though the timing of their launch remains unclear.

New Approach at SEC

After years of fighting greater adoption of cryptocurrencies, the SEC now has a more favorable view of digital assets under the administration of U.S. President Donald Trump. Canary and other asset managers are looking to list ETFs for cryptocurrencies such as Solana, XRP ($XRP) and Cardano ($ADA) that would have been rejected under the SEC previously.

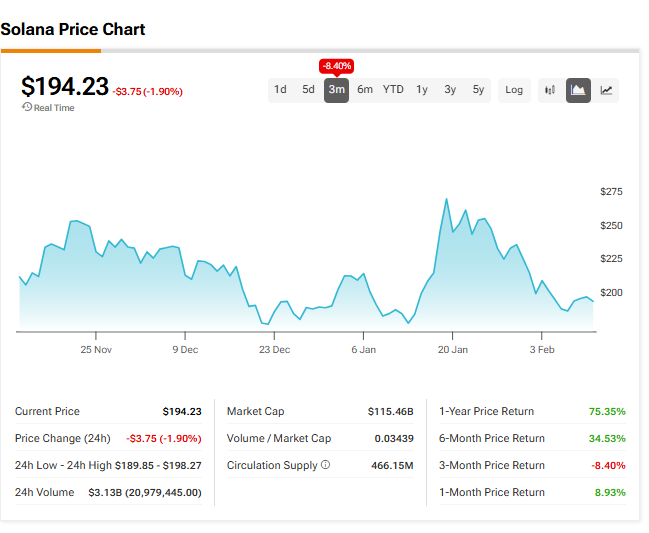

Solana is one of the larger altcoins, which are defined as all cryptocurrencies other than Bitcoin ($BTC). Over the past 12 months, Solana has risen 75% and currently trades at $194 per digital token. Many analysts anticipate that SOL will be the next crypto to have spot ETFs that track its price movements after BTC and Ethereum ($ETH) ETFs were given the greenlight from the SEC last year.

Is SOL a Buy?

Most analysts don’t offer ratings or price targets on Solana. So instead, we’ll look at the three-month price performance of the cryptocurrency. As you can see in the chart below, SOL’s price has declined 8% over the last 12 weeks.