Tesla (TSLA) reported Q3 earnings on Wednesday, impressing on several metrics. And for the 5th consecutive quarter, the EV maker managed to turn a profit.

However, for the fourth quarter in a row, Tesla would not have been able to turn a profit without the aid of regulatory credit sales – Other car makers who fail to produce enough “green” vehicles to meet federal standards buy these from Tesla. In the quarter, Tesla generated $397 million in regulatory credits, majorly assisting the company to achieve overall profit of $331 million.

It is a trend that has been getting stronger. Over the past nine months, Tesla has generated $1.18 billion in credit sales – more than double than it collected in all of 2019.

RBC analyst Joseph Spak says Tesla’s continued reliance on regulatory credits raises strong arguments on both sides of the Tesla divide.

“Since 1Q19, cumulative TSLA GAAP NI is a loss of $743mm and over same period cumulative regulatory credits (which are all margin) are ~$1.4bn (meaning the industrial loss is closer to $2.1bn). Bears will argue this is unsustainable and shouldn’t be capitalized. But bulls may rightly counter that this can persist until more competition is present and has helped fund TSLA’s development which could help TSLA maintain an advantage into the outer years,” Spak wrote.

Maybe so, but competition could soon put a dint in Tesla’s in cash cow, as other auto makers develop their own electric cars and start collecting credits.

Tesla stock has soared by over 400% this year, and despite the solid report, the valuation is too hot for Spak. Therefore, the analyst reiterated an underperform (i.e. Sell) on the shares. The price target, though, gets a boost and is raised from $290 to $339. Still, there’s downside of 18% from current levels. (To watch Spak’s track record, click here)

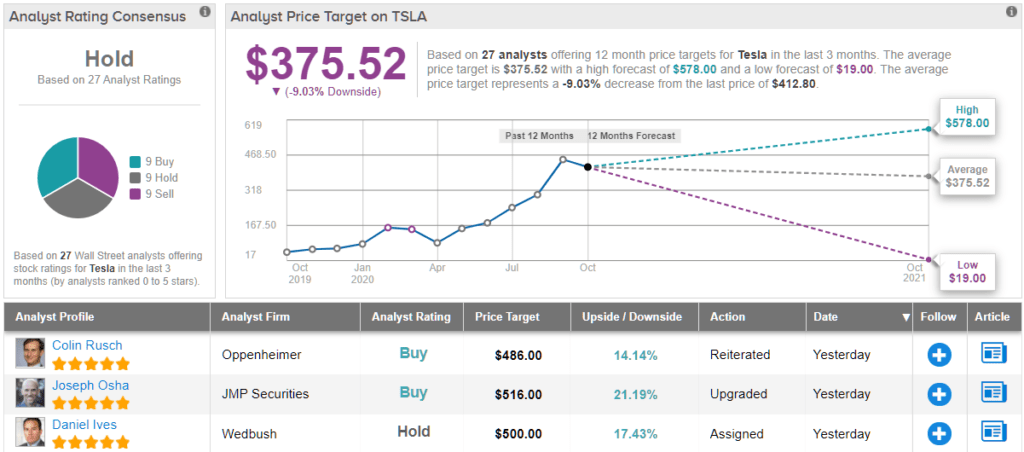

What does the rest of the Street make of Tesla right now? Based on 7 Buys, 13 Holds and 10 Sells, the analyst consensus rates the stock a Hold. Subsequently, the $375.52 average price target suggests shares will decline by 9% over the coming months.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.