We live in a rapidly changing world, there’s no doubt about that. The first two decades of the 2000’s have seen tech make leaps that were unimaginable as late as the 1980s. And now, we’re watching one more leap unfold in real time, as telecom companies are rolling out the new 5G networks.

The switch is no surprise; it’s been in the works since late 2017, but it’s accelerating now. In a report by Michael Walkley, 5-star analyst with Canaccord, major operators are signing up 5G subscribers and opening service at a faster pace than expected. Walkley says, “We believe the transition to 5G is ramping faster than global networks transition to 4G and any other previous wireless generations. In fact, there are now over 40 OEMs and 40 operators launching or announcing 5G products and commercial service.”

Getting into detail, Walkley points out that Korean mobile operators already have 4 million 5G subscribers, while in the US, both T-Mobile and AT&T have already launched low-band 5G service networks. In China, the three major mobile operators launched 5G commercial operations on November 1.

So, the switch is happening. As it expands, subscribers will find faster service and more efficient data streaming, while investors will find increasing potential in the companies that support the new 5G technology. We’ve taken three such companies and looked at them through the lens of TipRanks’ Stock Screener tool, to find out what Wall Street’s top analysts have to say in some specific cases.

Inseego Corporation (INSG)

Start with Inseego, a company specializing in mobile solutions for IoT systems. Inseego provides modems and routers that enhance device-to-cloud capability, and is front and center in the move toward faster 5G capable connectivity. Inseego introduced the first commercially available 5G mobile broadband hotspot last year.

INSG shares rose 76% in 2019, as the company’s revenues showed strong gains in the final quarter of the year. The Q3 earnings report, the most recent on record, showed top-line revenues of $62.72 million, 5.4% over the expectation. Year-over-year, the gain was even stronger, at 23.8%. The revenue spike shows both the profit potential and industry importance of 5G for the IoT sector.

Wall Street’s analysts are bullish on INSG, looking ahead at the company’s prospects for acquiring big-name customers. Northland Securities’ 5-star analyst Michael Latimore took especial note of INSG landing a contract with Vodaphone. He wrote, “Inseego has stacked up numerous wins, esp. for 5G hotspots and home routers, the most recent being a division of Vodafone. Vodafone has numerous operating entities that could launch with Inseego eventually. Other operators are prospects too across most geographies. Enterprise SaaS is turning for the better…” Latimore pointed out specifically that Inseego will provide the hardware for Vodaphone Qatar’s upcoming hotspot – and that worldwide, Vodaphone offers 640 million subscribers.

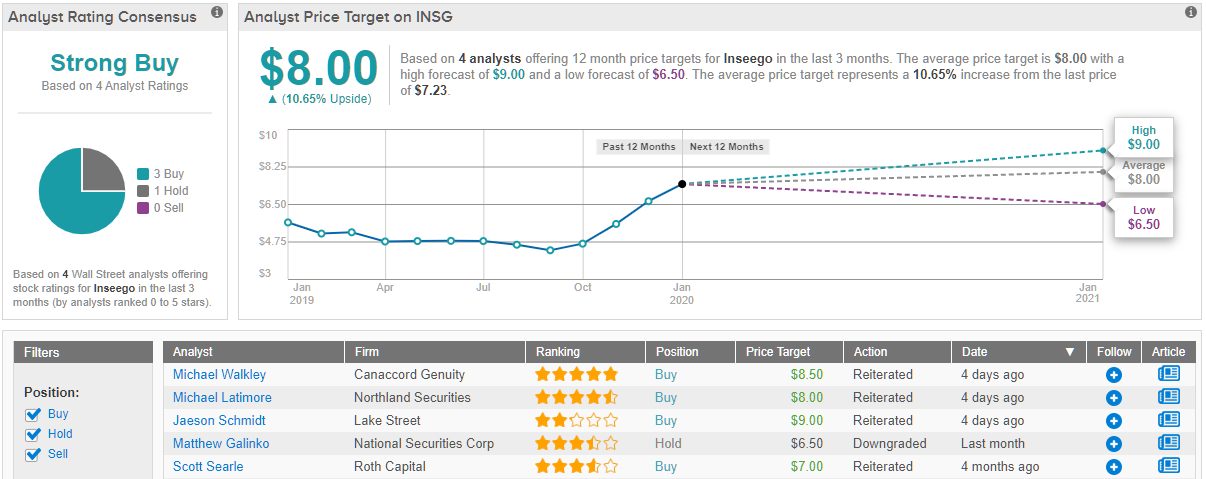

Latimore puts a Buy rating on INSG, along with an $8 price target that suggests an upside better than 10%. (To watch Latimore’s track record, click here)

