As consumers’ purchasing habits are in flux amidst a slow transition from WFH routines, Starbucks (SBUX) faces a difficult task as it attempts to reposition itself in the new reality.

BTIG analyst Peter Saleh said, “While we are encouraged to see significant improvement in same-store sales in the most recent months/weeks, we believe the shift in strategy to develop more pick-up/to-go stores in the U.S. and away from the third-place strategy that Starbucks has enjoyed for decades could present challenges and limit sales and earnings growth in the near future. We would look for evidence that consumers are returning to their daily commuting routines before becoming more constructive on shares.”

Starbucks has now opened 90% of its stores, either partially or fully. The company has said comparable store sales have steadily picked up, as various states have loosened lockdown measures. Year-over-year, same store sales were 43% into the red in May (32% in the last week), compared to 63% during the pandemic’s peak impact in April – indicating an improving trend. However, many of the sales are from drive-thru or digital, which amounted to 90% of overall sales as opposed to 60% pre COVID.

“We believe this change in customer behavior has ramifications across the restaurant sector, likely leading to smaller footprint locations and greater emphasis (investments) in digital and take-out, as Starbucks outlined for its own store portfolio,” added Saleh.

Starbucks anticipates the U.S. and Americas comps to drop between 40% to 45% in 3QF20 (ending June), amounting to a $3 billion to $3.2 billion hit, while also expecting a decline between 10% and 20% in 4QF20.

The company also expects to shut down 400 locations over the next 18 months, but will be adding takeout and pick-up only locations. On a positive note, with sales picking up, the coffeehouse chain “expects to be generating positive cash flow by the end of June.”

To this end, the BTIG analyst rates SBUX a Neutral (i.e. Hold) rating, without suggesting a price target. (To watch Saleh’s track record, click here)

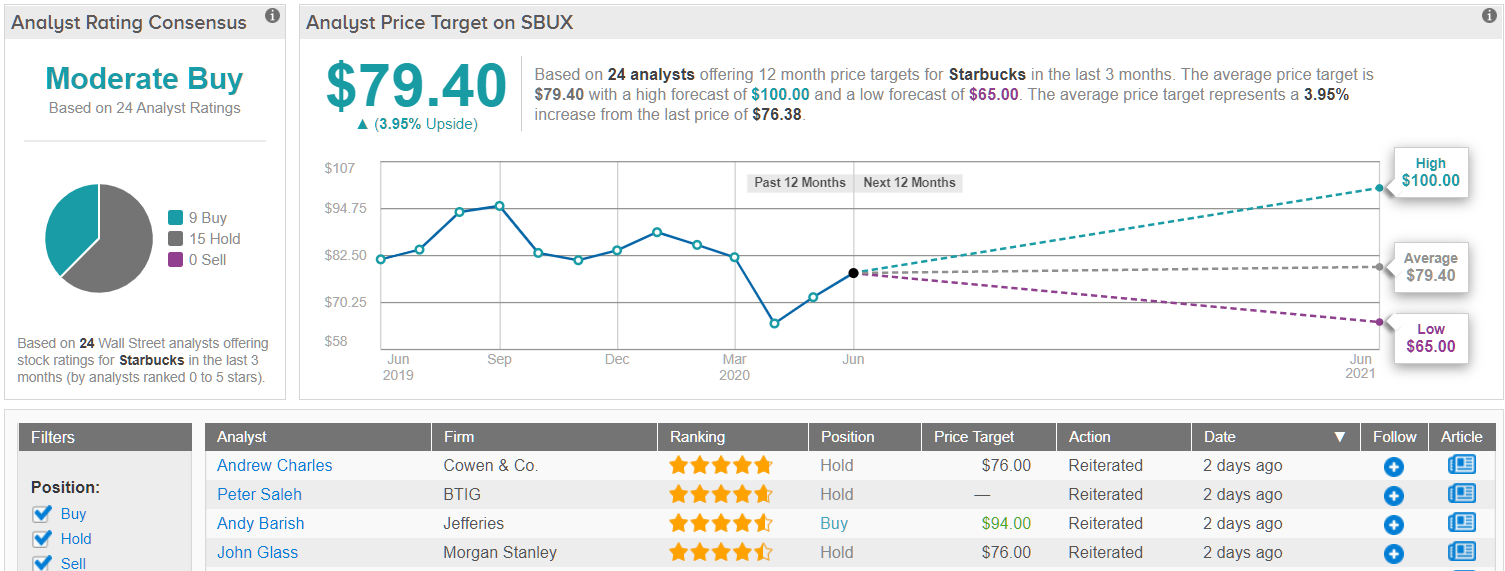

The rest of the Street remains cautiously optimistic when considering Starbucks’ prospects. SBUX’s Moderate Buy consensus rating is based on 9 Buys and 15 Holds. At $79.40, the average price target indicates a modest 4% uptick. (See Starbucks stock-price forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.