Target Corp. (TGT) said booming digital sales growth in March and April fueled by consumers piling up on their shopping from home during coronavirus-related lockdowns will offset pressure on short-term profitability as its stores remain closed.

Sales trends improved “meaningfully” beginning April 15 sending online comparable sales up by more than 275% this month, the clothing and food retailer said. However, store comparable sales have declined in the mid-teens. Shares rose 6.4% in U.S. pre-market trading.

During the last quarter, Target experienced “significant” changes in shopping patterns in response to the COVID-19 pandemic, it said. Throughout this period, it saw broad market-share gains across its core merchandising categories.

“Our strategy was built to be durable and sustainable in any environment and its strength is driving our business in the face of marked shifts in shopping behaviors caused by COVID-19,” said Brian Cornell, chairman and CEO of Target. “We are seeing record-setting digital growth, strong demand for our same-day fulfillment services and broad market-share gains across each of our core categories. While this crisis will certainly put near-term pressure on our profitability, that pressure is far outweighed by doing right by our team and our guests. The actions we’re taking today will drive growth and greater guest affinity over the long-term.”

Against this, Target expects its first-quarter operating margin rate to decline by more than 5 percentage points due to employee pay and benefit plans during the COVID-19 crisis, the shift in channel mix towards digital fulfillment, and inventory write-downs, among other factors.

“While we expect our short-term profitability to be affected by COVID-19, we expect to have the financial capacity to emerge from this crisis in a position of strength,” said Michael Fiddelke, executive vice president and chief financial officer at Target. “Having established an even stronger bond with our guests during this unprecedented time, we expect to have a compelling long-term opportunity to grow profitably and gain additional market share in the years ahead.”

Quarter-to-date, total comparable sales have grown more than 7%, reflecting a slight decline in stores and more than 100% growth in digital channels, Target said.

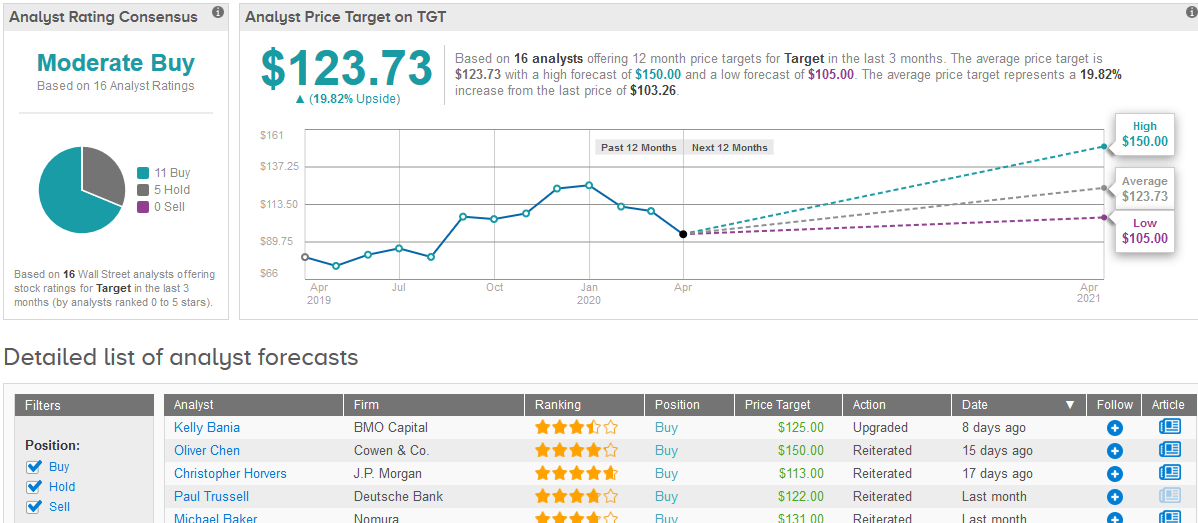

Kelly Bania at BMO Capital Markets this month upgraded the stock to Buy from Hold amid expectations that the company will win market share from retailers that cease operations post-coronavirus. Bania raised the price target to $125 from $115.

The rest of the analyst community is cautiously optimistic about Target’s stock as 11 say Buy and 5 say Hold adding up to a Moderate Buy consensus rating. The $123.73 average price target foresees 20% upside potential in the shares in the coming year. (See Target stock analysis on TipRanks)

Related News:

Kimberly-Clark Sales Jump to $5 Billion Boosted by Tissue Sales

Boeing Sued by Kuwaiti Aviation Over $336 Million 737 MAX Jet Order

Quest Diagnostics Beats Quarterly Earnings But Pulls 2020 Outlook