As Charlotte’s Web Holdings (CWBHF) trades below $7, the stock is finally at levels where investors can buy the stock. The U.S. CBD market enters 2020 in a highly competitive state and faces FDA uncertainty, but the leading CBD company should attract investor interest as the market value dips to $665 million.

Top Quality

As the cannabis sector in general matures, quality brands will eventually rise to the top. The cannabinol or CBD sector already has topped 4,500 brands leaving the general consumer with limited ability to ascertain the brands with the top quality for the price.

According to MarijuanaBreak, Charlotte’s Web ranked in the top 10 of CBD oils on the market. The company notes that huge gaps exist in the quality of oil on the retail shelves due to lack of regulators. The highest quality hemp-infused CBD comes from the U.S.

Using The Advantage

How Charlotte’s Web takes advantage of a quality designation and a leading market share position remains the question. The company used this position to attract leading retailers such as Kroger (KR), but the potential FDA restrictions on dietary supplements and food products has the major FDM retailers holding back on selling the products.

The House Bill H.R.5587 is looking to instruct the FDA to remove any restrictions from allowing hemp-infused CBD in food products. Such a bi-partisan bill would unleash CWB back towards previous estimates for 2020 revenues topping $350 million.

The stock recently rallied to $10 based on the promises of the bill. Unfortunately, or fortunately for investors on the sidelines, CWB is below $7 for a market cap of $665 million. Even better for new investors, the company recently raised ~$50 million to fund operations while the FDA has a mixed message.

Analysts have updated 2020 revenue targets to only $150 million due to up to 85% of potential retail sales coming from products where the FDA has caused mass retailers to pull back on stocking the items due to a lack of legal and regularity concern. CWB had gross margins topping the 75% range and was highly EBITDA profitable before the business was hit by the FDA safety concerns.

The upside remains for the existing business with access to around 10,000 retail stores when the FDA removes regulatory restrictions. Analysts had previous revenue targets in excess of $350 million for 2020 with gross margins topping 75% and EBITDA margins in excess of 20%. The stock only trades at 2x normalized sales targets and somewhere below 10x normalized EBITDA targets.

Analyst Consensus

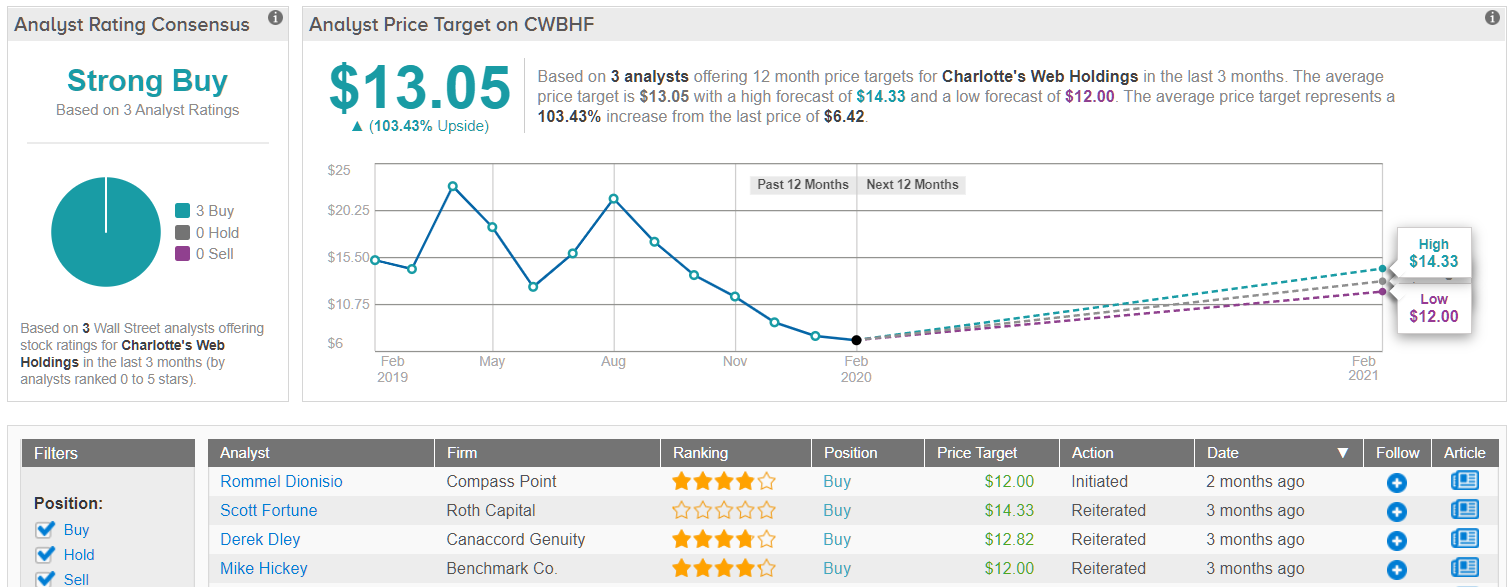

Great minds think alike. Over the last three months, three analysts have unanimously declared CWB a “buy.” Their average price target is 13.05 per share, suggesting that shares could more than double in the twelve months ahead. (See CWB’s price targets and analyst ratings on TipRanks)

Takeaway

The key investor takeaway is that Charlotte Web Holdings is reasonably priced trading near multi-year lows around $6.50. Though risks exist due to the exploding level of CBD brands entering the market, CWB has one of the highest rated brands and biggest market shares to survive and thrive a competitive marketplace. Any removal of FDA uncertainty on food products will immediately send the stock above recent highs above $10. Ultimately, the stock is set with potential upside to reach the previous highs above $20 before the FDA crimped revenue growth.

To find good ideas for cannabis stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclosure: No position.