Also optimistic about INSG’s prospects this year is Lance Vitanza, of Cowen. Vitanza writes, “Inseego delivered 3Q19 revenue that was ahead of our estimates in both IoT & Mobile as well as Enterprise SaaS and above management’s previously provided outlook ranges for both divisions. Gross margins in IoT & Mobile and Enterprise were also 100 bps and 120 bps better than we had modeled… [looking forward], growth is expected to be 2H20-weighted, given the anticipated launch cycle for second generation 5G products now in the Inseego-to-customer pipeline…” Vitanza also backs his Buy rating with an $8 target.

Overall, INSG has a Strong Buy from the analyst consensus. The stock’s sharp gains in Q4 2019 have brought it 3 recent Buy ratings against a single Hold. Shares are priced at $7.23, and the average price target is $8. Again, that suggests an upside potential of ~10%. (See Inseego stock analysis at TipRanks)

Ceva, Inc. (CEVA)

Ceva develops and markets digital signal processor (DSP) technology for the semiconductor industry. The company works with both chip makers and original equipment manufacturers, providing the innards for a variety of devices in the mobile, consumer, industrial, and IoT segments. Ceva’s DSPs are helping to power the conversion to 5G, across a wide range of tech companies.

Ceva has found success in the DSP niche, and the company saw some strong metrics in 2H19. In Q3, the last reported, CEVA showed a 61% sequential gain in royalty income, to $12.2 million, and the total revenues, $23.5 million, were up 10% year-over-year.

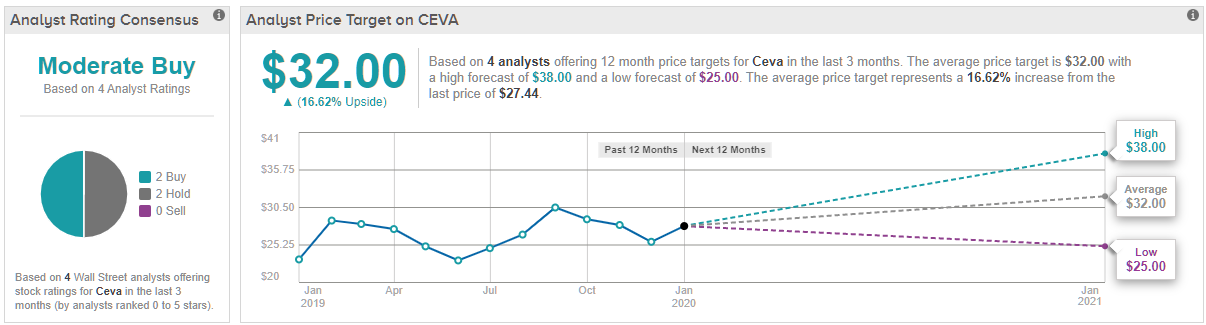

Strong revenues and a solid position in a growth-oriented niche have earned CEVA some love from two of Wall Street’s top-rated analysts. Writing from Cowen, 5-star analyst Matt Ramsay writes, “CEVA’s 3Q beat and strong outlook point to seasonal strength… We believe CEVA is an attractive growth story tied to low power edge processing in a growing list of applications. We believe diversification beyond handsets is beginning to take root and expect initial traction from basestations and other non-basesband applications to drive sustainable licensing and royalty growth for the foreseeable future.” Ramsay put a $35 price target on CEVA shares, supporting his Buy rating and indicating his confidence in a 27% upside. (To watch Ramsay’s track record, click here)

Canaccord’s Michael Walkley also takes a bullish stance of CEVA. He says, “With roughly 40-50 customers currently paying royalties to CEVA, we believe this number could increase to 100-110+ over the next several years as CEVA’s strong licensing revenue has driven a strong pipeline of new customers working on CEVA-powered chipsets.” Walkley sees CEVA’s growth supporting a 38% upside in the next twelve months, and gives the stock a $38 price target with a Buy rating. (To watch Walkley’s track record, click here)

Looking at the consensus breakdown, opinions on CEVA are split. The bulls come in with 2 “buy” ratings compared to 2 “hold” ratings received over the previous three months. The upside potential lands at ~17% as a result of its $32 average price target. (See Ceva stock analysis at TipRanks)

Akoustis Technologies (AKTS)

Akoustis inhabits the acoustic wave segment of the technology world. The company’s single-crystal piezoelectric materials are used in bulk acoustic wave (BAW) filters in smartphones and other mobile wireless devices. AKTS operates in the US market, and boated a 61% gain in share price last year.

