The oft repeated mantra of ‘buy low, sell high’ makes perfect sense, but the execution of said instruction is a lot harder than it suggests. We humans are naturally inclined to latch on to a winning horse, rather than back those languishing behind.

However, as anyone with knowledge of the investing game will tell you, going against the grain is often the way to maximize returns. In the ever-changing marketplace, some stocks have fallen on hard times for a variety of reasons like disappointing earnings, removal of a CEO and macro trends, all of which can impact investors’ confidence in a company’s ability to deliver. But often, the cycle will turn, and a recovery will occur, so long as the fundamentals remain strong enough.

With these thoughts as a starting point, we used TipRanks’ Stock Screener to find 3 tickers the Street thinks are about to execute a turnaround in 2020 after falling on hard times over the last year. Let’s take a closer look at what we uncovered.

Schlumberger Limited (SLB)

A big player in oilfield services, Schlumberger has endured a roller coaster 12 months, gaining and losing its share price intermittently. Ultimately, though, over the last year, SLB stock has lost 24%, the bulk of which it recently shed in January.

Companies in the oil industry are heavily subjected to the impact of macrotrends. The energy sector was recently affected by the outbreak of the coronavirus in China. The virus has restricted people’s movement, which in turn causes a decrease in the amount of fuel purchased. This, naturally, exerts downward pressure on energy stocks.

Schulmberger’s recent earnings report was a mixed affair, too. Despite reporting Q4 revenue that exceeded expectations, the company posted a $10.1 billion loss in 2019. Driven mostly by land market weaknesses, North American revenues fell 10% year-over-year to $10.8 billion. SLB’s Q4 revenue dropped quarter-over-quarter by 4%, too.

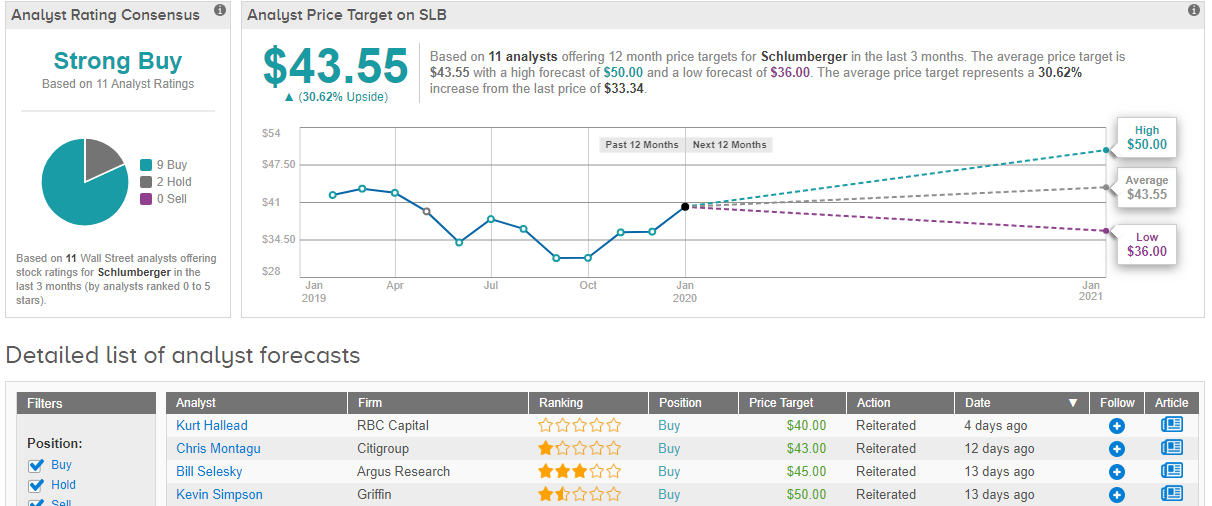

Nevertheless, following a recent meeting with the company’s CEO, RBC’s Kurt Hallead came away impressed. The analyst believes the company has “a compelling case for margin improvement and free cash flow generation.” Acceleration in global energy expenditures, rebound in high-margin offshore drilling activity and a greater-than-expected increase in international exploration, completion and production activity are potential catalysts according to Hallead.

Additionally, Hallead highlights SLB’s commitment to the dividend (the company pays a $2 annual dividend with a yield of 5.97% – more than double the average of S&P 500 companies).

