Investors seeking diversification for their IRAs (Individual Retirement Accounts) might want to consider this strategic addition, uranium. IRA retirement portfolios tend to be long-term investments with diversified growth stocks and bonds that are expected to average a desirable return over time. But even with the buy-and-hold approach, it’s prudent to exercise caution, especially in sectors of the market that have been in a long bull run and are historically overvalued, such as growth and technology stocks.

Contributions to IRA accounts are heavy in April. Currently, investors are concerned about potential stagnation or even decline in trends for electric vehicle manufacturers, chipmakers, and other growth stocks. Considering the long-term prospects, investments in uranium could potentially power your IRA into your golden years.

The Uranium IRA Opportunity

Uranium presents a unique opportunity for IRA investors. It could offer diversification to investments in generic broad stock market index funds and into a resource with mounting demand.

The demand for uranium is primarily driven by the increasing need for clean energy. Nuclear power plants generate electricity without producing greenhouse gases. This makes them a recognized critical component in the clean energy transition. China, for example, is aggressively expanding its nuclear energy program, reflecting a global trend away from fossil fuels. As the world transitions away from petroleum, the demand for uranium is expected to surge.

Uranium hit a high in February but has since dropped by over 10%. The recent market volatility might be a blessing in disguise for IRA investors considering uranium. While uranium has been under some downward pressure due to concerns about oversupply and geopolitical tensions, these factors could be temporary as demand for uranium is expected to grow. The long-term fundamentals for uranium remain strong, potentially making the current dip a potential buying opportunity for IRAs focused on long-term growth.

How to Invest in Uranium for Your IRA

Even if you could buy a half-ton of uranium and put it in your safe, it would not be considered an IRA investment. Unlike gold, owning physical industrial-grade uranium is not advisable. Instead, there are other ways to incorporate uranium into your IRA investment strategy, such as investing in uranium mining companies.

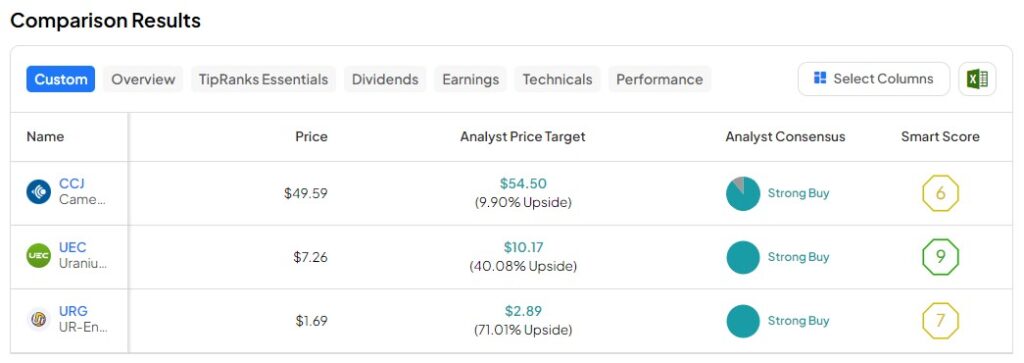

For IRA investors comfortable with individual stock picking, investing directly in uranium mining companies could offer the potential for higher returns. Some established players to consider for your IRA include Canada’s Cameco Corp. (NYSE:CCJ), Uranium Energy (NYSE:UEC), or UR-Energy (NYSE:URG).

Using the TipRanks Comparison Results tool, we have discovered these three uranium mining stocks that are rated Strong Buys, with an average upside potential of over 10%.

Investor Takeaway

While uranium offers exciting potential, it’s important not to overexpose your IRA. Instead, consider allocating a portion of your IRA towards uranium, while maintaining a well-balanced allocation across various asset classes.

With the broad market facing potential volatility, uranium presents a unique opportunity for IRA investors seeking diversification and long-term growth potential. The increasing demand for clean energy and the crucial role nuclear power plays position uranium as a strategic addition to a well-balanced IRA portfolio. However, conducting thorough research and focusing on long-term investment horizons are important before incorporating uranium into your IRA strategy.