Akoustis reported Q1 fiscal 2020 in November, and showed $22.6 million cash and cash equivalents on hand. The cash on hand was good news, as the company reported a net loss in earnings per share despite more than doubling revenues year-over-year. Also on a positive note, AKTS narrowed its net loss from the year-ago quarter. While share prices fell after the earnings report, they have since regained the loss – and more – on recent developments.

Last month, AKTS moved to raise capital through a public stock offering. The offering, of 4.8 million shares, was priced at $6.25 per share. Including the 720,000 shares allotted to the underwriters, the offering brought the company upwards of $30 million in fresh capital. Since the mid-December sale, AKTS has spiked 9% in share price.

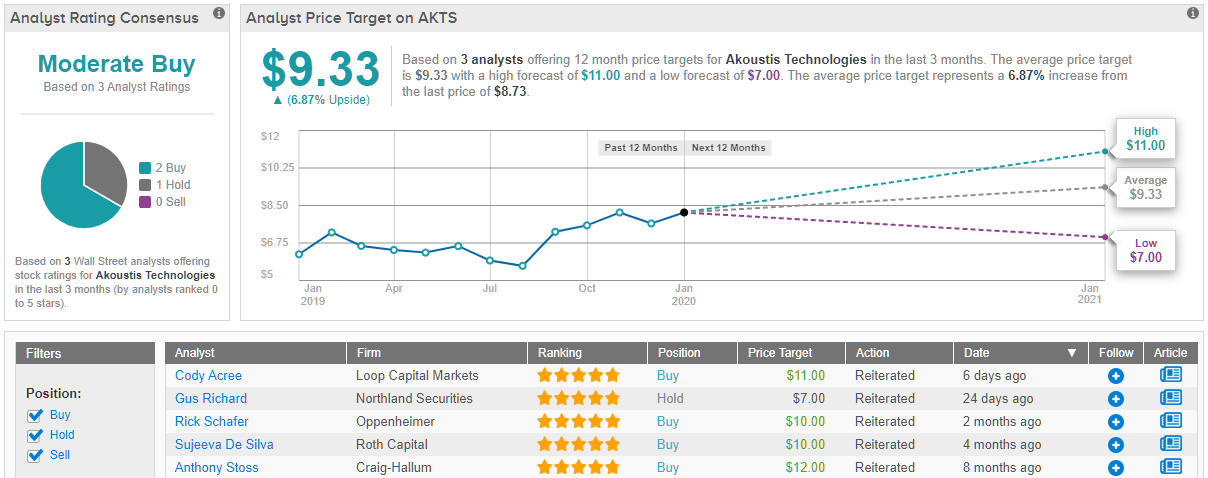

Anthony Stoss, 5-star analyst with Craig Hallum, sees the company as well positioned, especially after the successful stock offering and capital infusion, for growth and expansion in the coming months. He writes, “We think with AKTS’ recently raised ~$30 million the company now has enough cash to reach breakeven in Q42020. Moreover, we believe the company is now sampling filters to 50+ companies with likely 20+ Wi-Fi router makers including Asian router makers as well. AKTS’ new funds will allow the company to capitalize on some of their upcoming design wins on both the Wi-Fi and 5G infrastructure side set to rollout in 2020.”

Stoss puts a Buy rating on AKTS, supported by a $12 price target that indicates room for 38% upside growth. (To watch Stoss’s track record, click here)

It has been relatively quiet when it comes to other analyst activity. In the last three months, only 2 analysts have issued ratings. However, the word on the Street is that AKTS is a “buy.” Based on the $9.33 average price target, shares could climb 7% from current levels. (See Akoustis stock analysis at TipRanks)