The analyst concluded, “We continue to see SLB as a through-cycle core holding for large cap energy investors. Given our outlook for an improving international market dynamic, we believe SLB is fundamentally well positioned to outperform during 2020.”

Taking all of this into consideration, Hallead reiterated an Outperform on the energy giant. At his $40 price target, a 19% twelve-month gain could be in the cards. (To watch Hallead’s track record, click here)

And what about the rest of the Street? It sees SLB drilling for more gains, too. 9 Buys and 2 Holds add up to a Strong Buy consensus rating. The average price target outstrips Hallead’s and comes in at $43.55, implying upside potential of 31% over the coming months. (See Schlumberger stock analysis on TipRanks)

Halliburton Company (HAL)

Staying in the same (oil) field, we drill deeper into one of the world’s largest oil field service companies, Halliburton. Closely mirroring Schlumberger’s performance, over the last 12 months, HAL’s share price has lost 30%. The downtrend stretches back three years now, a period in which HAL stock has declined by over 60%. According to RBC’s Hallead (who covers HAL, too), 2020 will see a reverse of the trend.

Like SLB, Halliburton has been affected by recent macrotrends and similarly, the company’s latest earnings report exhibited a decline in North American revenues. The outlook confirms business in the region won’t get any stronger in 2020, but drilling activity will continue to rise in the international markets and should positively impact Halliburton’s earnings.

Hallead thinks so, too. The analyst argues that increased activity, pricing power and HAL’s ability to compete for high margin services “should lead to international margin expansion in 2020.” The highest growth is expected in the Asia-Pacific region followed by Europe and the Commonwealth of Independent States, Middle East and Latin America. All of these will lead to “similar margin progression as 2019.”

The analyst said, “We are increasing our 2020E/21E EPS to $1.29/$1.63 from $1.17/ $1.47. The primary driver is adjustments to C&P (completion and production) revenue and margin progression. We continue to see HAL as a through-cycle core holding for large-cap energy investors given improving international markets and a better than group average return profile.”

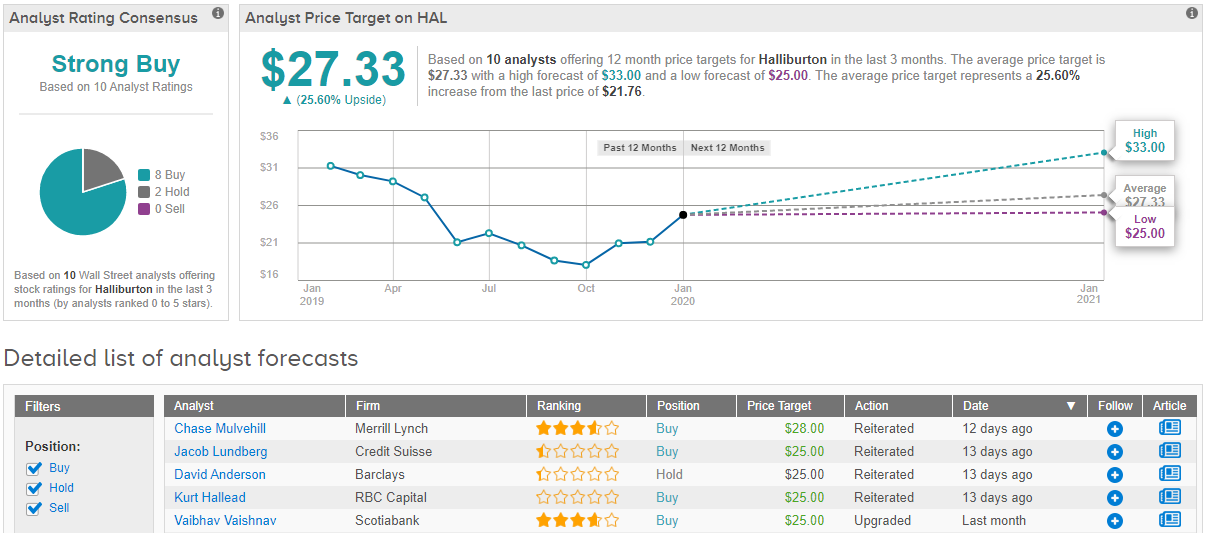

So, what’s the bottom line? Hallead sided with the bulls, keeping his Outperform rating as is. He also bumped up the price target from $23 to $25, representing potential gains of 16% in the year ahead.

