Stitch Fix, Inc. (SFIX) is an online personal shopping and styling service. Recently, the company posted better-than-expected fourth-quarter fiscal 2021 results.

Let’s have a look at SFIX’s recent financials and understand what has changed in its key risk factors that investors should know.

SFIX’s fourth-quarter revenue increased 28.8% year-over-year to $571.2 million, outperforming analysts’ estimates by $23.1 million. During this period, active clients of the company increased 18% year-over-year to $4.16 million and net revenue per active client increased 4% year-over-year to $505. Notably, in fiscal 2021, SFIX crossed $2 billion in net revenue for the first time.

In comparison, the selling, general and administrative expenses of the company grew to $244.7 million from $213.5 million a year ago. SFIX generated net income of $21.6 million against a net loss of $43.2 million a year ago. Earnings per share of $0.19 beat analysts’ estimates by $0.31. (See Stitch Fix stock chart on TipRanks)

The CEO of SFIX, Elizabeth Spaulding, said, “These results reflect strong performance across our business, in Women’s, Kids and the UK. Today we are proud to serve almost 4.2 million clients, and with the launch of Stitch Fix Freestyle in August we are significantly increasing our addressable market and we are energized by the opportunity ahead.

“As we look forward, we are focused on continuing to expand and transform our offering, and drive awareness of Stitch Fix as the destination for personalized shopping, styling, and inspiration, leveraging our unique combination of data science, and creative human judgment.”

Looking ahead, the company expects net revenues to land between $560 million and $575 million in the first quarter of fiscal 2022. Adjusted EBITDA is estimated to be in the range of $15 million to $20 million.

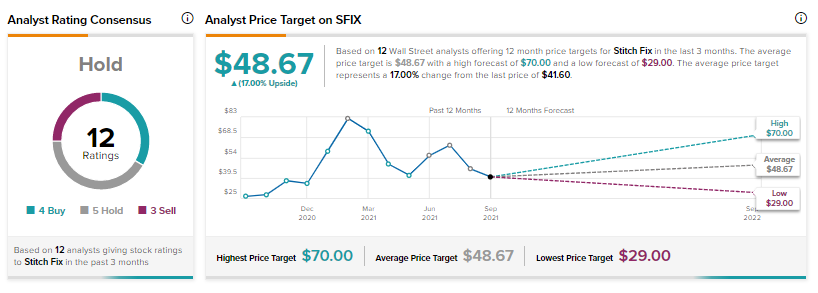

On September 22, Stifel Nicolaus analyst Scott Devitt reiterated a Hold rating on the stock and decreased the price target to $46 from $70.

Devitt said, “The company is transforming the retail apparel/accessories industry and has expanded the platform through the development of Direct Buy, which is effectively broadening the addressable market…We see the company continuing to take share in the apparel/accessories sector as the business continues to move online while offline retail experiences significant disruption.”

Based on 4 Buys, 5 Holds and 3 Sells consensus on the Street is a Hold. The average Stitch Fix price target of $48.67 implies 17% upside potential for the stock. Shares are down 25.8% so far this year.

Now, let’s look at what’s changed in the company’s key risk factors.

According to the new Tipranks’ Risk Factors tool, SFIX’s main risk category is Finance & Corporate, which accounts for 29% of the total 48 risks identified. On September 27, 2021, the company added one key risk factor under the Finance & Corporate risk category.

SFIX notes that at the end of July, it had state net operating loss (NOL) carryforwards of $142 million, which start to expire in 2025 if not utilized. The company also has R&D tax credit carryforwards of $47.1 million.

The ability to use NOL carryforwards depends upon the availability of future taxable income and any potential limitations on offsetting future income with tax attributes may lead to increased future tax liability.

The Finance & Corporate risk factor’s sector average is at 38%, compared to SFIX’s 29%.

Related News:

Ford, SK Innovation to Invest $11.4B in EVs

FedEx Logistics Opens Office in South Korea

Coinbase to Enable Direct Paycheck Deposits