Tesla Inc. (TSLA) is said to have been given a green light by health officials to resume production at its main Fremont auto plant ending a stand-off between the electric automaker and Alameda County.

Tesla informed employees it received approval to resume operations at its factory after Alameda County’s interim health officer had approved its Fremont work plan and safety measures, according to an email seen by Bloomberg.

“We have local support to get back to full production at the factory starting this upcoming week,” Laurie Shelby, Tesla’s vice president for environmental, health, and safety told employees.

The Alameda decision comes after Tesla’s CEO Elon Musk last week had restarted production defying Covid-19 health orders currently in place throughout Alameda County. Furthermore, Musk filed a lawsuit against the County claiming its lockdown orders have prevented the electric automaker from resuming operations at its California plant planned for earlier this month.

The outspoken billionaire also threatened to move the carmaker’s operations out of California to Texas or Nevada saying that if the company retains its “manufacturing activity at all, it will be dependant on how Tesla is treated in the future”.

The value of Tesla shares has more than doubled in the past two months. The stock fell 0.5% to $799.17 as of the close on Friday.

Commenting on the stock after a meeting with Tesla’s investor relations, Emmanuel Rosner at Deutsche Bank, still maintained a Hold rating with a $850 price target, despite saying that the company’s message was positive.

“While management provided few details about its 2Q/2020 outlook, it believes Fremont production can ramp back up very quickly given its experience in China and that the supply chain is already coming back online,” Rosner wrote in a note to investors. “Tesla’s record backlog of orders should provide strong pipeline of deliveries regardless of near-term conditions.”

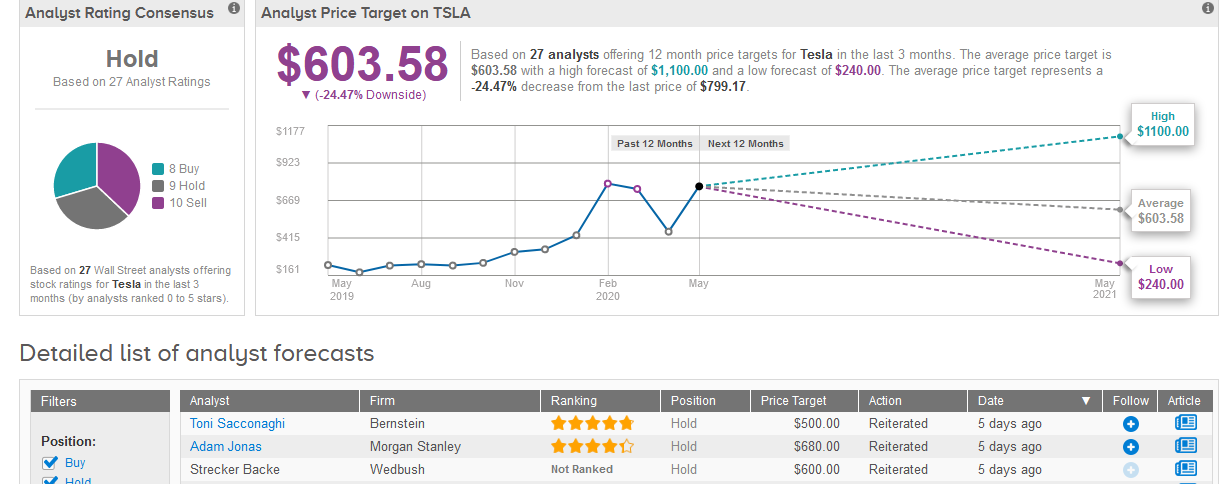

Overall, the rest of Wall Street analysts is sidelined on the stock. The Hold consensus rating is based on 10 Sells, 9 Holds, and 8 Buys. Following the stock’s recent rally it comes as little surprise that the $603.58 average price target projects 25% downside potential in the shares in the next 12 months. (See Tesla’s stock analysis on TipRanks).

Related News:

Fiat Chrysler Shares Decline on Dividend Payout Withdrawal

Tesla’s California Auto Plant Gets Go-Ahead to Reopen Next Week

GM Plans To Reopen Lucrative Mexican Pickup Plant Next Week- Report