Investors are constantly looking for stocks that will yield massive returns. That being said, finding these stocks can seem like an overwhelming task. Not to mention it can be expensive. Some of the most well-known names like Amazon and Alphabet can put you out thousands of dollars for just a single share. However, snapping up stocks with strong long-term growth prospects doesn’t have to cost you your entire savings.

Defined these days as stocks priced under $5 per share, the penny stocks offer a fascinating – and frequently lucrative – combination of attributes, advantages, and risks. The advantages come from the low price; even a very small increment in price gain will quickly translate into a high percentage return on the original investment.

Although penny stocks can deliver massive returns, there could be a reason they are changing hands at such low levels. Finding themselves in challenging times, these names could be bogged down by overwhelming headwinds or poor fundamentals.

The bottom line? Doing some research is necessary before pulling the trigger on any penny stock. Following the recommendations from Wall Street pros can help in the due diligence process.

With this in mind, we turned to investment firm Wedbush for some inspiration. The firm’s 5-star analyst, David Nierengarten, has pinpointed two compelling penny stocks, noting that each could climb 200%, or more, in the year ahead. After running the tickers through TipRanks’ database, both have been cheered by the rest of the Street as well, as they boast a “Strong Buy” analyst consensus.

Kinnate Biopharma (KNTE)

We’ll start with Kinnate Biopharma, an innovative clinical-stage company dedicated to enhancing cancer treatments through leveraging advancements in targeted therapies. This new direction in medical research offers the promise of more effective drug design, by focusing on highly selective compounds that will effectively and precisely target the oncogenic drivers or genomic structure of the patient’s cancer.

The company is currently working on small-molecule kinase inhibitors, primarily designed to treat genomically-defined malignancies that have proven resistant to currently available treatment regimens. Following this path, Kinnate has put together a strong portfolio of proprietary drug candidates, and has six research tracks active in the pipeline. Three of these are at various stages of pre-clinical development, while the other three have entered Phase 1 clinical trials.

Kinnate’s leading drug candidate is exarafenib, an investigational pan-RAF inhibitor. This candidate is the subject of two trials, a Phase 1b study against BRAF-driven advanced adult solid tumors and a Phase 1a study in the treatment of advanced NRAS mutant melanoma. The company reported that it had released positive early results from both of these studies. Additional data on exarafenib, in dose escalation as a combo therapy with binimetinib and in monotherapy dose expansion, are expected in 2H23 and 1H24 respectively.

Also making waves is Kinnate’s trial of KIN-3248, a small-molecule kinase inhibitor that specifically targets cancer-associated alterations in the FGFR2 and FGFR3 genes. These genes are frequently identified as oncogenic drivers in solid tumor cancers. This drug candidate is undergoing a Phase 1 clinical trial, and the initial dose escalation data is expected to be released in 2H23.

Based on the progress of its pipeline and $3.83 share price, Wedbush’s David Nierengarten sees significant gains in Kinnate’s future. He writes: “We believe that exarafenib’s structural attributes should enable a differentiated clinical profile in patients with class II/III BRAF alterations, an unmet area of need that approved RAF inhibitors have failed to address… The nearest significant catalyst for shares is the initial dose escalation data from the KIN4802 study of KIN-3248 in patients with FGFR2/3 driven solid tumors, expected in 2H23. We expect to see activity against escape mutations, and possibly hints of improved duration of effect against FGFR relative to currently approved therapies…”

“We continue to believe the market is underappreciating KNTE’s pipeline, which could potentially have 4 clinical stage programs by 1H24. With shares currently trading at less than cash, we would take advantage of this steep discount ahead of the upcoming FGFR readout,” the top analyst summed up.

To this end, Nierengarten rates KNTE an Outperform (i.e. Buy), and his $14 price target implies a robust 265% upside potential for the next 12 months. (To watch Nierengarten’s track record, click here)

