These are the times when you really wish the world was nothing more than a disposable conversation in Snap (SNAP), erased and forgotten once completed. The maker of the disappearing photo app joins a growing list of companies receiving a pullback of estimates and price targets on account of the pandemic’s effect on projected earnings.

SunTrust’s Youssef Squali reiterated a Hold rating on Snap shares along with a price target reduction – lowered from $18 to $12. (To watch Squali’s track record, click here)

Snap’s position in the social media universe is an interesting one. Like with Facebook and Twitter, the app has seen user engagement increase significantly since the outbreak began. Snap also has several USPs, including the app’s Discover section which acts as a source of entertainment and news, while its young demographic is currently stuck at home driving further engagement.

The problem, though, as so many ad reliant platforms are finding out, involves the slashing of advertising budgets following the economy’s contraction. Snap being a smaller ad platform means it is among the first to be discarded from advertisers lists.

As Squali notes, “Despite the anticipated increase in engagement, we do not believe the rise in usage will translate into higher revenues given the disturbance to the overall economy and the resulting pullback by advertisers… Snap remains a relatively smaller social ad platform for advertisers when compared to Facebook, Instagram and YouTube, and therefore easier to cut.”

The timing is unfortunate for Snap, as last year it reorganized its sales force in an effort to bring on more advertisers. But In the current macro environment, Squali notes, advertisers are unlikely “to start experimenting with new ad mediums.”

In the long run, though, the 5-star analyst believes Snap will prevail. The company has a strong balance sheet and should be able to withstand the current setback.

“We believe this ad-weakness is short-term in nature, that the platform remains highly under-monetized when compared to other social platforms, and as such it should benefit as ad demand starts coming back, hopefully by 4Q20,” Squali concluded. Nonetheless, now is not the time to make a bet on Snap shares.

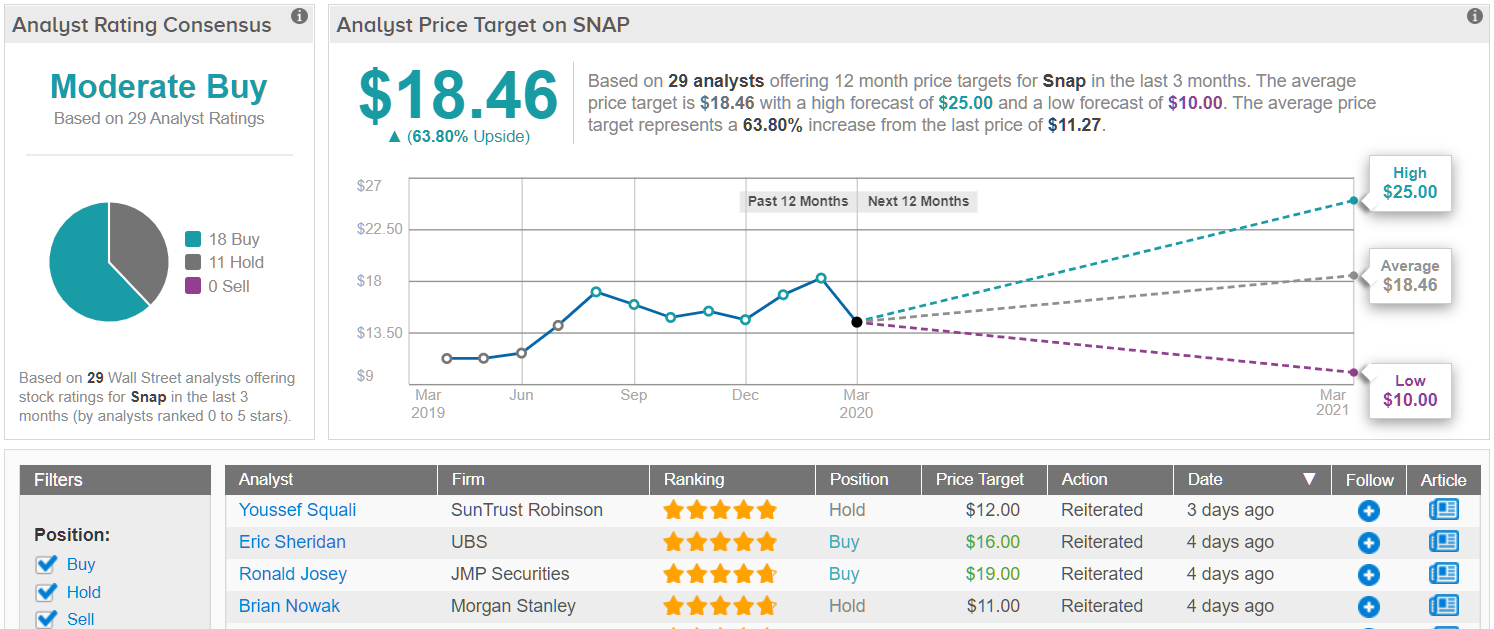

Overall, most of the Street is more confident than Squali’s sidelined stance, with TipRanks analytics showcasing SNAP as a Buy. Based on 29 analysts tracked in the last 3 months, 18 rate the stock a Buy, while 11 remain sidelined. Importantly, at $18.46, the average price target could provide investors with upside of 64% in the year ahead. (See Snap stock analysis on TipRanks)

To find good ideas for tech stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.