Tesla has recalled more than 9,500 of its vehicles because of faulty roof and bolts, Reuters reported, citing documents from the National Highway Traffic Safety Administration (NHTSA).

The recalls involve Tesla’s (TSLA) 9,136 Model X vehicles from the 2016 model year. According to the NHTSA document, “On September 21, 2020, Field Quality was made aware of a field event involving a 2016 Model X with missing applique. Field Quality initiated an investigation into the root cause and frequency of the condition.”

The NHTSA added that “Tesla Service will inspect affected vehicles and apply a retention test on the appliques. If the appliques pass the retention test, then they have sufficient primer and no further action is necessary.”

Per Reuters, the electric vehicle maker has also recalled 401 Model Ys from the 2020 model year, which have an inadequate tightening of “bolts connecting the front upper control arm and steering knuckle.” (See TSLA stock analysis on TipRanks)

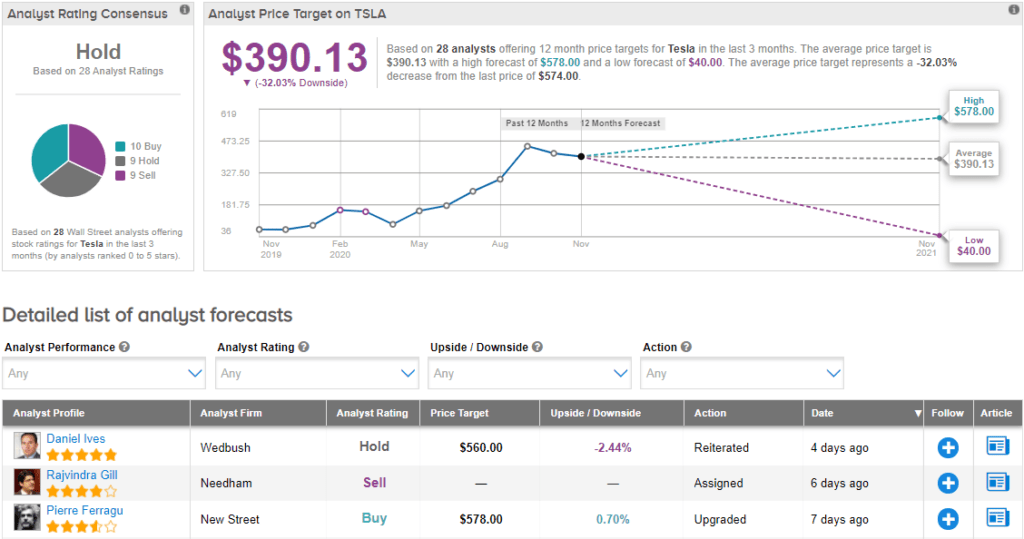

On Nov. 22, Wedbush analyst Daniel Ives raised the stock’s price target to $560 (2.4% downside potential) from $500 and reiterated a Hold rating. In a note to investors, Ives wrote, “While Model 3’s remain the core driver, going forward new designs around Cybertruck and Model Y will further aid growth globally and thus enable to Tesla to achieve its million delivery units likely by 2023 (2022 not out of the question) in our opinion.”

Like Ives, the Street is also sidelined on the stock. The Hold analyst consensus is based on 9 Holds, 10 Buys and 9 Sells. The average price target stands at $390.13 and implies downside potential of about 32% to current levels. Shares have skyrocketed 586% year-to-date.

Related News:

Tesla Pops 13% On S&P 500 Inclusion; Stock Up 388% YTD

Tesla To Recall 29,193 Vehicles In China Due To Suspension Defect

Tesla 3Q Profit Blows Past Estimates; Street Says Hold