Automaker Stellantis (NYSE:STLA) is having a bittersweet experience with striking workers. Canada’s Unifor union decided to strike at all of Stellantis’ plants in the country effective today. On the other hand, in the U.S., Stellantis struck a tentative deal with the United Auto Workers (UAW) union, bringing back the striking workers to plants beginning today.

Unifor represents 8,200 workers at the automaker’s plants in Windsor and Brampton in southern Ontario. The union is demanding salary hikes and employment benefits, including pension raises. Meanwhile, both Unifor and Stellantis have said that they are continuing to negotiate a new four-year labor contract.

The strike follows similar actions at rivals General Motors (NYSE:GM) and Ford (NYSE:F), who have already reached tentative deals with Unifor, successfully ending the strikes. Both GM and Ford agreed to a 20% base hike for hourly workers and a 25% increase for skilled trades over the contract’s life. Moreover, all temporary workers will be converted to full-time employees. Unifor seeks a similar contract with Stellantis in its negotiations.

What is the Future of Stellantis Stock?

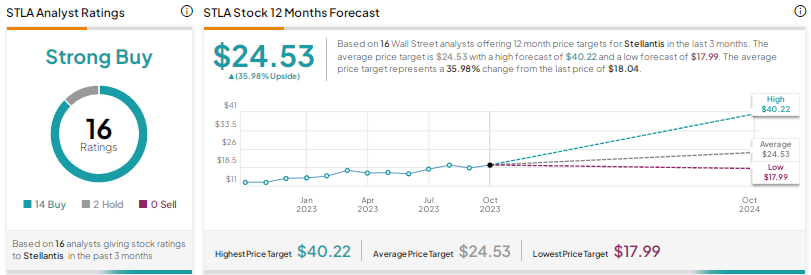

Stellantis stock commands a Strong Buy consensus rating on TipRanks. This is based on 14 Buys and two Hold ratings. On TipRanks, the average Stellantis price target of $24.53 implies nearly 36% upside potential from current levels.