One of the best-performing analysts out there is Standpoint’s Ronnie Moas (Track Record & Ratings). As we can see from the screenshot below, he is currently ranked at #192 out of close to 5,100 analysts tracked by TipRanks.

And I mention this because he has just released a very interesting report, sharing his latest stock recommendations and predictions.

As Moas points out, the Dow Jones has collapsed by 5000 points since he issued a warning in early October. It was the worst three-month period in 10 years. So where will the market go now? According to Moas, “It would NOT surprise me if we drop another 5000 points.” (His emphasis added.)

But don’t get bearish too fast, because long-term the market will gain back these losses, and ultimately move much higher. He writes: “That being said, I think the market will double from where we are today and the next 7 to 10 years.”

That’s relevant to today’s trading because savvy investors can get ahead by buying the right stocks now. In fact, Moas tells us:

“There are babies being thrown out with the bath water and I am seeing opportunities right now that I have not seen in a LONG time.”

With that in mind, he makes a number of moves initiating, reiterating, upgrading and reinstating 12 names at this time. Here we take a closer look at 5 of the most compelling of these recommendations. Plus using TipRanks’ market data we can also see whether the Street shares this bullish take on these stocks.

Let’s dive in now:

1. Citigroup (C– Research Report)

Standpoint: Upgrading from Hold to Buy

With his Citigroup upgrade, Moas joins RBC Capital’s Gerard Cassidy (Track Record & Ratings) in the bull camp. Just to give some idea of the kind of scale we are talking about, Citigroup boasts a whopping $1.93 trillion in assets with 200 million customers across 160 countries and jurisdictions.

“At current prices, Citigroup stock appears undervalued to us relative to its stated book value; therefore, we rate the stock Outperform” explains Cassidy. He reiterated his C buy rating on December 12 with a $76 price target- indicating sizable upside potential of 47%.

He sees multiple catalysts for the stock including heavy investment in its mobile platform and strong emerging markets growth. “Over the long term, with more than 50% of its revenues coming from outside North America, Citigroup is the best-positioned bank for emerging markets growth” comments the analyst.

And luckily for shareholders, Citi is busy returning excess capital to shareholders. The company was approved to repurchase $17.6 billion of shares and increase its quarterly dividend to $0.45 per share from $0.32 per share in the 2018 CCAR cycle, a total return of $21.9 billion.

Taking a step back, we can see that the overall consensus stands at Moderate Buy. This is with juicy upside potential from the average analyst price target of 59%. As Oppenheimer’s Chris Kotowski writes, “Citi remains one of the cheapest banks in our universe of coverage, at 1.1x tangible book value and ~9x our 2019 EPS estimate.” See what Top Analysts are saying about C.

2. Hewlett Packard (HPE– Research Report)

Standpoint: Initiating with Buy

Having spun off and monetized its Enterprise Services (e.g., former EDS) and Software (e.g., Autonomy, Mercury Interactive, Opsware, ArcSight, et al) businesses last year, HPE is now looking increasingly compelling.

The company is spending the proceeds on buybacks and, according to the Street, remains an inexpensive stock. That’s with a Moderate Buy rating and $17 average price target.

“Executing to plan” is how Oppenheimer’s George Iwanyc (Track Record & Ratings) summed up Hewlett Packard following strong October-quarter results. He has a buy rating on the stock with an $18 price target (38% upside potential).

HPE once again reported solid results reflecting broad-based strength (especially Compute/Intelligent Edge) and further OM expansion. FY19 guidance was reaffirmed, with HPE management characterizing overall enterprise IT demand as healthy.

According to Iwanyc we are now seeing “an improved product portfolio as a positive lever for HPE to gradually gain share.”

He concludes: “[The results] reinforce our belief that HPE’s positioning is more favorable and could drive gradual share gains over time. We also see its strong capital return program as a positive in the current environment.” See what Top Analysts are saying about HPE.

