The long-fought battle between Tesla (TSLA) bulls and bears took an interesting turn after Tesla’s 2Q earnings last week. Tesla missed big on its gross margins and reiterated its prior forecast for its 2019 delivery numbers. The numbers were somewhat overshadowed by the resignation of CTO JB Straubel. Straubel has been with the company since its founding and is credited for developing many of the company’s key battery technology innovations.

Morgan Stanley analyst Adam Jonas wonders if Tesla can continue to fund its growth ambitions without requiring additional external capital. Meanwhile, the analyst reiterates an Equal-weight rating on TSLA and with $230 price target, which implies about 6% downside from current levels. (To watch Jonas’ track record, click here)

Tesla came out of the gates firing in its 2Q earnings release that its “business has grown to the point of being self-funding.” However, Jonas isn’t so sure this is the case.

The story on the Street coming after Tesla’s 1Q earnings was about Tesla’s weakening demand, but demand for Tesla’s vehicles may have been the best thing about its 2Q release. Jonas believes that Tesla has quieted many of the demand concerns in the short-term, but he decreased his FY19 delivery estimate by 2k. Jonas forecasts the FY19 delivery number coming in at 345k units, which is well below Tesla’s own guidance of 360k to 400k. Jonas notes that the reduction in the electric vehicle tax credit at the end of June may have pulled forward some third-quarter demand into the second quarter. This previously happened at the end of 2018, so Jonas is cautious about putting too much weight into Tesla’s strong 2Q delivery numbers.

On gross margin, Jonas reduced his full-year forecast to 17.4% from 19.6% (excluding regulatory tax credits). Regarding cash flow, Jonas forecasts negative 3Q cash flow due to a reversal of the positive working cash flow that benefited Tesla in the second quarter.

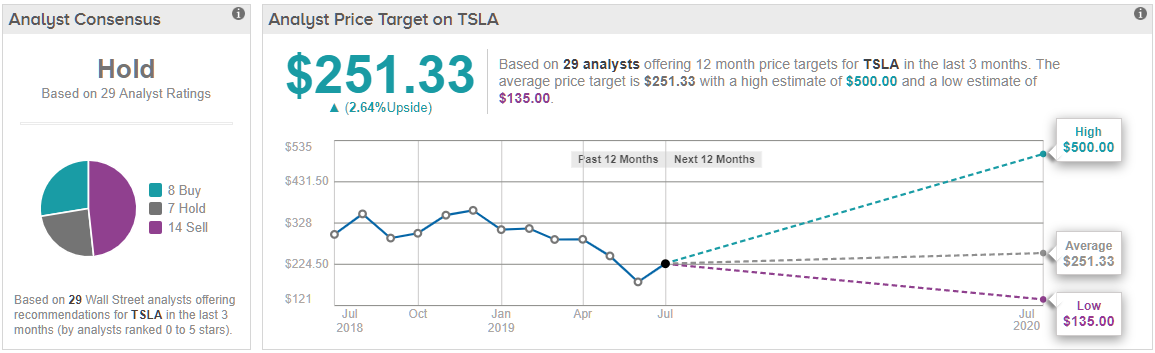

All in all, Jonas understands that there is a “wide range of complex events that could combine to influence the ultimate direction of Tesla’s stock price.” Due to this complexity, Jonas can envision scenarios where Tesla’s stock price rises to $391 or falls all the way to $10. This leads Jonas to remain sidelined which is generally in line with the rest of the Street. TipRanks analysis of 29 analyst ratings on TSLA (over the last three months) shows a Hold consensus, with 8 analysts recommending Buy, 7 advising Hold, and 14 suggesting Sell. The average price target among these analysts stand at $251.33, which represents a slight upside from current levels. (See TSLA’s price targets and analyst ratings on TipRanks)