Shares of Stratasys Ltd. closed 8% higher on Wednesday following its announcement to buy 3D printing start-up Origin Inc. in a cash and stock deal valued at $100 million. The manufacturer of 3D printers and 3D production systems expects the deal to close in Jan 2021. Shares rose 1.6% in Thursday’s pre-market session.

Stratasys (SSYS) said that the merger will enable the company “to expand its leadership through innovation in the fast-growing mass production parts segment with a next-generation photopolymer platform.”

Specifically, Origin’s Programmable PhotoPolymerization (P3) technology is expected to generate incremental annual revenues of up to $200 million within five years. Further, the acquisition is projected to be slightly dilutive to the company’s earnings in 2021 and accretive to its earnings by 2023.

Stratasys CEO Yoav Zeif said, “We believe Origin’s software-driven Origin One system is the best in the industry by combining high throughput with incredible accuracy. When combined with Origin’s extensive materials ecosystem and our industry-leading go-to-market capabilities, we believe we will be able to capture a wide range of in-demand production applications on a global scale.” (See SSYS stock analysis on TipRanks)

Following the deal, Needham analyst James Ricchiuti said, “We believe the Origin acquisition in tandem with the planned launch of Stratasys’ new powder-bed fusion 3D printer in 2021 positions the company for a return to growth and improving profitability assuming the economic environment brightens next year.” He maintained a Hold rating on the stock.

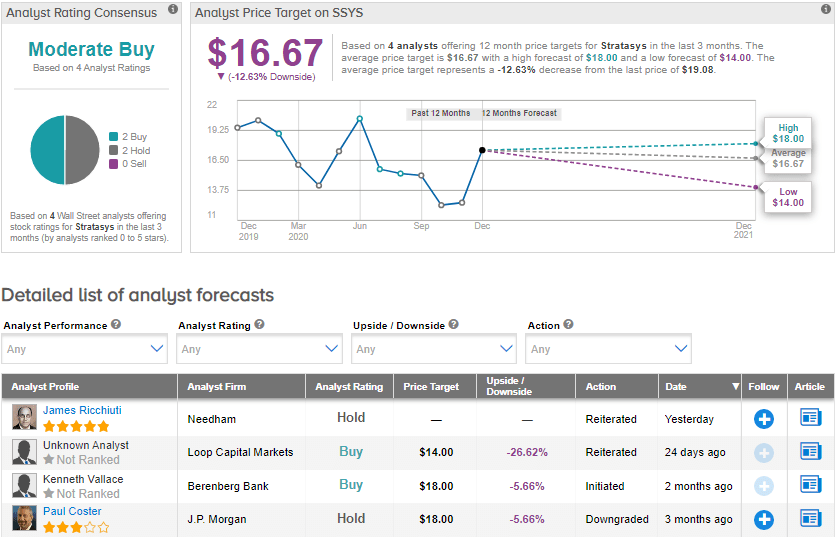

Meanwhile, the Street has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus is based on 2 Buys and 2 Holds. The average price target stands at $16.67 and implies downside potential of about 12.6% to current levels. Shares have declined 5.7% year-to-date.

Related News:

Amphenol To Snap Up MTS Systems For $1.7B

Starbucks Ramps Up Long-Term Profit Forecasts, Shares Gain 3.5%

AT&T To Sell Crunchyroll To Sony For $1.18B; Morgan Stanley Says Buy