As the cannabis sector gained popularity with investors back in 2018, the Canadian stocks garnered far more interest from investors than their U.S. counterparts. The ability of Canadian companies to list on major stock exchanges and their grand global aspirations sent those stock prices soaring. Even after a year of disappointments in Canada, the U.S. stocks still offer far better values for new investors.

For 2020, analysts forecast the U.S. cannabis space to dominate the global cannabis markets in term of revenues. More than 50% of the global sales will occur in the U.S. with expectations for the country generating up to $17 billion in sales this year while Canadian sales may only reach $2.5 billion after a December where the monthly total was only $109 million (C$146 million).

The real question here is whether international locations including Canada can reach these aggressive targets. The U.S. is set to continue to generate substantial revenue growth even with the federal government not approving cannabis. Federal approval of cannabis offers another bonus to investors in the U.S. market.

A lot of the multi-state operators (MSOs) in the U.S haven’t garnered the same investor attention as the large Canadian LPs, but these secondary MSOs are now generating annual sales above $100 million. In addition, most MSOs have built in growth drivers as medical cannabis states approve recreational such as Illinois starting January 1, 2020. Other promising states for the next few years include Arizona, Florida, Ohio and New York.

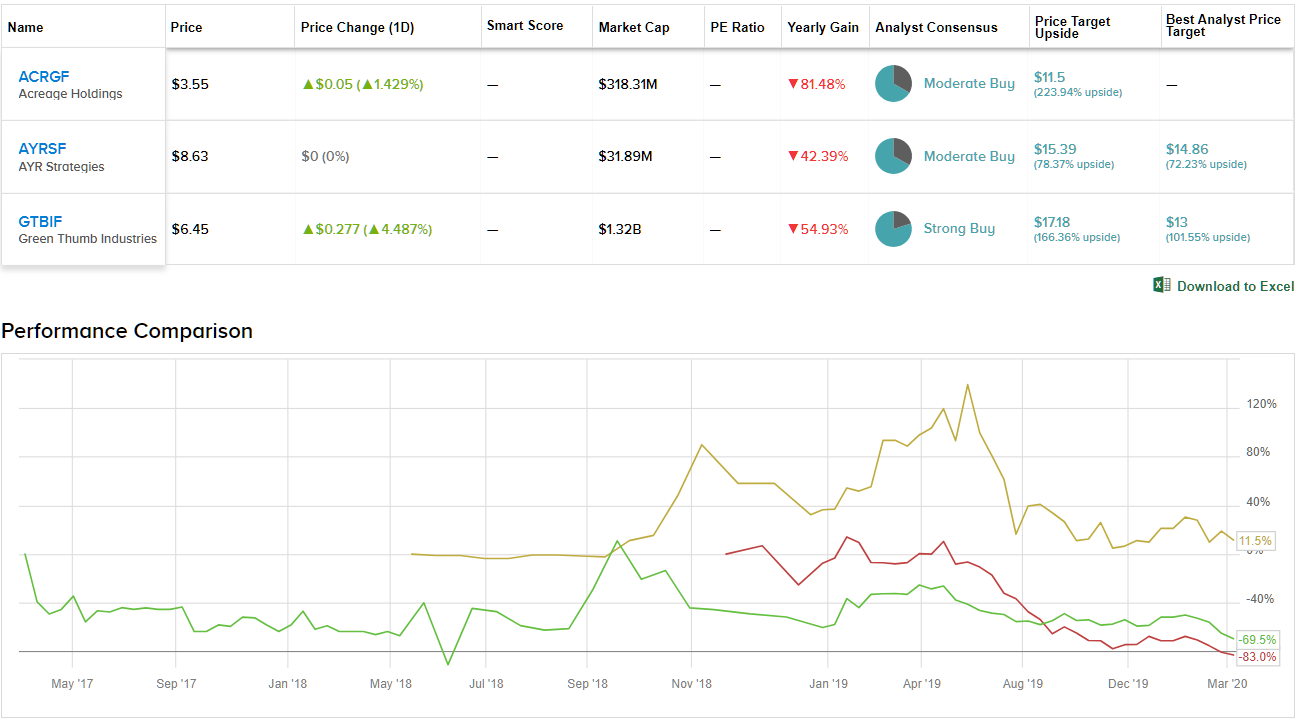

We’ve delved into three stocks providing clear signs the U.S. cannabis space remains even more attractive in 2020. Using TipRanks’ Stock Comparison tool, we lined up the trio alongside each other to get the lowdown on what the near-term holds for these cannabis players.

