The transition from carbon-based fossil fuels to renewable energy sources has been in progress for some time, given the ongoing effects of climate change. Right now, around 20% of the electricity the power sector produces comes from renewable energy sources like wind, hydroelectricity, and solar. Over the past 10 years, the industry has experienced rapid growth, quadrupling its ability to produce electricity. Yet, the pace has picked up recently due to growing concerns about climate change.

The pivot to new sources of energy also got a real boost with the passing of the Inflation Reduction Act, signaling the government’s intention to accelerate growth and hasten the transformation.

At the heart of it are all the companies seeking to put this change into action; many are publicly listed, opening up opportunities for investors.

With this in mind, let’s take a look at two companies operating in the solar energy space and see how they are positioned to benefit from the shift in energy production. These names have received a recent thumbs up from some Street analysts, and with assistance from the TipRanks platform, we can gauge the rest of Wall Street’s sentiment and find out which one offers more bang for the buck for investors right now.

SolarEdge Technologies (NASDAQ: SEDG)

First, let’s have a look at SolarEdge, a developer and producer of an optimized inverter system. The device attaches to the back of solar panels and increases the amount of power generated, which helps to reduce energy costs.

SolarEdge has also begun to use its knowledge of inverters to develop other smart energy offerings. It has increased its range of products by acquiring companies that specialize in several energy market categories, including storage, batteries, grid services solutions, and electric vehicle charging.

Although SolarEdge’s unique technology can be more expensive upfront than a straightforward string array solution, it maximizes the array’s lifetime value. MLPE (Module Level Power Electronics) innovation, backed by patent protection, has helped move SEDG to the front of the U.S. solar rooftop industry.

That leading position has been built on solid and consistent growth. There was more on tap when the company reported Q2 financials at the start of August.

Revenue increased by 52% year-over-year to a record $727.8 million, with the Solar segment also generating record sales of $687.6 million. The figure just missed the Street’s call for $730.7 million. The bottom line beat estimates, however. Analysts were expecting adjusted EPS of $0.88, but that figure came in at $0.95.

The company’s outlook disappointed investors. SEDG is expecting margins to take a hit due to a drop in the price of the Euro; the European market accounts for more than 30% of SolarEdge’s business.

Investors might have sent shares down following the report’s release, but the stock has still managed to outperform the market this year, showing 7.8% year-to-date losses vs. the S&P 500’s (SPX) over 21% drawdown.

JPMorgan’s (NYSE: JPM) Mark Strouse thinks there are enough reasons to believe that outperformance is set to continue.

“SEDG is one of the few solar stocks that is consistently profitable, generates cash, and has a solid balance sheet,” the five-star analyst explained. “We believe further penetration of the global solar market and expansion into new verticals should allow the stock to outperform our solar coverage… We believe SEDG has significant potential for upside to estimates from share gains, energy storage adoption, new products, and expansion into new verticals.”

Along with an Overweight (i.e., Buy) rating, Strouse’s $419 price target makes room for 61.9% upside potential from current levels. (To see Strouse’s track record, click here)

What about the rest of Wall Street? Most analysts agree the stock is a Buy – eight, in total – yet, with an additional two Holds and one Sell, the consensus is that the stock is a Moderate Buy. Standing at $369.45, the average SEDG stock price target offers potential 12-month returns of ~42.8%.

First Solar (NASDAQ: FSLR)

If there’s one company that has been noted as a prime beneficiary of the Inflation Reduction Act (IRA), it’s leading solar panel manufacturer First Solar.

The bill includes climate-related provisions, and the company stands to benefit from significant production tax credits and $369 million earmarked for energy security and climate change programs.

First Solar plans to put the cash credits to good use and recently announced plans to invest up to $1.2 billion in expanding its U.S. solar panel manufacturing abilities, citing the IRA as a big reason for doubling down on investing in U.S.-based facilities.

Additionally, surging energy commodity prices have helped solar power costs get closer to those of other, more traditional power-generating sources. The company’s recent hot streak was further enhanced by a strong Q2 report.