The Street agrees. HAL’s Strong Buy consensus rating breaks down into 8 Buys and 2 Holds. Should the average price target of $27.33 be met over the next 12 months, investors stand to take home gains in the shape of 26%. (See Halliburton stock analysis on TipRanks)

Occidental Petroleum (OXY)

Lastly, we come across another big player in the energy sector. Occidental Petroleum is valued at $36 billion, with its exploration and drilling operations spanning from the US to the Middle East to Colombia. The company also engages in petrochemical manufacturing in the US, Canada, and Chile.

The past 12 months also haven’t been kind to OXY. In fact, OXY’s share price over the last year exhibits the worst performance of all three – a downturn in the shape of 40%. The nadir was reached in December, when the share price hit $37.25, the lowest it has been since 2005. The market has been unforgiving to OXY due to the company’s high debt load; investors were unhappy in 2019 following the massive outlay of $57 billion to outbid Chevron for the purchase of Anadarko Petroleum.

Don’t be alarmed, though, says Morgan Stanley’s Devin McDermott, as the pullback presents opportunity. Furthermore, investors should take comfort in the company’s handsome dividend.

McDermott said, “We believe the dividend, which offers a best-in-class 7% yield, is safe with room for long-term growth under most scenarios. While efforts to reduce leverage have made significant progress in de-risking the business, Occidental still trades at 2 times the free cash flow yield of U.S. integrated and large-cap E&P peers… From here, execution on synergy targets, recently provided guidance through 2022, and planned debt reduction via asset sales will be key to compressing the dividend back toward pre-deal levels of 5%.”

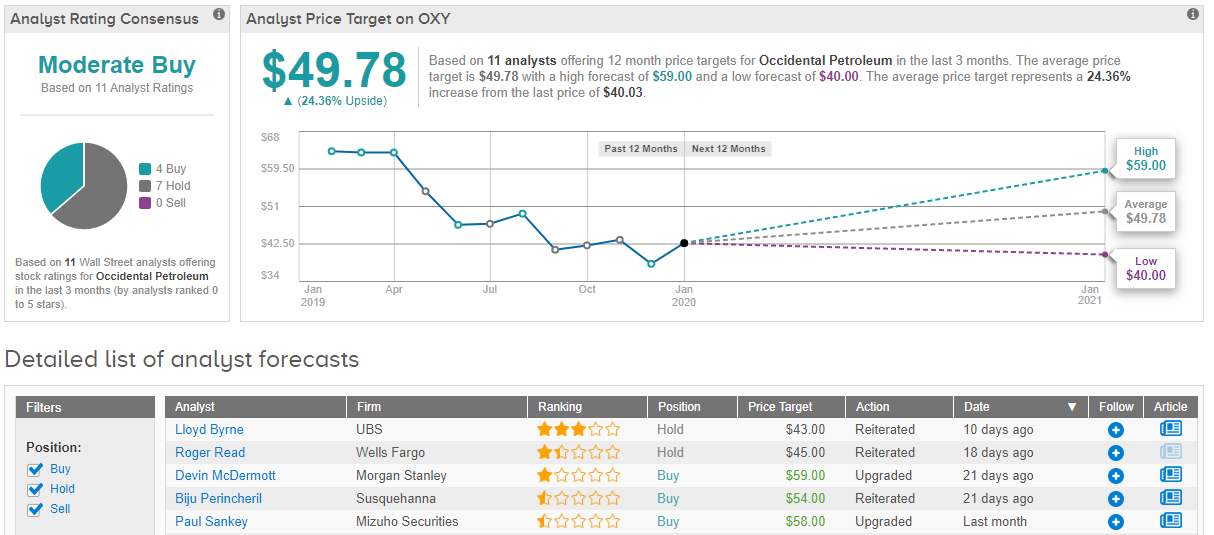

To this end, McDermott upgraded Occidental Petroleum from Equal Weight to Overweight. The upgrade comes with a new $59 price target, too. The updated figure implies upside potential of a hefty 49%. (To watch McDermott’s track record, click here)

Away from the oil field and out on the Street, the outlook is mixed. 4 Buys and 7 Holds amount to a Moderate Buy consensus rating. With an average price target of $49.78, though, the bulls have the upper hand as the figure implies potential upside of 24%. (See Occidental stock analysis on TipRanks)