General Electric Co.’s (GE) credit outlook was lowered to negative from stable by rating agency S&P Global, amid concern that the engine maker won’t be able to reduce debt leverage, should the aviation industry fail to see the start of a recovery later this year.

The outlook change comes after GE disclosed that it expects adjusted 1Q EPS to be “materially below” its prior guidance on March 4, 2020 of about $0.10, according to preliminary figures and withdrew financial guidance for 2020. In March GE announced job cuts at its aviation unit, which makes engines for Boeing Co (BA) and Airbus Group SE (EADSF) aircraft.

Read more: GE Shares Tumble on Analyst Downgrade, Reversing Earlier Gains

Furthermore, S&P Global warned that the company’s BBB+ credit rating could be at risk of a downgrade.

“We could lower our ratings if we believe the company’s leverage will stay above 3.5x beyond 2021 as lower EBITDA and the need to retain more of the cash balances prevents the debt leverage reduction that we currently anticipate,” S&P Global said.

GE’s stock dropped 2.2% on Thursday even as the S&P 500 Index rose 1.5% and the Dow Jones Industrial Average increased 1.2%. To date, the company’s shares have lost more than a third of their value as the coronavirus pandemic has led to a production halt at its aviation unit.

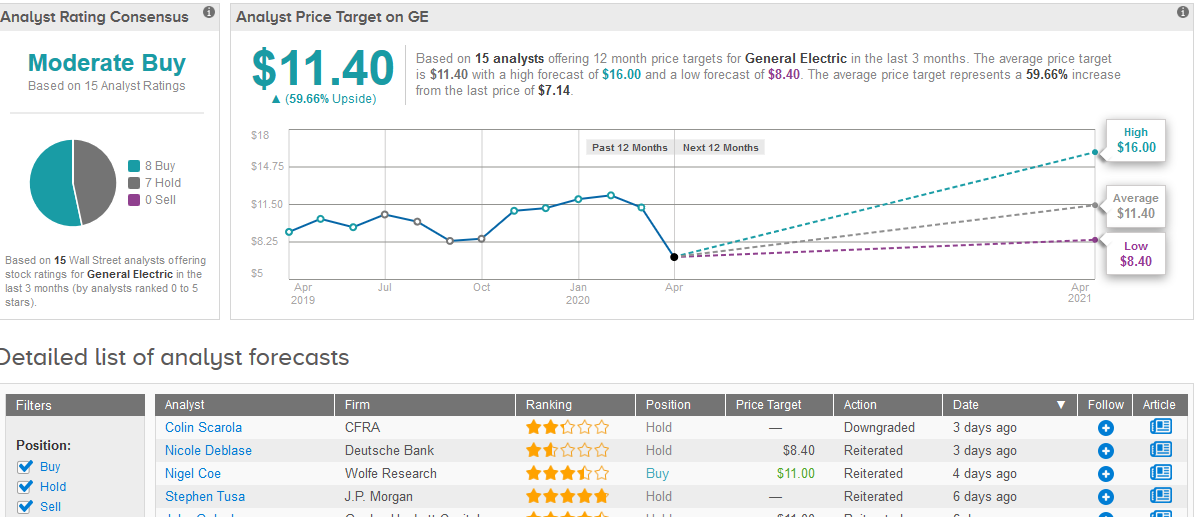

TipRanks data shows that Wall Street analysts are slightly cautious about recommending GE as 8 have a Buy rating on the stock and 7 have a Hold rating adding up to a Moderate Buy consensus rating. The average price target of $11.40 per share implies a 60% twelve-month gain, should the target be met. (See General Electric’s Stock Analysis on TipRanks).

Related News:

3M Sues Performance Supply For Alleged Price Gouging of its Respirator Masks

Weekly Market Review: U.S. Stocks Cap Best Week Since 1974

US Stock Market Takes A Break From Rally For Good Friday