COVID-19 has impacted ad spend on content platforms, but Spotify’s (SPOT) relative lack of dependency on advertising is good news, according to Rosenblatt analyst Mark Zgutowicz.

“We take relative comfort in Spotify’s ~10% ad revenue exposure and its dominant global share in a low-cost, high utility subscription service,” said the 5-star analyst.

Spotify remains the dominant player in music streaming and has held a 36% market share since 2017, with Apple far behind in second place and a number of other players trailing in the distance. Its brand is already closely associated with streaming in consumers’ minds, and it will be hard to knock it off top spot.

The company just reported results for the first quarter, exhibiting the most robust year-over-year revenue growth – sales of €1.85 billion, up by 22.5% year-over-year – and subscriber additions since 2018.

Which is a touch surprising, even for management. As CEO Daniel Ek noted, following a drop in usage, the company expected MAUs and paid subscribers to take a hit, but that didn’t happen. Total MAUs grew 31% year-over-year in the quarter to 286 million. Q1 2020 was the third straight quarter exhibiting year-over- year growth of more than 30%.

As expected, during the quarter, user engagement decreased as stay-at-home measures forced consumers to reduce gym and commuting time – where Spotify gets a large amount of engagement. But the stay-at-home culture has contributed to new trends; smart TV and gaming console engagement increased by more than 50%.

Zugwitcz is impressed with Spotify’s durability, noting, “Despite the abrupt NT ad carnage, loss of significant commute streaming engagement, and steep FX headwinds, management maintained its CY20 guidance, excluding a modest ~$400M reduction to revenue (midpoint), with nearly half attributed to FX… We also see a stable gross margin profile emerging with what appears a favorable long-term global licensing agreement with Warner Music (and one last label to go), a reset ad-supported baseline, and a relative call option on LT podcast and two-sided marketplace margin benefits.”

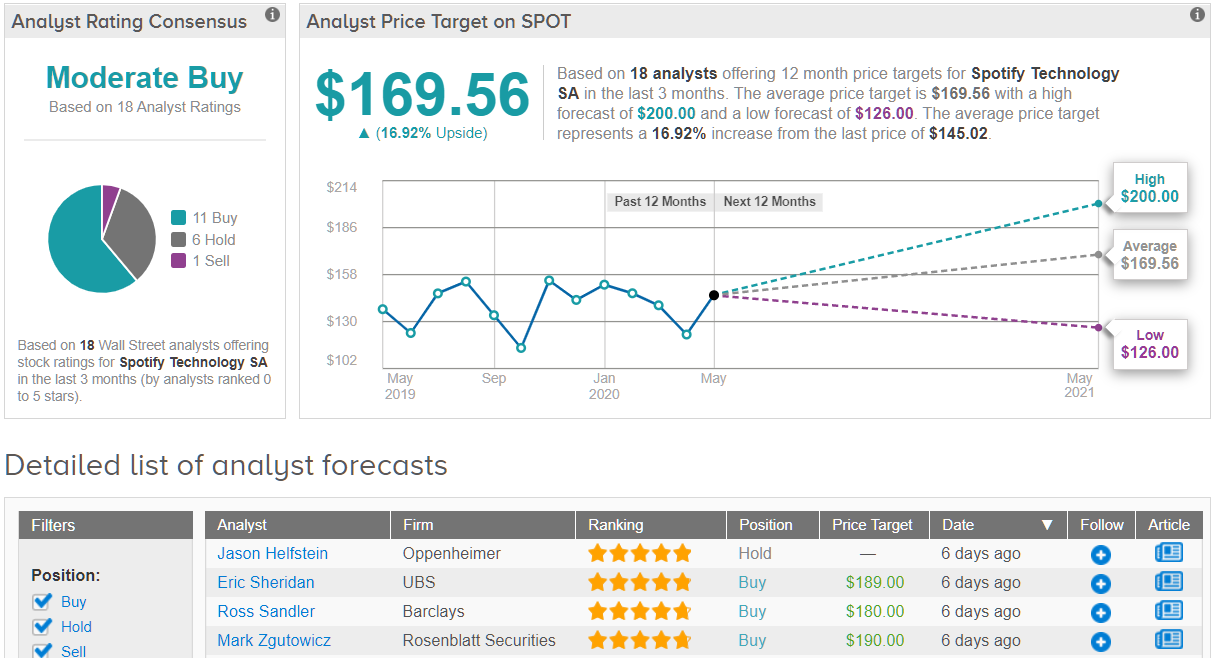

Accordingly, Zgutowicz reiterated a Buy rating on Spotify shares, and raised his price target to $190 (from $184). Investors stand to take home a 31% gain, should the analyst’s thesis play out over the coming months. (To watch Zgutowicz’s track record, click here)

What about the rest of the Street’s view? 11 Buy ratings, 6 Holds and 1 Sell add up to a Moderate Buy consensus rating. At $169.56, the average price target represents possible upside of 17%. (See Spotify stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.