What is the most shorted stock on Wall Street, you ask? Just beating out Apple for the top spot, it is Elon Musk’s Tesla (TSLA). $14.5 billion have been borrowed by investors in order to bet against the electric car manufacturer, apparently.

The news is not very surprising as Tesla is one of the most polarizing companies out there. Hardly ever out of the headlines, most Wall Street observers have an opinion on what the future holds for the automobile industry disruptor.

Earlier this week, Tesla notched an all-time high, closing Tuesday’s session at $537.92. The figure rounds out an extraordinary six months that has seen Tesla leave behind 2019’s initial troubles and virtually double its share price since the start of October. So, where is Tesla headed? This week, analysts have been throwing the hat in, offering takes on the electric vehicle company from all possible angles, with the most recent rating being a downgrade. In this article, we’ll take a look at three different ratings from the analysts.

The Sell

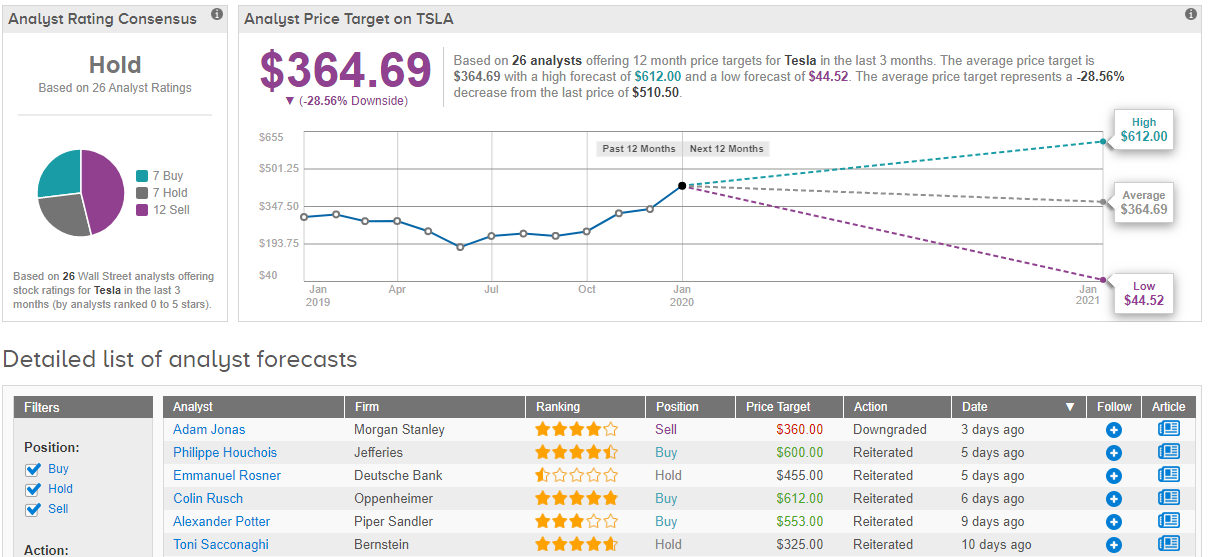

Running with the bears is Morgan Stanley’s Adam Jonas. Today, the 4-star analyst downgraded his rating on TSLA from Hold to Underweight, although he did raise his price target from $250 to $360. The new target implies downside of 29%. (To watch Jonas’ track record, click here)

While acknowledging Tesla’s delivery beats and the progress of the company’s massive production facilities in China, Jonas believes Tesla’s recent surge is unsustainable. Jonas said, “Near-term momentum and sentiment around the stock is admittedly very strong, but we ultimately question the sustainability of the momentum… We believe the current share price discounts a fully ramped up China, Berlin and Model Y.”

The Hold

Sitting in the middle seat of the Tesla debate is Deutsche Bank’s Emmanuel Rosner. Rosner highlights Tesla’s recent 4Q19 vehicle delivery figures which beat consensus expectations across the board; In the fourth quarter, Tesla delivered 112,000 units, exceeding the Street’s estimate of 106,000 and totaling 367,000 for the whole year. The number is within the boundary of the company’s yearly guidance, which called for between 360,000 – 400,000 units. It also provides a 50% increase over 2018 figures.

Rosner said, “We believe this new solid quarter of deliveries could further put to rest investor concerns around softening demand for Tesla’s product. While bears will likely argue 4Q deliveries benefited from strong purchases ahead of tax credits expiring in various countries, Tesla is just about to start deliveries of locally made Model 3s in the very large China market, at an attractive price point.”

Bearing this in mind, Rosner kept his Hold rating on Tesla as is but bumped his price target up to $455 from the previous target of $290. The target, though, still implies downside of 11% over the next year. (To watch Rosner’s track record, click here)

The Buy

After Tesla’s stock hit a high point, is it time to sell? Not according to Jefferies’ Philippe Houchois, who believes Tesla is likely to start turning a profit this year and, therefore, selling at the present valuation will be a mistake. Houchois argues that present consensus estimates are “reasonable and conservative”, with Tesla standing to gain not only from car sales but also from products such as power storage and third-party battery sales. The company’s upcoming Q4 report in which it will lay out its financial plans for more factories and other capital-heavy costs will be “critical”, adds the analyst.

So, what does it mean? It means Houchois kept his Buy rating but increased his price target to $600. The new target implies upside of 18%. (To watch Houchois’ track record, click here)

The View from the Street

What does the rest of the Street make of Tesla’s prospects, then? 7 Buys, 7 Holds and 12 Sell ratings coalesce into a Hold consensus rating. The bears currently have the momentum, though, as the average price target comes in at $364.69 and indicates potential downside of 29%. (See Tesla price targets and analyst ratings on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.