Electric vehicles maker Tesla (NASDAQ:TSLA) is utilizing the data gathered by its Insurance business to minimize the cost of repairing its vehicles. During the fourth-quarter earnings call, CEO Elon Musk stated that feedback from the Tesla Insurance business is also helping in making small changes in design and in improving the logistics of spare parts to ensure customer satisfaction and reduce repair costs.

Musk stated that “two really important side benefit” to its Tesla Insurance business are worth mentioning. Firstly, seeing Tesla Insurance’s competitive rates, other insurance companies have also started offering better rates, thus ensuring lower insurance costs for customers even if they don’t use Tesla Insurance. Secondly, Musk noted that Tesla Insurance is giving them “good feedback loop into minimizing the cost of repair of Teslas.”

Musk explained that earlier, the company didn’t have a good insight into the cost of repairing or other aspects as third-party insurance companies were covering the costs, which in certain cases were unreasonably high. Based on the feedback from Tesla Insurance, the company adjusted the design of the car and even made changes in the car’s software to minimize the repair cost.

Tesla Insurance’s Growth Potential

Tesla launched its insurance division in August 2019, promising rates up to 30% lower than rival insurance providers. Responding to an analyst’s question about when Tesla Insurance will generate enough revenue for the company to provide details, CFO Zachary Kirkhorn said, “I think it’s probably going to take some time before this business is large enough for specific financial disclosures.”

Nonetheless, Kirkhorn revealed that Tesla Insurance was generating premiums at an annual run rate of $300 million as of the end of last year. He added that it was growing at a quarterly rate of 20%, “growing faster” than the company’s vehicle business. The CFO also highlighted that 17% (on average) of the customers in the states where the company has a presence are using a Tesla Insurance product.

While Tesla is using data from Tesla Insurance to bring down costs, third-party insurers have a very different approach to address the high repair costs. A Reuters report mentioned that insurers are writing off low-mileage Tesla Model Y cars that have been in crashes and sending them to salvage auctions as they feel they are too expensive to repair.

What is the Target Price for Tesla Stock?

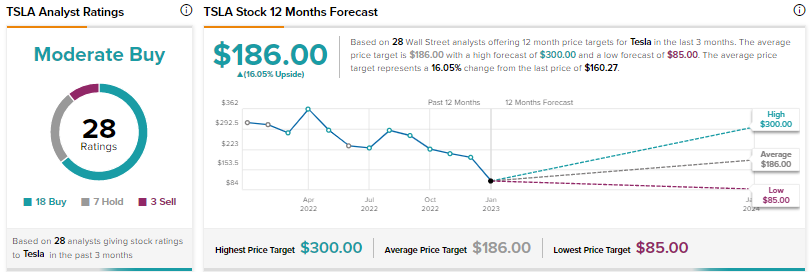

Wall Street is cautiously optimistic about Tesla, with a Moderate Buy consensus rating based on 18 Buys, seven Holds, and three Sells. The average TSLA stock price target of $186 implies 16.1% upside potential. TSLA shares have rallied 30% year-to-date. This week, the company reported upbeat Q4 results.