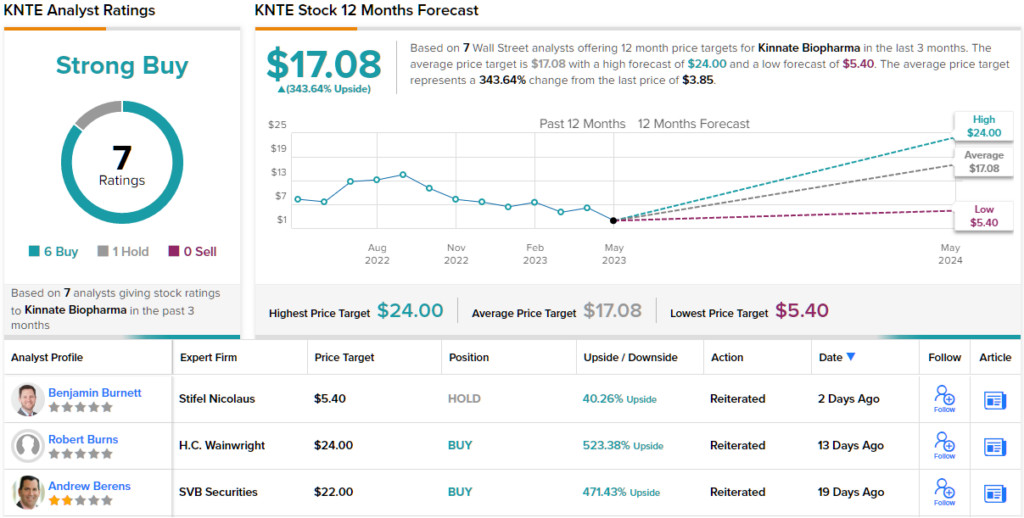

What does the rest of the Street have to say? 6 Buys and 1 Hold add up to a Strong Buy consensus rating. The average price target of $17.08 is even more bullish than Nierengarten’s prediction, suggesting a whopping 343% upside over the one-year horizon. (See KNTE stock forecast)

Fusion Pharmaceuticals (FUSN)

The second stock we’re looking at is Fusion Pharmaceuticals. Like Kinnate, Fusion is a precision-oriented biopharma firm, looking into cancer treatments – but Fusion is looking at radiation therapies, using a proprietary development platform and technology to create targeted alpha therapies (TATs), for a safer route in the use of radiopharmaceuticals.

Fusion has connected its TATs to its Fast-Clear linker technology in a combination that permits the attachment of alpha particle emitting isotopes directly to antibodies – or other targeting molecules – which can be introduced into the patient’s body and used to deliver the therapeutic agent directly to the tumor in a highly selective manner, minimizing damage to healthy tissues.

The development of this safer route for the use of radiotherapies has been the underlying theme of Fusion’s research pipeline, and the company has two leading candidates currently in clinical trials. It is worth noting that a third candidate, FPI-1966, was part of Fusion’s research program, but in an announcement earlier this month Fusion made public the discontinuation of that program.

The first of these, FPI-2265, is an alpha-emitting radiopharmaceutical undergoing the TATCIST trial in patients suffering from mCRPC, a form of prostate cancer. Data on the first 20 to 30 patients should be available during 1Q24.

The second track features FPI-1434, the subject of a Phase 1 trial in the treatment of solid tumors expressing IGF-1R. The drug candidate is being tested as both a monotherapy and as a combination therapy with Merck’s KEYTRUDA. A clinical update of the Phase 1 trial is planned for this coming June 27, at the annual meeting of the Society of Nuclear Medicine and Molecular Imaging.

Checking in again with Wedbush’s David Nierengarten, we find him upbeat about Fusion’s prospects. He writes: “We continue to remain bullish on FUSN and look forward to data catalysis from ‘1434 and ‘2265 over the next 9-months. The company decided to discontinue the Ph 1 study of FPI-1966 in patients with FGFR3 expressing solid tumors as part of a portfolio prioritization. While unfortunate, it will allow for the reallocation of capital to ‘2265 that could have a better risk-adjusted ROI… We continue to believe that the market is overlooking FUSN’s pipeline opportunities and would be buyers of shares ahead of the upcoming readout[s]…”

All of this adds up to an Outperform (i.e. Buy) rating from the top analyst, whose price target of $13 suggests room for ~207% growth in the coming months.

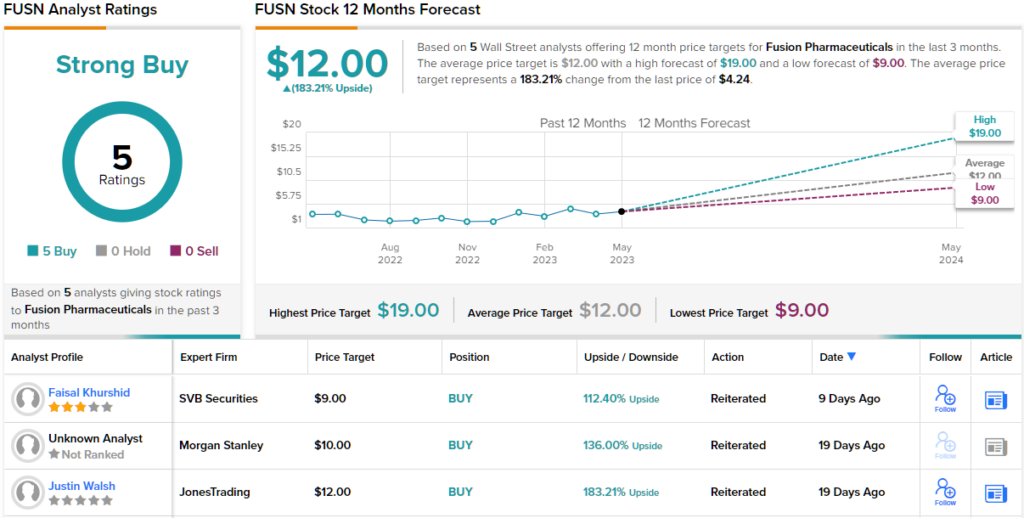

Overall, the Strong Buy consensus rating here is unanimous, based on 5 positive Wall Street analyst reviews of FUSN shares. The stock’s average price target of $12 implies a gain of 183% from the current trading price of $4.24. (See FUSN stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.