Is the coronavirus outbreak on its way to becoming a pandemic? This is the question on the minds of people throughout the world. Global fear reached its pinnacle yesterday after Nancy Messonnier, a director with the CDC’s National Center for Immunization and Respiratory Diseases, stated the U.S. is “buying more time to prepare” with its current efforts to contain the virus, warning that its spread domestically is “inevitable.”

“Ultimately, we expect we will see community spread in this country. It’s not so much a question of if this will happen anymore, but rather more a question of exactly when this will happen and how many people in this country will have severe illness,” Messonnier commented.

Community spread occurs when people become infected without knowing how or where they contracted the infection. These worrisome statements wreaked havoc on the market; both the S&P 500 and NASDAQ dropped 3% in response.

That being said, some good news was reported. On February 24, biotech name Moderna (MRNA), which develops vaccines and therapeutics using messenger RNA (mRNA), revealed that vials of its coronavirus vaccine candidate, mRNA-1273, were shipped to the National Institutes of Health (NIH) for human trials. mRNA-1273 could prevent the virus from entering host cells by targeting a “prefusion” form of the SARS-CoV-2 spike protein.

The news drove a 28% gain yesterday for the stock that has grabbed plenty of headlines lately thanks to its collaboration with the National Institute of Allergy and Infectious Disease, part of the NIH. Human testing is expected to start in April with a Phase 1 trial in 20 to 25 healthy volunteers, and initial data could be released by July or August.

With funding from the Coalition for Epidemic Preparedness Innovations (CEPI), MRNA was able to ship the experimental vaccine only 42 days after designing the molecule.

Chardan Capital analyst Geulah Livshits cites this development as an impressive feat. “To us, the rapid turnaround reflects the company’s investment in manufacturing and mRNA design infrastructure,” she noted.

While some investors have expressed concern related to the future need for a coronavirus vaccine, Livshits argues, “commercial potential may evolve if [SARS-CoV-2] infection patterns become more like those of flu/cold than SARS.” According to the analyst, as the number of confirmed infections is on the rise, this might actually be the case, increasing the probability of a vaccine’s necessity beyond the first half of 2020.

Livshits does point out that “an efficacious vaccine against the 2003 SARS-CoV virus remained elusive and in fact, vaccines were reported to elicit antibody-dependent enhancement (ADE) of SARS infection in some settings.” However, the four-star analyst thinks that MRNA’s partnership with the NIH, its manufacturing speed and early data for a related coronavirus vaccine give it a solid standing.

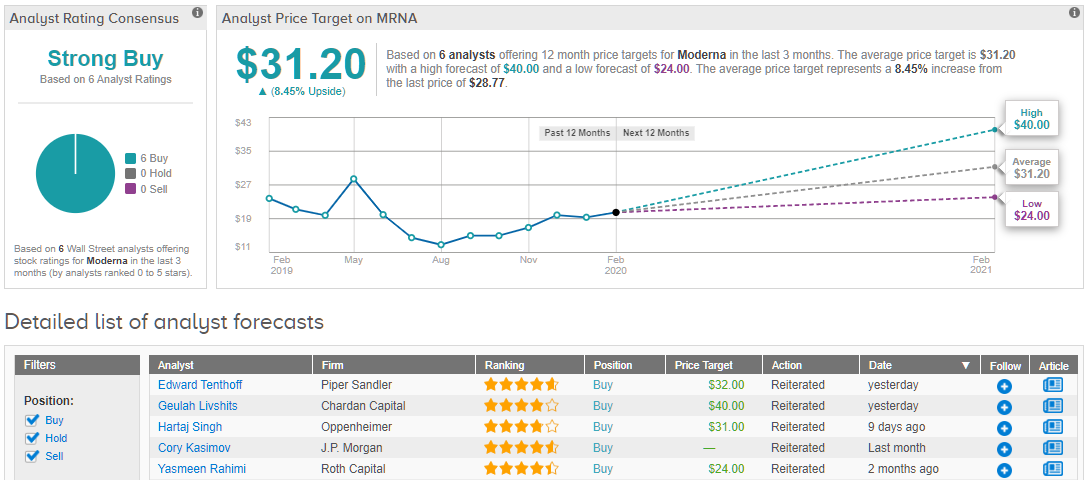

In line with her optimistic outlook, Livshits reiterated her Buy rating and $40 price target. Should this target be met, shares could be in for a 40% twelve-month gain. (To watch Livshits’ track record, click here)

Looking at the consensus breakdown, it appears other analysts also have high hopes for this biotech. With 100% Street support, or 6 Buys to be exact, the message is clear: MRNA is a Strong Buy. While not as aggressive as Livshits’ forecast, the $31.20 average price target still puts the upside potential at 9%. (See Moderna stock analysis on TipRanks)