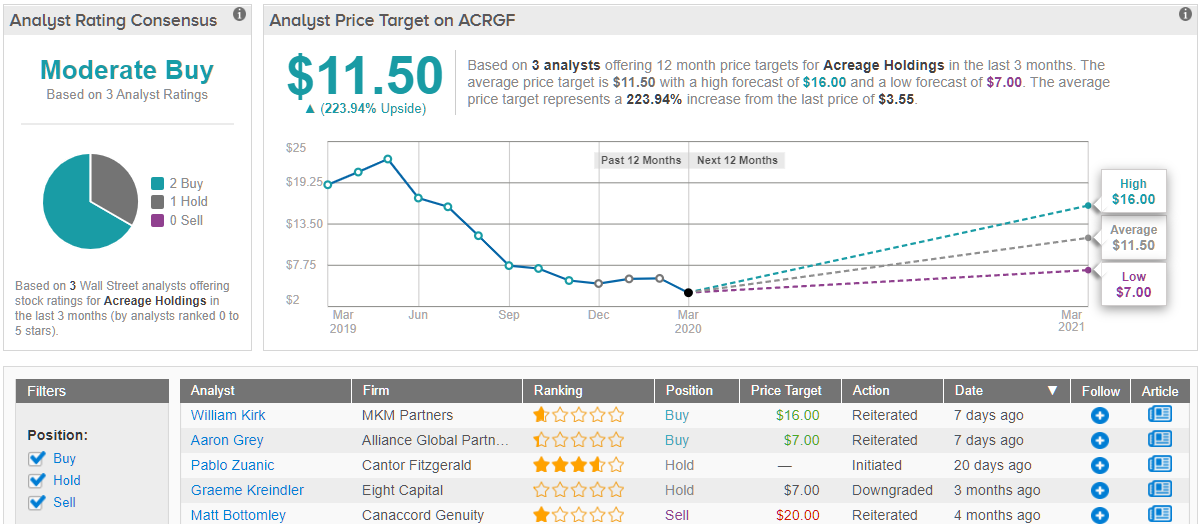

Acreage Holdings (ACRGF)

The prime example of the value in the U.S. MSO space in Acreage Holdings. The stock trades below $4 now while having an established right for Canopy Growth to acquire the company at a far higher price.

For Q4, Acreage reported $43.6 million in revenues. Revenues were up 90% from last year, but the company still reported a quarterly EBITDA loss of $14.6 million. The revenue number was only up slightly from the Q3 total of $42.2 million.

Unlike a lot of the large Canadian LPs that grabbed the stock markets attention last year, the U.S. MSO has the ability to simply expand via opening new stores. The company has the plans to open 10 to 15 new retail dispensaries during the year to bring total dispensaries to 45 and operations in 20 states.

The stock will become far more appealing with or without Canopy Growth, if the company can achieve adjusted EBITDA positive goals in the 2H of the year. Acreage plans to cut $7 million in general and administrative costs this year while growing the company via the additional retail store openings and a larger shift into the wholesale market.

The good news for investors is the Canopy Growth deal provides investors the right to 0.5818 shares of the Canadian LP when a triggering event occurs allowing the cannabis giant to acquire the company. Canopy Growth currently trades at $17.50 providing for a deal price of $10.18 or approaching 200% upside.

What does the Street think? Looking at the consensus breakdown, opinions from analysts are spread out. 2 Buys and 1 Hold add up to a Moderate Buy consensus. In addition, the $11.50 average price target indicates over 220% upside potential. (See Acreage’s price targets and analyst ratings on TipRanks)

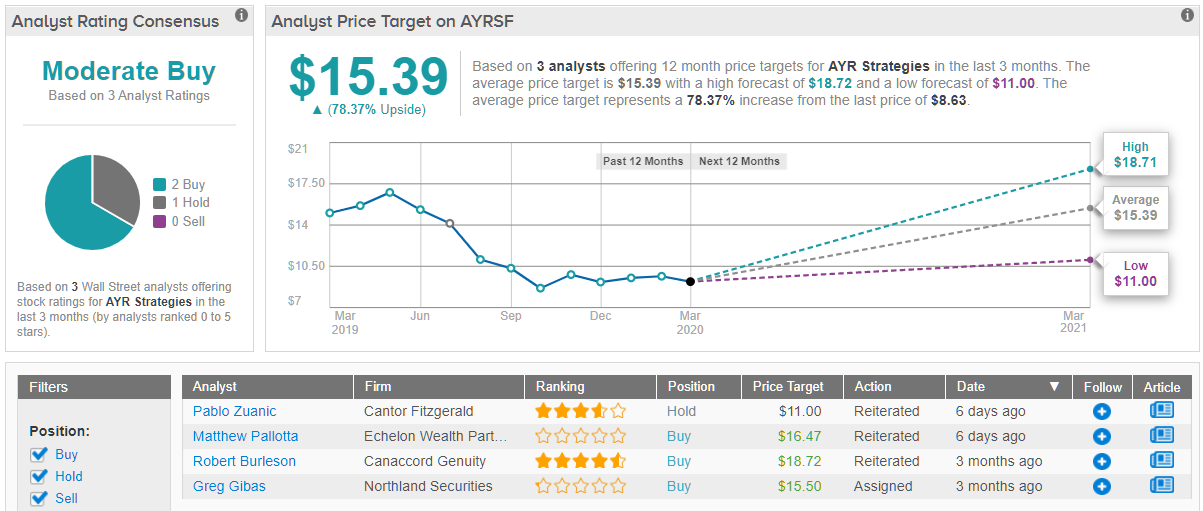

AYR Strategies (AYRSF)

AYR Strategies is probably the least known vertically-integrated cannabis MSO. The stock has a market value of only $250 million despite just reporting a quarter with $32.3 million in sales and a positive EBITDA of $9.2 million.

