Stifel Nicolaus lifted the price target on Penn National Gaming to $85 (17.8% upside potential) from $47 and maintained a Buy rating on the stock, citing strong momentum for the sports gaming business. Shares of the casino operator jumped over 9% during Thursday’s early morning trading.

Stifel analyst Steven Wieczynski expects several states to pass gaming legislation that should keep the sports betting momentum rolling, which means that the stock “can continue to work, especially into November.”

Back in January Penn National (PENN) acquired a 36% stake in sports news platform Barstool Sports. The company will officially launch its Barstool Sports online betting app on Sept. 18.

Last month, Penn National reported a 2Q loss of $1.69 per share, versus the Street consensus of a loss of $2.06 per share. 2Q revenues of $305.5 million exceeded analysts’ estimates of $249.1 million . (See PENN stock analysis on TipRanks).

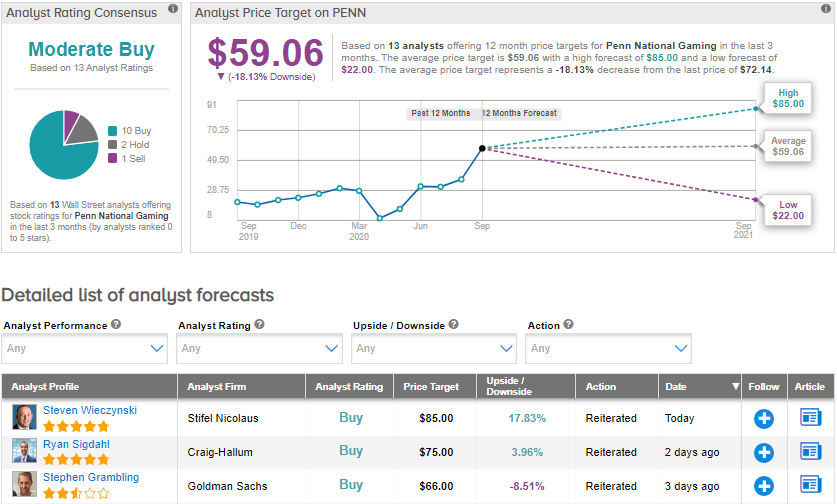

Currently, the Street has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus is based on 10 Buys, 2 Holds and 1 Sell. Given the year-to-date share price rally of over 182%, the average price target of $59.06 now implies downside potential of about 18.1% to current levels.

Related News:

Rosenblatt Initiates Penn National With A Buy, Street High PT; Shares Rise

Whiting Petroleum Plans $20M In Cost Cuts, Provides 2H Guidance; Shares Rise

Oak Street Health Drops 5% in Pre-Market On Larger 2Q Loss