3. Carnival Cruise Lines (CCL– Research Report)

Standpoint: Initiating with Accumulate

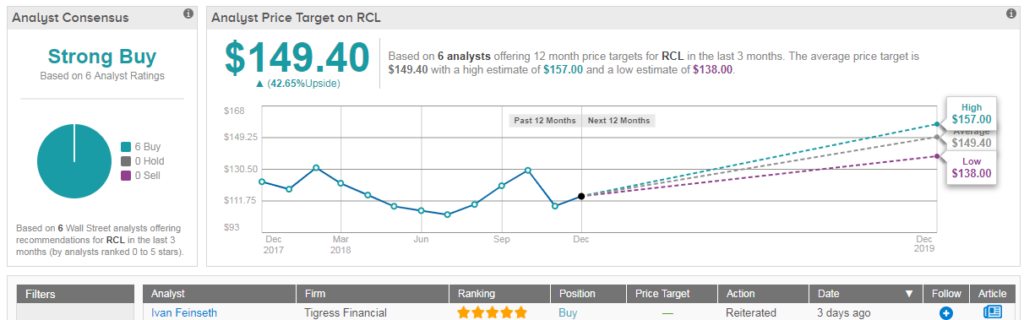

Florida-based cruise stock Carnival Cruise Lines boasts 26 cruise ships, which it nicknames ‘The Fun Ships.’ According to five-star Tigress analyst Ivan Feinseth (Track Record & Ratings), cruise stocks are benefiting from the increasing demand driven by the secular shift in consumer spending patterns.

That’s thanks to cruises offering some of the best value and diversification in the travel industry. More consumers are choosing cruise-based vacations because of their incredibly broad product offerings, land excursions, and shipboard amenities, comments the analyst.

“The opportunity for the cruise industry to gain share in the overall travel market, along with the opportunity to develop a significant cruise market in China, creates tremendous opportunity for the upside of the shares of the three public cruise operators” writes Feinseth. He is speaking of Norwegian Cruise Lines, Royal Caribbean and, of course, Carnival Cruise Lines.

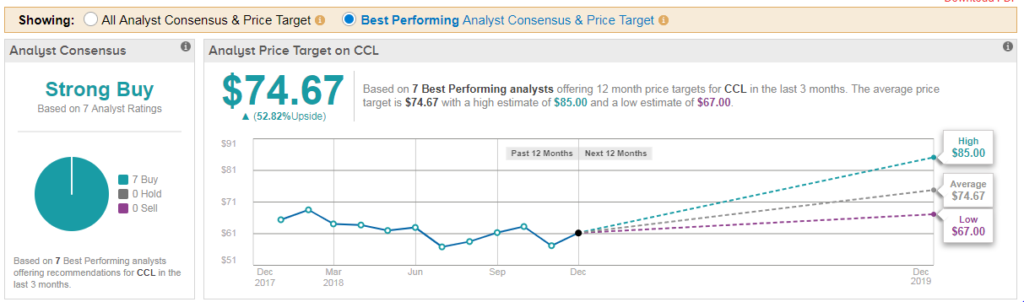

As for Carnival stock specifically, Buckingham’s Daniel McKenzie sees “good value” at current share levels for investors with a longer time horizon. Indeed, the analyst’s $85 price target implies 75% upside after factoring in a 3.5% dividend yield.

Bear in mind, seven out of seven top analysts are bullish on the stock.

4. Caterpillar (CAT– Research Report)

Standpoint: Upgrading to Accumulate

Ronnie Moas isn’t the only analyst upgrading Caterpillar right now. Merrill Lynch’s Ross Gilardi (Track Record & Ratings) has also just boosted CAT from Hold to Buy.

“We are still late in the cycle, but two key macro developments lead us to upgrade CAT at 10.9x 2019E EPS and an 8% FCF yield. First, Fed Chairman Jerome Powell seemed less hawkish last week on the future path of interest rate increases, and 2) the US-China agreed to a temporary cease fire on additional US tariff increases,” Gilardi said in a note. “We see 20 % upside potential,” he commented.