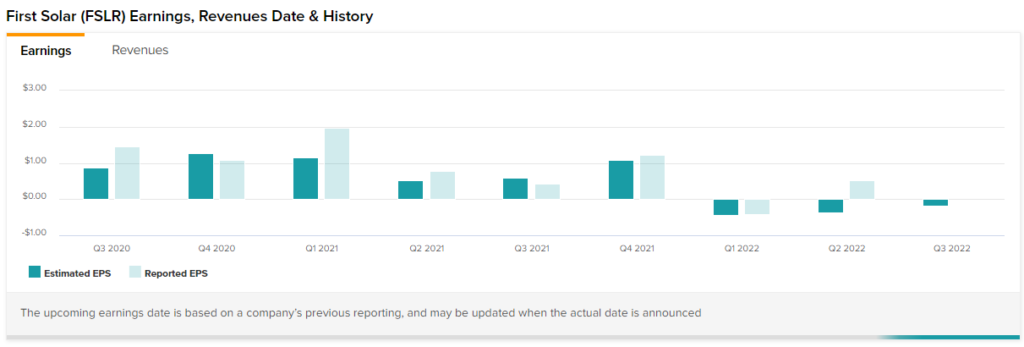

Despite dropping by 1% from the same period last year to $621 million, the revenue haul beat the $607 million analysts predicted. Similarly, net income fell from $82.4 million a year ago to $55.8 million, resulting in $0.52 per share, but that figure easily trumped the loss of $0.36 per share expected on Wall Street.

As for the outlook, the company increased its sales guidance for the year and is now expecting revenue in the $2.55 billion to $2.8 billion range compared to $2.4 billion to $2.6 billion beforehand. The Street was looking for $2.43 billion.

All these developments have helped the stock become an outlier in 2022’s downtrodden market. Shares have accumulated gains of 49% since the turn of the year.

For Baird analyst Ben Kallo, FSLR is his “favorite name in the solar space,” while the analyst highlights the company’s sound financial standing.

“FSLR continues to have the strongest balance sheet in the solar industry, and we think its balance sheet strength relative to its competition will play an increasingly important role in winning new business, particularly as the ability of its Chinese competitors to avoid bankruptcy remains in doubt,” the five-star analyst explained.

“FSLR’s financial position should increase confidence from customers that the company will have the longevity to deliver on warranties and should also allow FSLR to garner more favorable financing rates on projects…We believe shares will trade higher as sentiment continues to improve,” Kallo added.

26.3% higher, that is, according to Kallo’s $164 price target. No need to add, Kallo has an Outperform (i.e., Buy) rating for the shares. (To see Kallo’s track record, click here)

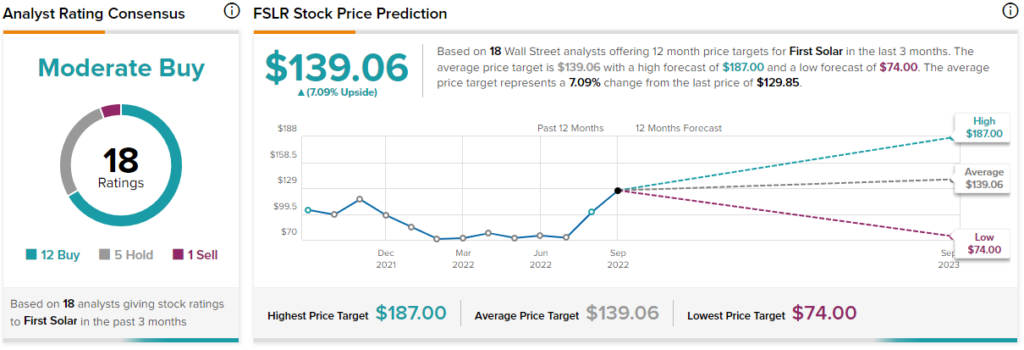

Looking at the consensus breakdown, based on 12 Buys, five Holds, and one Sell, the stock receives a Moderate Buy consensus rating. However, following the huge recent gains, the $139.06 average price target suggests 7.1% upside potential.

Conclusion

So, what solar stock wins the day? Both seem to elicit quite similar takes right now, with the main differentiator being First Solar’s perceived capped gains following its big rally. Therefore, purely from a returns perspective, SolarEdge looks like the one to go with right now.