With a market cap of a miniscule $10.16 million, you can firmly place biotech Capricor Therapeutics (CAPR) in the nano cap section. Although, according to one analyst, if recent developments are anything to go by, the Beverly Hills, California based company won’t be in the small fry category for much longer.

H.C. Wainwright’s Joseph Pantginis reiterated a Buy on Capricor along with a $9.00 price target. The implication for investors? Potential upside of a humungous 737%. (To watch Pantginis’s track record, click here)

So, what is driving an analyst to set such an extravagant target for such a tiny player? Well, among other reasons, Capricor is one of the companies fighting back against the coronavirus on multiple fronts, both with a search for a vaccine and a possible treatment.

Last Friday, Capricor announced that under the compassionate use pathway, CAP-1002, its novel cell therapy currently in clinical development for the treatment of Duchenne muscular dystrophy (DMD), is being used to treat patients with advanced COVID-19. So far, two patients at Cedars Sinai Hospital in Los Angeles have received the treatment and both are presently clinically stable.

“We note that both patients were in critical condition before receiving CAP-1002 and, according to the compassionate use pathway, they had exhausted all options for treatment. We remind investors that for drugs being administered under compassionate use, the FDA can immediately collect information and make the appropriate decisions about the safety and efficacy of those experimental treatments.” Pantginis said.

In the coming weeks, more patients are expected to receive the experimental treatment, while discussions are currently taking place regarding a formal clinical trial. Additionally, the FDA is currently reviewing Capricor’s Investigational New Drug (IND) application to investigate the use of CAP-1002 in certain COVID-19 patients.

The news comes following last month’s KOL (key opinion leader) event which discussed Capricor’s partnership with Dr Stephen Gould, a leader in the field of exosome biology, to develop exosome-based vaccines against COVID-19.

The two teams are currently testing two exosome-vaccine candidates (in non-human primates and small animals), with the hope that an IND can be filed either in the third or fourth quarter.

Although Pantginis reminds investors that usually “the gold standard for vaccine development is proven protection from infection,” the urgent need could result in a faster than usual process.

The analyst said, “In the context of the COVID-19 emergency, we expect that long and expensive studies, while are still required for traditional vaccine strategies, may not be needed for all approaches, providing solid scientific evidence of safety and efficacy in stimulating specific immunity. Capricor is planning to accumulate detailed results of both humoral and cellular immune responses from vaccinated subjects, which could potentially accelerate the regulatory process.”

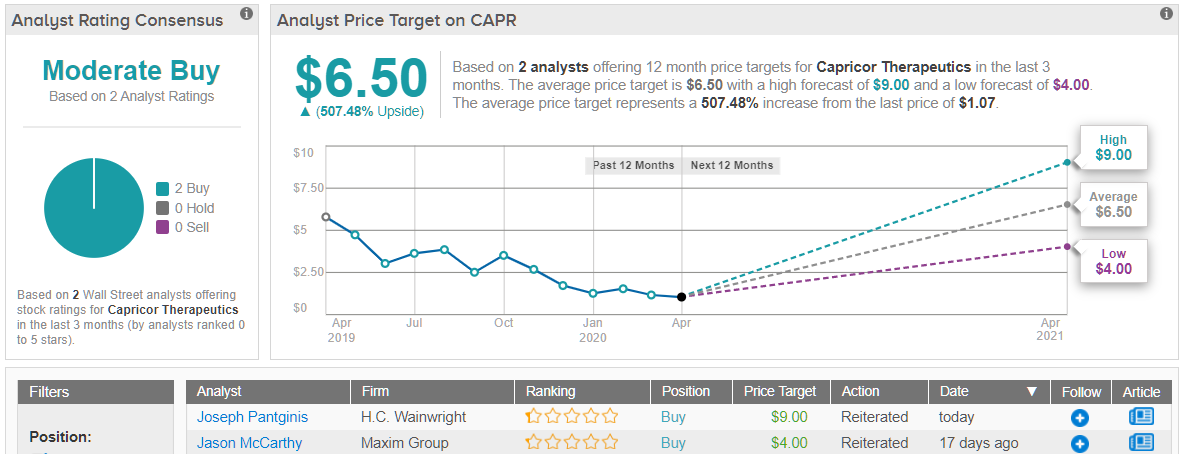

Over the last three months, there has been only one further analyst to throw the hat in with a view on Capricor’s prospects. The additional Buy rating means the small biotech currently holds a Moderate Buy consensus rating. At $6.50, the average price target implies possible upside of a sky scraping 507%. (See Capricor stock analysis on TipRanks)