Shares of Tesla (TSLA) rose over 4% in Wednesday’s after-hours trading after the company reported stronger-than-expected 2Q earnings. The electric-car maker’s adjusted earnings of $2.18 per share topped analysts’ expectations of $0.03.

Quarterly earnings also compared favorably with the year-ago quarter’s loss of $1.12 per share. Strong deliveries and cost-cutting measures helped to offset the negative impact of the coronavirus-related factory shutdown. The company delivered 90,650 vehicles during the second quarter.

The company’s revenues of $6.04 billion beat analysts’ expectations of $5.37 billion. However, revenues declined 4.9% year-over-year due to lower vehicle average selling price and reduction in services and other revenues.

Tesla CEO Elon Musk also announced that Tesla is going to open a new factory in Travis County, Texas. Furthermore, the company is hoping to achieve its goal of delivering over half a million vehicles in 2020 despite production disruptions caused by the COVID-19 pandemic.

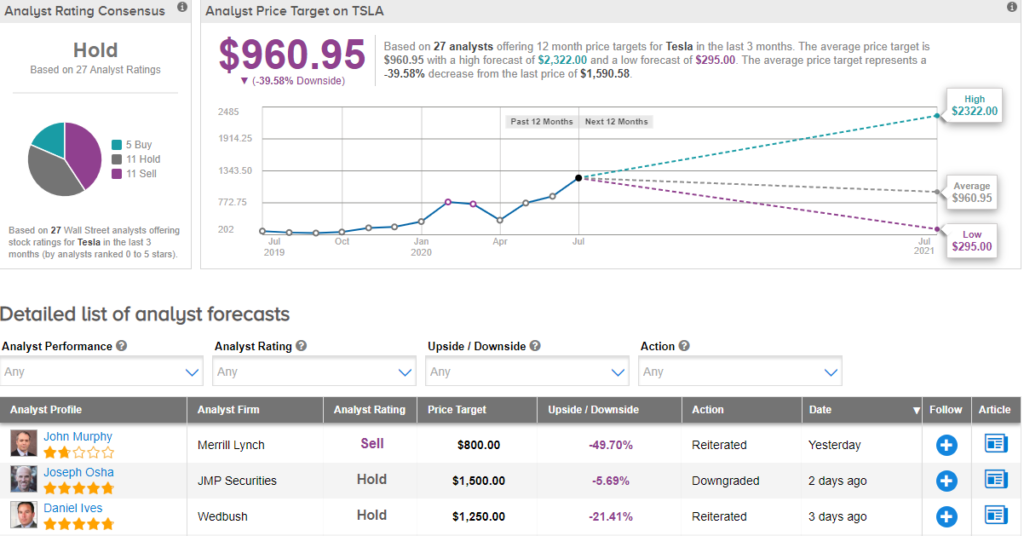

Overall, the majority of TSLA analysts are sidelined on the stock with a Hold consensus. With shares up 281% this year, the average analyst target price of $960.95 implies 39.6% downside potential for the coming 12 months. (See Tesla’s stock analysis on TipRanks).

Related News:

Tesla Drops 4.5% After JMP Securities Downgrade

Tesla Is Said To Push For Record Q3 Deliveries; Shares Rise In Pre-Market

GM To Release Electric Truck Next Year With 20 More EVs By 2023