Not to be outdone by its other mega-cap brethren, shares of Chinese internet giant Alibaba (BABA) reached an all-time high on July 9, closing at the price of $261.58 per share.

Amid the rise of new coronavirus cases, the stock market, and tech stocks in particular, have surged and are now dangerously close to bubble territory. With this in mind, is now the time to reduce exposure to another high-flying tech stock?

Not if that stock is Alibaba, says Needham analyst Vincent Yu. In fact, the analyst just added BABA to his conviction list and initiated coverage with a Buy rating. Yu’s price target is $275, implying another all-time high and a 9% uptick are in the cards. (To watch Yu’s track record, click here)

So, what’s driving Yu’s bullish thesis? “We think the company’s well-established ecosystem, strategic position in the e-commerce value chain, and deep understanding of China’s retail environment are not only competitive strengths in its primary business, but also keys to expanding its presence in adjacent industries such as offline retail, food delivery, and cloud computing,” the analyst said.

And that is basically the gist of it. Like Amazon, BABA has its fingers in all of the pies, and has the appetite to take a bigger slice out of each one.

Let’s start with the e-commerce market pie. Here, Alibaba boasts flash sales platform Juhuasuan, in addition to the world’s biggest e-commerce website, Taobao (which offers Taobao Deals). Both offer value-for-money products and should further deepen Alibaba’s appeal within the fast-growing market of consumers from “low tier cities.” This is a market that has made up 70% of the 72 million new annual active users in FY2020.

The next slice is from the live streaming shopping pie. Alibaba owns the “best-in-class e-commerce live-streaming platform on the market,” Taobao Live. Offering consumers an “interactive shopping experience,” its industry leading market position has “helped grow GMV (gross merchandise value) up by more than 100% in FY2020,” in Yu’s opinion.

Let’s get the cloud services pie on the table, too. Alibaba’s cloud service, Alicloud, is a market leader. With the shift from traditional IT infrastructure to the cloud already in motion, Alibaba’s 46% market share means, as the decade progresses, this secular trend is another one that Alibaba stands to benefit from.

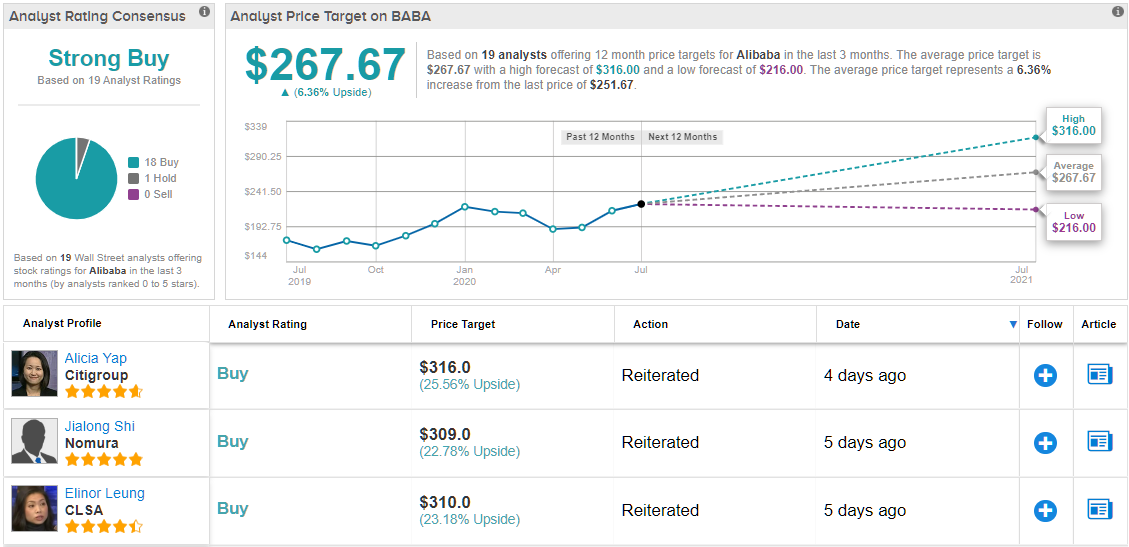

Looking at the consensus breakdown, the rest of the Street agrees with Yu’s assessment. 1 lone Hold rating is trounced by 18 Buys, positioning BABA as the owner of a Strong Buy consensus rating. The recent surge, though, has left room for only a 6% uptick, should the $266.90 average price target be met. (See Alibaba stock-price forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.