Automaker Stellantis ($STLA) has cut its U.S. vehicle inventory by over 100,000 units to reach its target of fewer than 330,000 cars by the end of 2024, according to North American chief Antonio Filosa at the Detroit Auto Show. Filosa, who took over in October, said that the company offered steep discounts to clear dealer lots, which he admitted was costly but necessary in order to stabilize the firm’s operations.

The leadership shift comes after former CEO Carlos Tavares’ unexpected resignation on December 1, which was 18 months before his contract was set to end. Concerns from stakeholders over Stellantis’ North American strategy and Tavares’ pricing tactics—leading to rising inventories and declining sales—played a role in his departure. Until a new CEO is appointed, board Chairman John Elkann is leading an interim committee, with Filosa considered a top candidate for the role.

Filosa emphasized that the next CEO must be able to deal with challenges like fluctuating EV demand and technological hurdles. He also highlighted the importance of using flexible production platforms for EVs, hybrids, and fuel-powered cars. In addition, Stellantis may face new difficulties if President-elect Donald Trump imposes 25% tariffs on imports from Mexico and Canada, where some Jeep and Ram models are produced.

Is STLA a Good Stock to Buy Now?

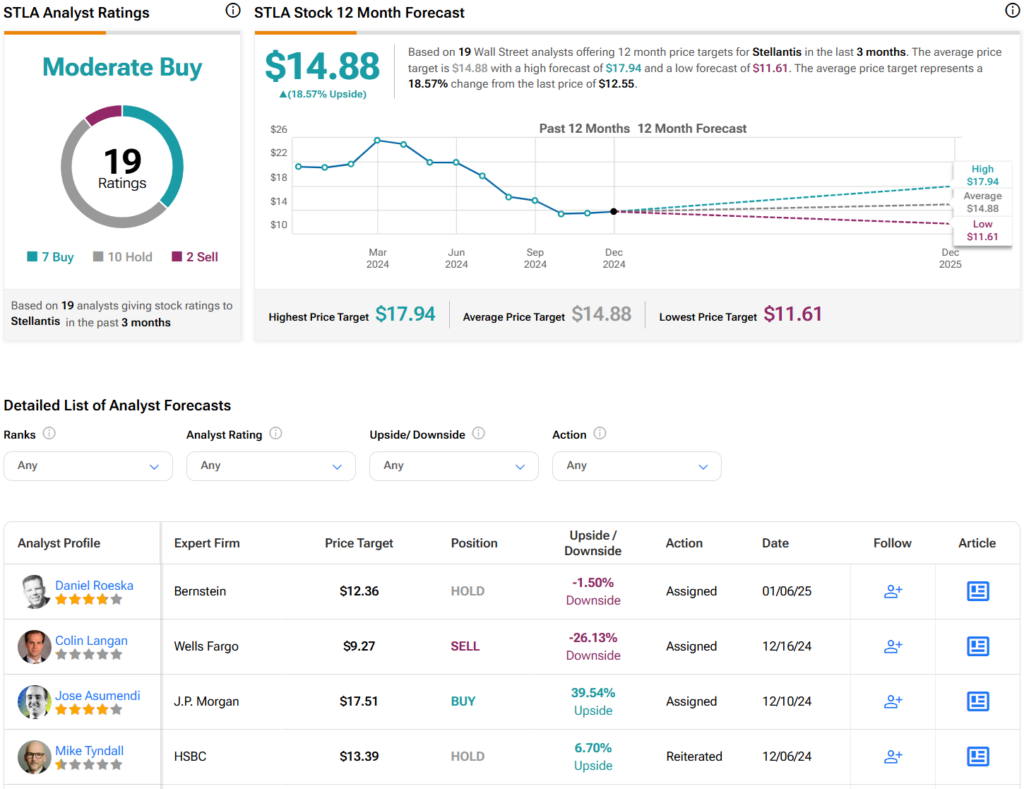

Turning to Wall Street, STLA stock has a Moderate Buy consensus rating based on seven Buys, 10 Holds, and two Sells assigned in the last three months. At $14.88 per share, the average Stellantis price target implies an upside potential of 18.6%. It is also worth noting that shares of the company have declined 41% over the past year.