Electric car giant Tesla (TSLA) is at the top of its game, hitting another all-time high on Wednesday, and reaching the long-ballyhooed $1,000 mark. The latest surge ensued when a memo from CEO Elon Musk telling employees it was “time to go all out” on the production of the Tesla Semi, began making the rounds.

But Tesla’s latest rally picked up steam earlier this week, when reports came out that demand for Model 3s in China has accelerated. News outlets focused on the 11,095 Model 3s that zoomed out of Tesla’s Shanghai Giga 3 factory last month and are now sitting pretty outside a new home.

However, GLJ Research analyst Gordon Johnson argues the celebrations are premature and, in fact, the figures are misleading.

“The China May 2020 Sales numbers released yesterday, which have been covered by nearly every news outlet, were from China Passenger Car Association (“CPCA”)… Stated more clearly, the numbers from CPCA yesterday, according to CPCA, were just an estimate, and have not been confirmed,” Johnson said.

According to Johnson, the figures to look out for are those released by the China Automotive Technology and Research Center (CATARC) or the China Banking and Insurance Regulatory Commission (CBIRC).

Ok, so where are they? “Those numbers are not yet available,” Johnson added, “So all the Reuters and Bloomberg articles from yesterday are wrong. Also, the many analysts commenting on these numbers today on TV are also wrong.”

While TSLA’s production number of 11,501 is not disputed by the analyst, Johnson believes “we do not yet know how many cars TSLA sold in May in China.”

What we do know, Johnson adds, are Tesla’s EU sales figures. “They were pretty bad,” he said.

Down by 5.2% month-over-month and 33% year-over-year, as it happens. Additionally, through June 8, quarter-to-date, 2Q20 sales dropped by 54% quarter-over-quarter and 75% year-over-year in “Norway + the Netherlands + Spain, which accounted for 47% of all of TSLA’s EU sales in 2019.”

“But,” Johnson summed up, “Who cares about numbers/facts when Ron Barron is on TV nearly monthly saying TSLA’s stock will increase 10x with no supporting details – and also saying he wants to buy more, despite the fact he’s been selling… why won’t the media focus on the numbers vs. perpetually having people on to give their opinions on what Tesla will do in 2025? what about 2020?”

Unsurprisingly, Johnson rates Tesla shares a Sell, without suggesting a price target. (To watch Johnson’s track record, click here)

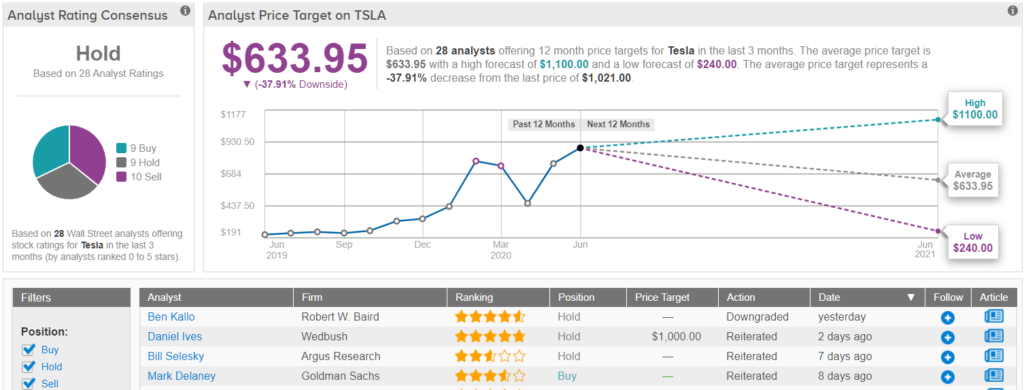

While not quite as flummoxed as Johnson, the Street appears out of sync with Tesla’s ascent, too. 9 Buys, 9 Holds and 10 Sell ratings add up to a Hold Consensus rating. With an average price target of $633.95, the analysts expect Tesla stock to drop by 38% over the next 12 months. (See Tesla stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.