Back in 2013, Snap CEO Evan Spiegel resisted Facebook’s offer to buy the company behind the successful Snapchat app. The rejection caused a stir at the time, but in hindsight, it appears the correct decision was made. Snap has since gone public and has a market cap of $23 billion, which is far bigger than the $3 billion offered at the time by Zuckerberg’s all-encompassing social media behemoth.

Facebook, though, had just bought Instagram, and a year later would add WhatsApp to its ever-expanding universe. So, things have gone pretty well for both since, leaving everyone “liking” the way things have panned out.

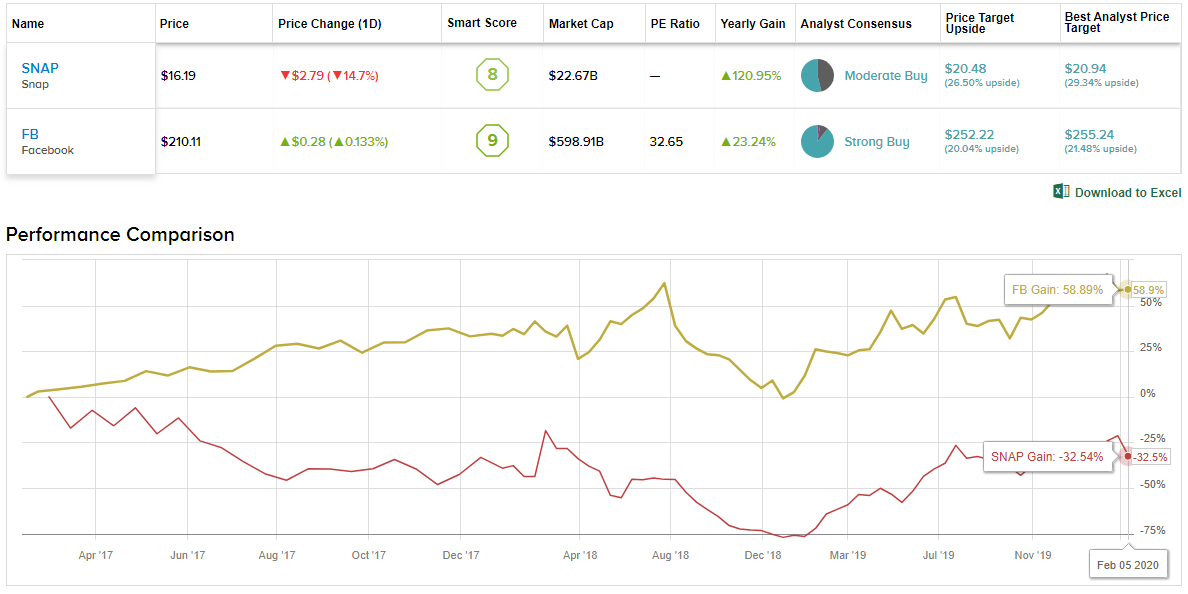

However, as it happens, both recently released earnings reports that the Street took to unfavorably. Using TipRanks’ Stock Comparison tool, we lined up the two alongside each other to get the lowdown on what the near-term holds for both of these social media players.

Snap Inc. (SNAP)

One of last year’s success stories, the maker of the popular Snapchat app rebounded magnificently in 2019. Following two difficult years of continued share price decline, the 203% gain posted by the end of the year was further extended upon in January. This week, though, the rally came to an end.

Snap posted its Q4 2019 report on February 4 and the market got a little flustered with the print, sending the share price down by over 14% in the following session.

Despite daily active users rising by 17% year-over-year to 218 million, and EPS of $0.03 surpassing the estimate’s $0.01, the disappointment stemmed from Snap’s miss on revenue; at $561 million, the figure came in below the expected $562.9 million. This was the first revenue miss for the company in seven quarters. Snap expects revenue for Q1 2020 to land between $450 million and $470 million, roughly in line with the estimate’s $461.6 million. Guidance projects 224 million to 225 million daily average users, an 18% year-over-year increase.

In addition to the mixed print, Snap is also coming across increasing competition in the shape of Gen Z favorite Tik Tok. The popular app is gaining market share and could prove more troublesome for Snap’s numbers as the year progresses.

