2020 has been kind to small-cap biotechs. Some have spiked upwards dramatically this year, mostly on the hope of finding solutions to COVID-19, be it a treatment or vaccine. Those who haven’t gotten in on the action yet still yearn to join the fray, might justifiably feel a sense of apprehension. An investment in a stock that has already posted double, or in some cases, triple digit gains feels like risky business.

However, the volatile biotech world always presents fresh opportunities. Northland Securities analyst Tim Chiang argues the case for dermatology-focused Menlo Therapeutics (MNLO). Shares are down by a depressing 49% so far this year, but Chiang is anticipating hefty returns from the small-cap.

Based on what, you ask?

Last Friday, the FDA gave its nod of approval for Zilxi, Menlo’s topical 1.5% minocycline treatment for adults with rosacea. Rosacea is a skin condition marked by redness and clearly noticeable blood vessels on the face.

Additionally, Zilxi is the first topical foam formulation containing minocycline to receive the FDA’s stamp of approval, and Chiang believes that by 2026, the product’s sales could reach $120 million. That will make it Menlo’s second largest selling product, only behind acne treatment Amzeeq, which is expected to reach sales of $272 million by 2026.

The company plans to launch Zilxi in 4Q20. Based on Chiang’s calculations, the acne and rosacea treatment markets are substantial, believing the former’s TAM (total addressable market) to be worth $5 billion, and the latter around $1 billion.

Chiang opined, “With MNLO’s focused 50-person sales force already in place, we think the Co. will have the benefit of having two new topical foam products (both containing low doses of minocycline) to detail to dermatologists. We believe the recent approval of ZIlxi adds a complementary product to MNLO’s dermatology arsenal. Combined with Amzeeq, we estimate total revenues are likely to increase to $77 million in CY21, and $140 million in CY22.”

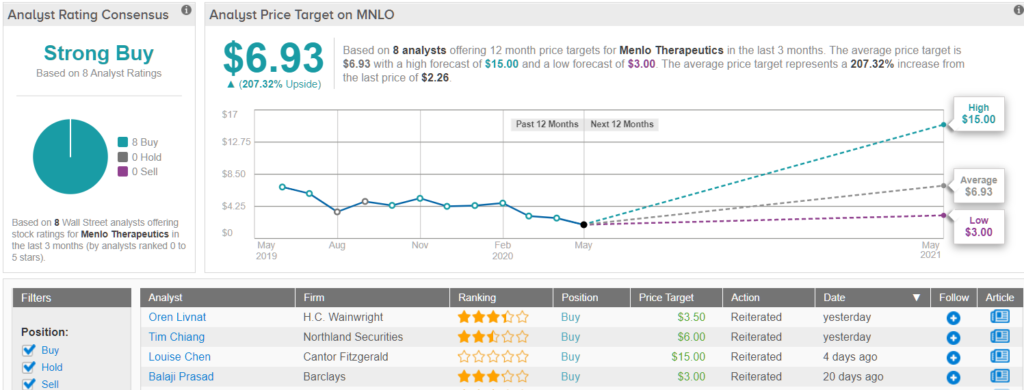

All of the above prompted Chiang to reiterate an Outperform rating on Menlo. Adding to the good news, he bumped up the price target from $3.50 to $6. There’s upside of 164%, should Chiang’s target be met over the coming months. (To watch Chiang’s track record, click here)

The rest of the Street is also optimistic. Based solely on Buys – 8, in fact – Menlo has a Strong Buy consensus rating. With an average price target of $6.93, the analysts forecast gains in the shape of 197% over the next 12 months. (See Menlo stock analysis at TipRanks)

To find good ideas for healthcare stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.