At the same time, China has agreed to purchase a “substantial” amount of agricultural, energy, and industrial U.S. products. The temporary agreement boosted crude oil.

“Caterpillar’s share price is highly correlated with crude oil prices and crude is down over 30 percent since early October,” Gilardi added. “Some combination of global demand improvement and/or supply curtailments could propel CAT higher if WTI starts to recover.”

That’s on top of Micrea Dobre elevating the construction equipment stock to ‘Fresh Pick’ status over at Baird. Dobre cited demand growth into 2019, improved price/cost dynamics, strong seasonal tailwinds, attractive valuation and meaningful capital deployment/buyback potential.

In total Caterpillar has a Moderate Buy analyst consensus, with an average price target of $156 (24% upside potential). See what Top Analysts are saying about CAT.

5. Marathon Petroleum (MPC– Research Report)

Standpoint: Initiating with Accumulate

If you are looking for a stock with across the board Street support, look no further. Marathon is the largest refiner in the US, with over 3 million barrels per day of capacity across 16 refineries.

In the last three months no less than 12 analysts have published buy ratings on MPC stock. In fact the last Hold rating received by Marathon was now eight months ago. Plus the average analyst price target of $102 suggests shares can surge over 75%.

Analysts are bullish on the $23.3 billion Marathon-Andeavor merger which closed on October 1. “We are excited to begin unlocking the extraordinary potential across our new platform, including approximately $1 billion of tangible annual run-rate synergies we expect within the first three years,” said MPC CEO Gary Heminger on the closing.

However, at its recent investor day, the company ramped up this synergy target 40% to $1.4 billion. That’s despite the deal closing only two months ago. Achieving this target would be a major catalyst for shares according to RBC’s Brad Heffern (Track Record & Ratings).

MPC also rolled out a new target for capital returns to shareholders of >50% of discretionary cash flow. The company is now targeting a 10%+ increase to its dividend annually, and $2.5 billion of share repurchases in 2019.

Plus: Valero (VLO– Research Report)

Alongside MPC, Moas is recommending Valero. Texas-based Valero is the world’s largest independent petroleum refiner, and a leading ethanol producer. Its assets include 15 petroleum refineries with a combined throughput capacity of approximately 3.1 million barrels per day and 14 ethanol plants.

“I would advise you to also double-down on Valero Energy VLO | that is a recent recommendation of mine” comments Moas.

He points out that this is a low-beta stock where 1) the dividend yield is now 4.6%; 2) 20% of the $30 billion market cap is in cash; 3) the name is trading at 11 times earnings and is currently 45% off its 52-week high.

Overall the Street has a cautiously optimistic Moderate Buy consensus on VLO. That’s with a $123 average analyst price target (67% upside potential). Top RBC Capital analyst Brad Heffern is also bullish on VLO (with a $130 price target).

“We like Valero Energy for its position at the bottom of the global refining cost curve and its significant leverage to the US Gulf Coast refining market… VLO also has a very strong program to return capital to shareholders, with $10+ billion returned in 2015–18” Heffern told investors.

He expects VLO to repurchase more than 15% of its outstanding shares in 2017–19. See what Top Analysts are saying about VLO.

Enjoy Research Reports on the Stocks in this Article:

Carnival Cruise Lines (CCL) Research Report

Caterpillar (CAT) Research Report

Hewlett Packard Enterprise (HPE) Research Report

Marathon Petroleum Corp (MPC) Research Report

Valero Energy Corp (VLO) Research Report

If you are looking for some fresh investing inspiration for 2019, then the TipRanks’ Stock Screener may be what you need right now. This tool gives you the lowdown on the most popular stocks from the Street’s top analysts. These are the analysts that consistently outperform. You can filter for ‘Strong Buy’ stocks from any sector and with serious upside potential ahead. Go to the Stock Screener.