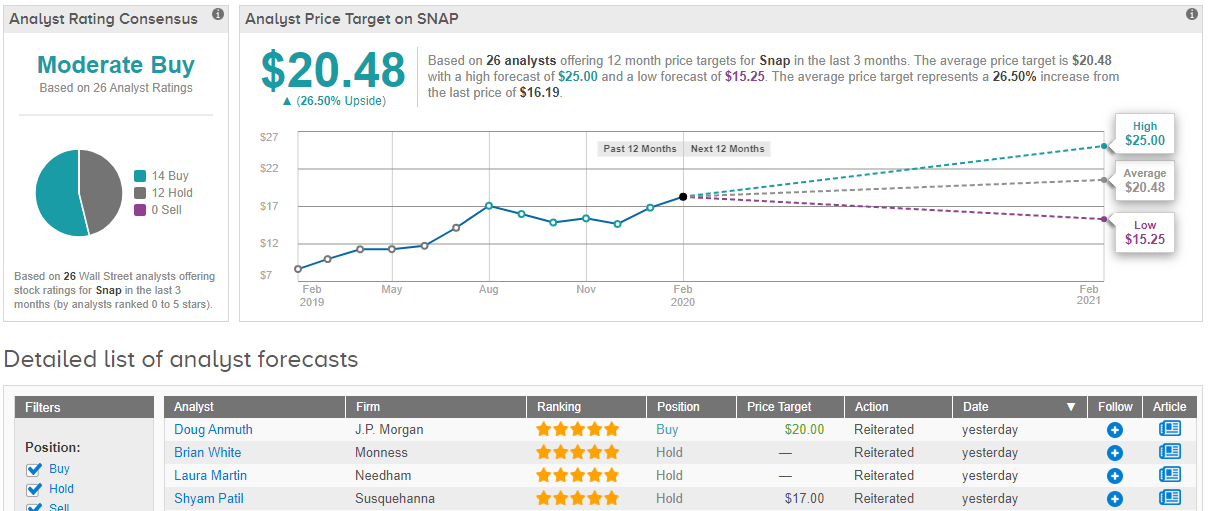

Nevertheless, according to J.P. Morgan’s Doug Anmuth, the market has overreacted to the overall positive results, and the post-earnings pullback represents a buying opportunity. Anmuth argues a backdrop of a growing user base and linear TV ad dollars shifting more toward mobile video can provide Snap with “strong” average revenue per user gains over time. Additionally, the 5-star analyst believes the shorter holiday impacted results and that Q1 sales could accelerate.

Anmuth, therefore, kept his Overweight rating along with his $20 price target. The figure implies upside potential of 24%. (To watch Anmuth’s track record, click here)

Out on the Street, Snap’s 14 Buys and 12 Hold ratings add up to a Moderate Buy consensus rating. With an average price target of $20.48, analysts see the social media name adding 27% to the share price over the coming 12 months. (See Snap stock analysis on TipRanks)

Facebook (FB)

Onto the F in FAANG, we move to the seemingly unstoppable Facebook. The social media giant was repeatedly in the news last year for all the wrongs reasons: allegations of user data breaches and regulatory issues concerning its proposed digital currency Libra. Did these affect the price movement? Au contraire. Facebook marched on and handily beat the S&P 500’s stellar 29% increase in 2019, posting a gain of 59% over the year.

Last week’s earnings report, too, displayed further impressive figures. Revenue came in at $21.1 billion, easily beating the estimate of $20.9 billion and exhibiting a year-over-year increase of 25%. At $2.56, EPS exceeded the Street forecast by $0.03. Facebook also reported that free cash flow rose, up from $3.3 billion to $4.8 billion. 2018’s overall figure of $15.4 billion was eclipsed by 2019’s free cash flow of $20.7 billion.

Despite the beats across the board, the Street was unimpressed, having expected more acceleration in the growth figures. The social media giant’s outsized growth expenses caused the relatively modest EPS increase of 8% year-over-year. As a result, the market reacted with a shrug and sent the share price down by over 3.5% the following day.

Jefferies analyst Brent Thill, though, is non plussed by the tepid reaction. Facebook’s core business is still “very healthy” and the 5-star analyst sees “plenty to like” in the company’s Q4 report.

Thill argues that if Facebook grows expenses at or below the low end of its initial FY20 guidance, the company “has a clear pathway to a bull case of $10 EPS in FY20.”

Accordingly, then, Thill reiterated a Buy rating on FB and kept his price target of $250 as is. The figure implies potential upside of 19% over the next year. (To watch Thill’s track record, click here)

The rest of the Street agrees. Facebook’s Strong Buy consensus rating breaks down into 34 Buys, 3 Holds and a single Sell. At $252.22, the average price target comes in slightly higher than Thill’s and indicates possible upside of 20%. (See Facebook stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.