The seemingly never-ending ordeal involving the merger of T-Mobile (TMUS) and Sprint (S) may finally be nearing a resolution. In a rare instance of good fortune, however way you look at it, says Nomura’s Jeff Kvaal, investors in T-Mobile stand to gain from both outcomes of the forthcoming legal decision.

The merger between the US’s third and fourth largest mobile carriers has been an ongoing process since it was first announced almost two years ago, in April 2018. The transaction has already gained approval from the Federal Communications Commission (FCC) and the Department of Justice (DOJ), seemingly the highest obstacle standing in the merger’s path. Arguing the merger is anticompetitive, 14 state attorneys general, including the D.C. attorney general, are suing to block the deal from taking place. On January 15, closing arguments will be presented, following which U.S. District Judge Victor Marrero will decide the outcome, expected to be announced by mid-February.

Kvaal’s both sides win scenario is based on a simple analysis. Should the merger gain approval, the deal, according to Kvall could send TMUS stock up to $104 as it fulfills T-Mobile’s objective of obtaining Sprint’s mid-band 2.5GHz spectrum and would allow the communications giant “to realize significant synergies.” Not to mention, the new size will allow it to up the competition with the larger AT&T and Verizon.

And the downside? There is no downside, argues Kvaal. A rejection of the deal would finally bring resolution to the saga and “could remove a sizeable multiple impediment and restore T-Mobile’s modest premium.” The analyst expects the stock to rise following a rejection, too; Up to $93 by his estimates. The deal has a 45% chance of approval, concludes the analyst.

In addition to the imminent solution, Kvall further bolsters the bullish case for TMUS through its higher 4Q net adds. The analyst expounded further, “We expect strong 4Q net add figures from TMobile; we lift our 800,000 postpaid phone estimate just above consensus to 925,000. We are comfortable with our churn (0.90%) and ARPU ($45.76) estimates. This suggests T-Mobile is able to execute crisply through recent price reductions from Verizon and AT&T and mounting cable competition.”

In conclusion, the 4-star analyst said, “We believe T-Mobile’s faster sales, EBITDA and FCF growth rates should command a multiple premium to its closest peers.”

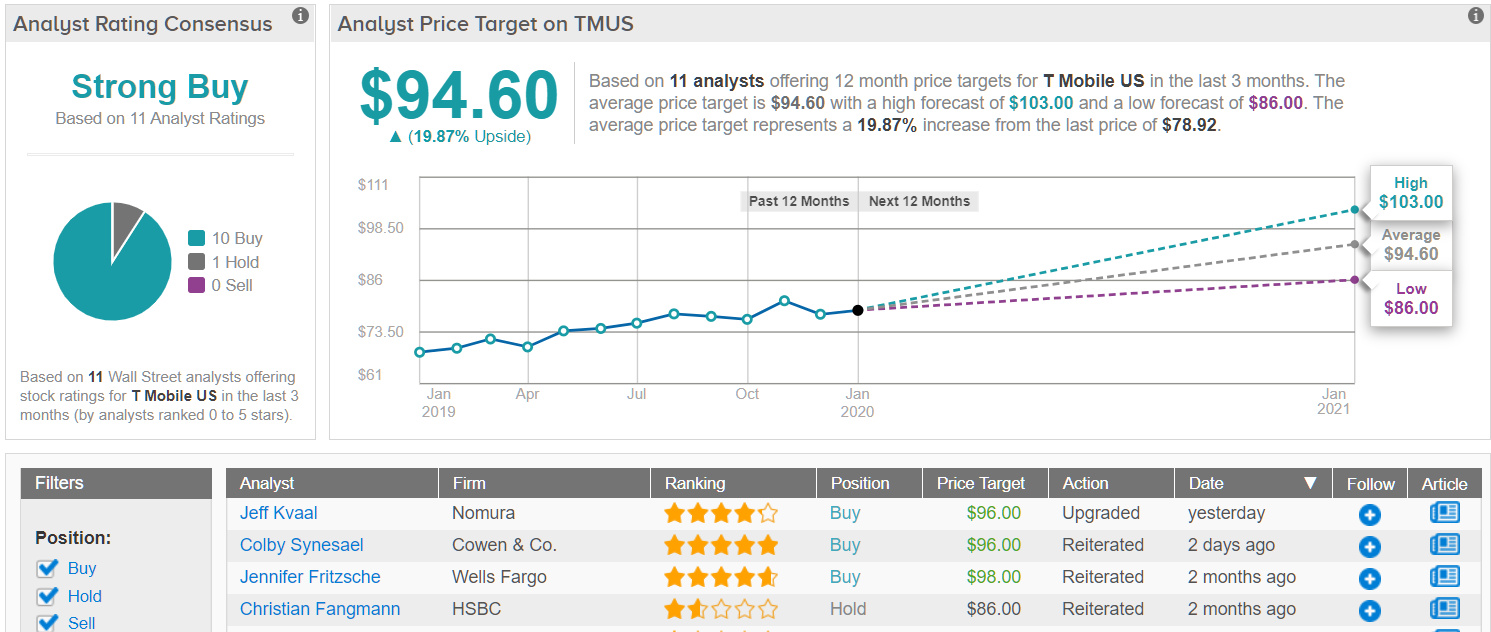

Unsurprisingly, then, Kvall upgraded his rating on TMUS from Neutral to Buy. The upgrade comes with a new price target of $96, up from $88. Should the target be met, investors pockets will be ringing from gains of 22%. (To watch Kvall’s track record, click here)

Kvall’s analysis is reflected in the Street’s confidence in T-Mobile’s prospects, too. 10 Buys and a single Hold coalesce into a Strong Buy consensus rating. At $94.60, the average price target could provide 20% upside. (See T-Mobile stock analysis on TipRanks)