The company is a leading MSO with anchor operations in Massachusetts and Nevada. In Nevada, the company has dispensaries averaging an incredible $17 million in annual sales.

While the stock has a market cap of only ~$250 million, AYR Strategies forecast 2020 revenues topping $207 million and reaching up to $227 million based on organic growth of 67% to 83%. The company even forecasts an incredible adjusted EBITDA in the range of $100 million.

Despite all of these positive numbers, the stock trades down at $9 and far closer to the lows than the highs of nearly $20. The stock trades at only 2.5x EBITDA forecasts while most Canadian stocks trade at far higher multiples of sales while still losing substantial amounts of money.

Over the past 3 month, “buy” ratings have outnumbered “holds” two-to-one on AYR Strategies, and the average price target cross all analysts surveyed by TipRanks stands at $15.39. Assuming they’re right about that, investors in AYR Strategies today stand to rake in nearly 78% profit over the next year. (See AYR’s price targets and analyst ratings on TipRanks)

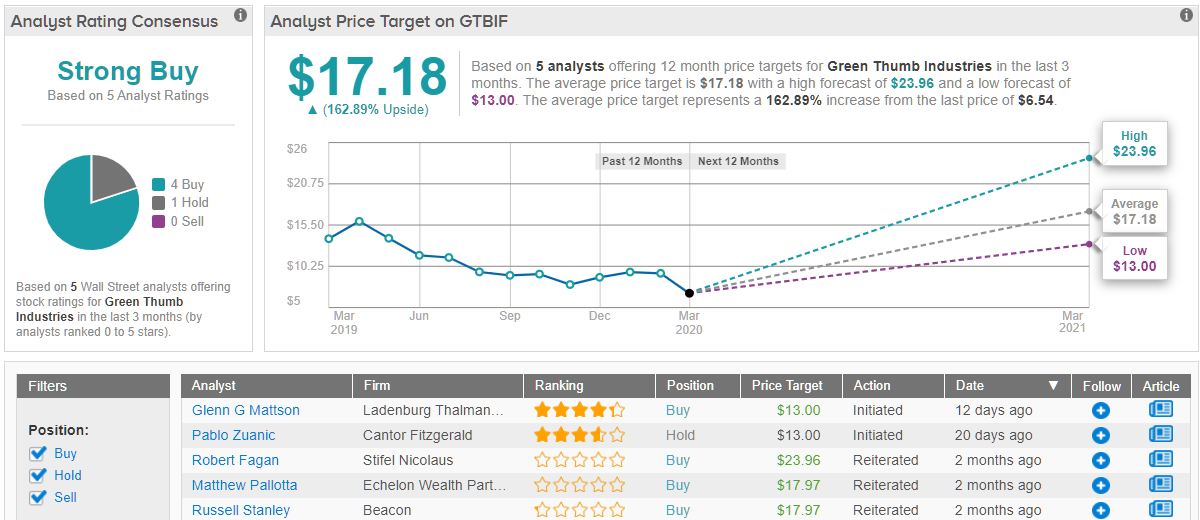

Green Thumb Industries (GTBIF)

Last week, Green Thumb Industries opened a sixth retail dispensary in Illinois to sell recreational cannabis. The state had $40 million in sales during the first month of adult-use sales in January and alone will come close to matching current sales levels in Canada that only reached $109 million in December.

Green Thumb now has over 40 retail stores, 13 manufacturing facilities and licenses for 96 retail stores in 12 U.S. states. The company reported Q3 revenues of $68 million already placing the company on a revenue path approaching $300 million before even including the potential sales from Illinois. In addition, the company has promising operations in Florida, New York, Ohio and Pennsylvania where future approval of adult-use cannabis will boost sales without the company having to build out new stores or operations.

The stock has a market value of $1.5 billion and trades near the yearly lows of the last few years. Green Thump traded as high as $20 all the way back in 2017.

Analysts have sales reaching $460 million in 2020 and nearly $700 million in 2021. The stock has far too many catalysts to trade at 2x sales while the Canadian LPs trade at much higher valuations. If these valuations were to remain, the Canadian companies will ultimate look to the U.S. MSOs to acquire businesses once the Federal government approves cannabis in the country.

Based on all the above factors, Wall Street also has high hopes for Green Thumb. As 4 Buy ratings were assigned in the last three months compared to single Hold, the consensus rating is a ‘Strong Buy.’ To top it all off, its $17.18 average price target puts the potential twelve-month gain at a whopping 163%. (See Green Thumb’s stock-price forecast and analyst ratings)