Rakesh Gangwal, director of Southwest Airlines ($LUV), has amassed shares worth $100 million in the past few trading sessions amid activist pressure from Elliott Investment Management. A corporate insider’s rapid share purchases indicate continued belief in the company’s future prospects. Southwest is one of America’s low-cost air carriers.

Gangwal was appointed to Southwest’s board in July 2024, following increased pressure from Elliott for a board overhaul. According to a Reuters report, Gangwal said that more executive changes could be “counterproductive and not in the best interest of shareholders.” Southwest and Elliott remain at loggerheads for ousting the CEO, changing more board members, and impacting a strategic turnaround of the company.

A Closer Look at the Insider’s Transactions

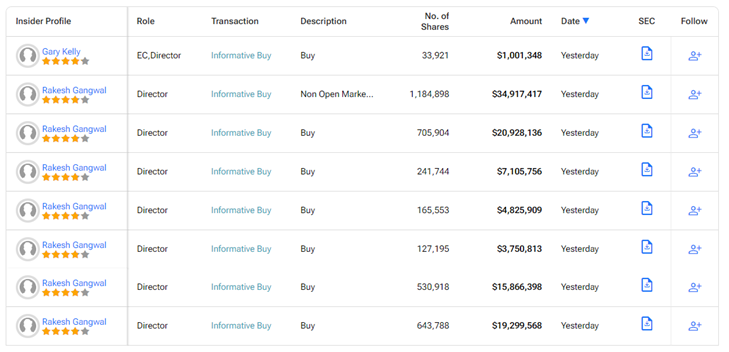

As per multiple Form 4 filings registered with the SEC, Gangwal made multiple purchases of LUV shares on September 30 and October 1. In all, Gangwal purchased 3.6 million Southwest Airlines shares at average prices between $29 and $30 per share. It is worth noting that following the latest Informative buy transactions, Gangwal now owns 3.6 million LUV shares.

Apart from Gangwal, Executive Chair and Director Gary Kelly also purchased 33,921 LUV shares worth $1 million on September 30, showing growing confidence in Southwest’s future ability. Elliott is also wanting to remove Kelly from his chairman position.

It is important to keep an eye on the Informative trades of corporate insiders, given their knowledge of a company’s growth potential. Interestingly, TipRanks offers daily insider transactions as well as a list of top corporate insiders. It also provides a list of hot stocks that boast either a Very Positive or Positive insider confidence signal.

What Is the Future of LUV Stock?

Analysts prefer to remain on the sidelines on LUV stock until the dust settles. On TipRanks, LUV stock has a Hold consensus rating based on three Buys, seven Holds, and one Sell rating. Also, the average Southwest Airlines price target of $27.93 implies 5.6% downside potential from current levels.