A familiar narrative has attached itself to social media platforms during the COVID-19 pandemic. Although most have seen strong engagement figures, current wisdom dictates these platforms should expect a decline in revenue this year, as ad spending – how these platforms make dollar – is reduced due to the contracting economy. However, Wells Fargo’s Brian Fitzgerald believes Snap (SNAP) is better positioned than others to cushion the blows.

“While we do not expect SNAP to be immune from COVID-19 impacts on ad budgets,” said the 5-star analyst, “we believe they may be better insulated vs. platform peers due to SNAP’s strong direct response momentum and more limited SMB/international exposure.”

Snap will release its quarterly statement today after market close, and Fitzgerald estimates the company will report quarterly revenue of $425 million and EPS of $0.21 (Street calls for $431 million and $0.19). Looking ahead, despite expecting the year-over-year ad market to drop between 30% and 40% in 2Q, the analyst believes Snap will withstand the headwinds and exhibit revenue growth to keep it in “positive territory over the course of 2020.”

The bold assertion in the current climate is based on key factors from Q1, which Fitzgerald believes are “positives heading into the quarter.”

The first factor, as expected, Snapchat usage has increased since the onset of COVID-19. Compared to data collated before the viral outbreak, snaps are up by 44%, while snap texts have increased by 50%. Moreover, compared to late February, by late March, voice and video calling also increased by 50%.

As a result, Fitzgerald points out that “SNAP has seen a 36% increase in install volume for app ads, and a 19% increase in swipe-up rate in late March vs. late Feb.” These are the sort of figures likely to attract more advertisers to the platform.

In addition to record levels of engagement for Snap Games during the quarter, the company also hired Hulu’s ex-head of ad sales Peter Naylor to become Americas VP.

“We note the addition of Naylor should be a positive for SNAP’s advertising business and increase ad revenue through premium/commercial ad sales,” Fitzgerald noted.

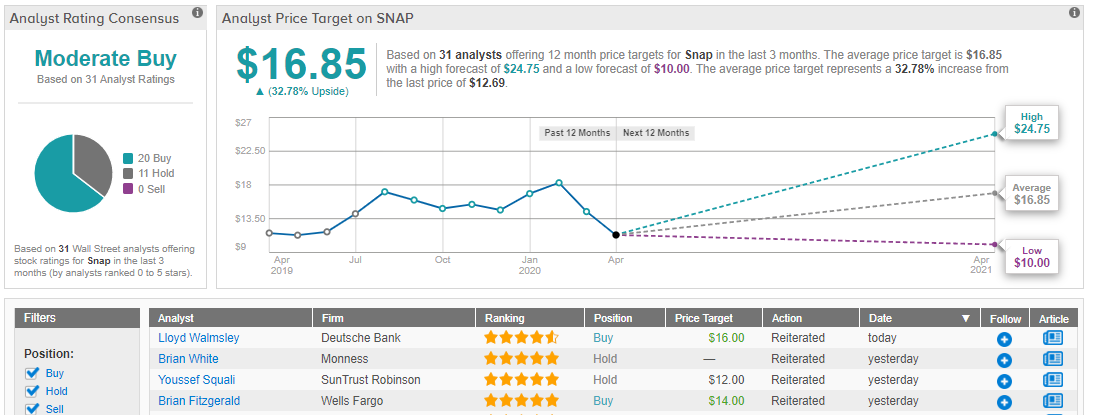

To this end, Fitzgerald reiterated an Overweight on Snap, along with a $14 price target, which implies an upside of 11%. (To watch Fitzgerald’s track record, click here)

So, there’s the Wells Fargo view. Turning now to the rest of the Street; Based on 20 Buy ratings and 11 Holds, Snap has a Moderate Buy consensus rating. The average price target is $16.85 and implies upside of 33%. (See SNAP stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.